Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read Kosta Gushterov

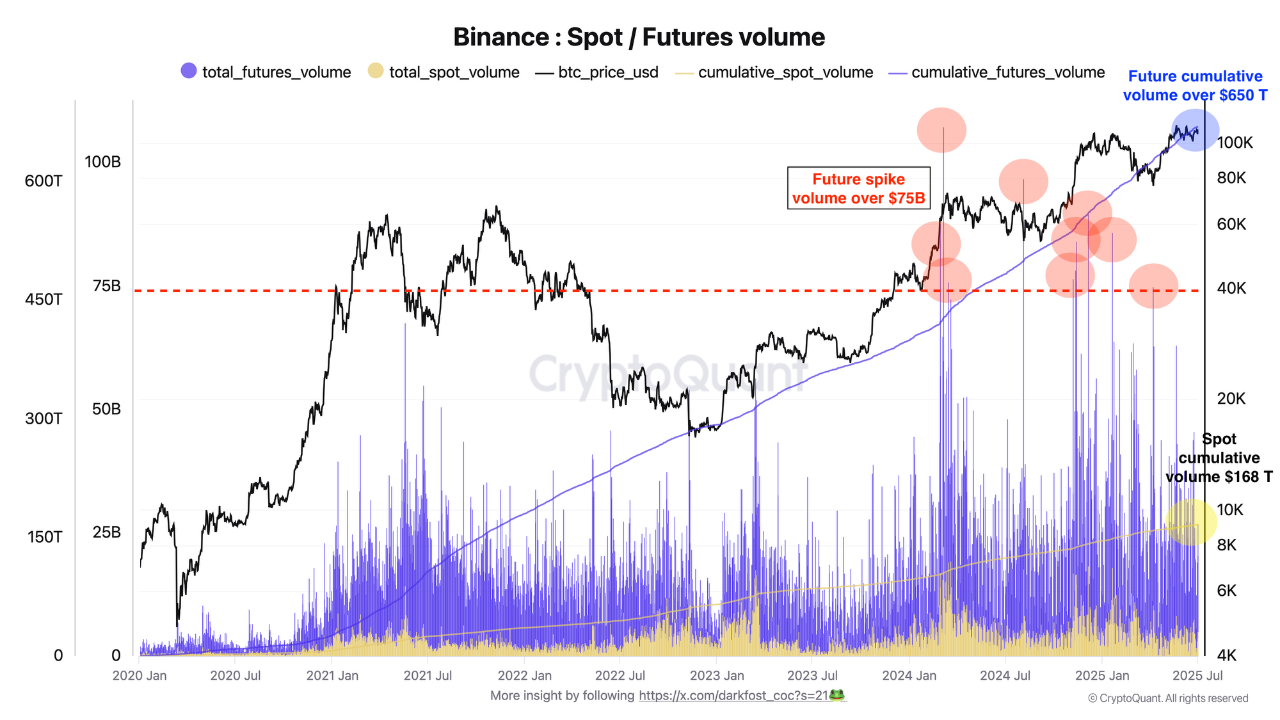

Bitcoin’s market structure has undergone a dramatic transformation, with Binance surpassing $650 trillion in BTC futures volume since launching the product in September 2019.

In comparison, the platform’s BTC spot volume reached just $168 trillion over the same period—highlighting a decisive shift toward speculative trading in the crypto landscape.

Derivatives Now Drive 75% of Bitcoin Activity

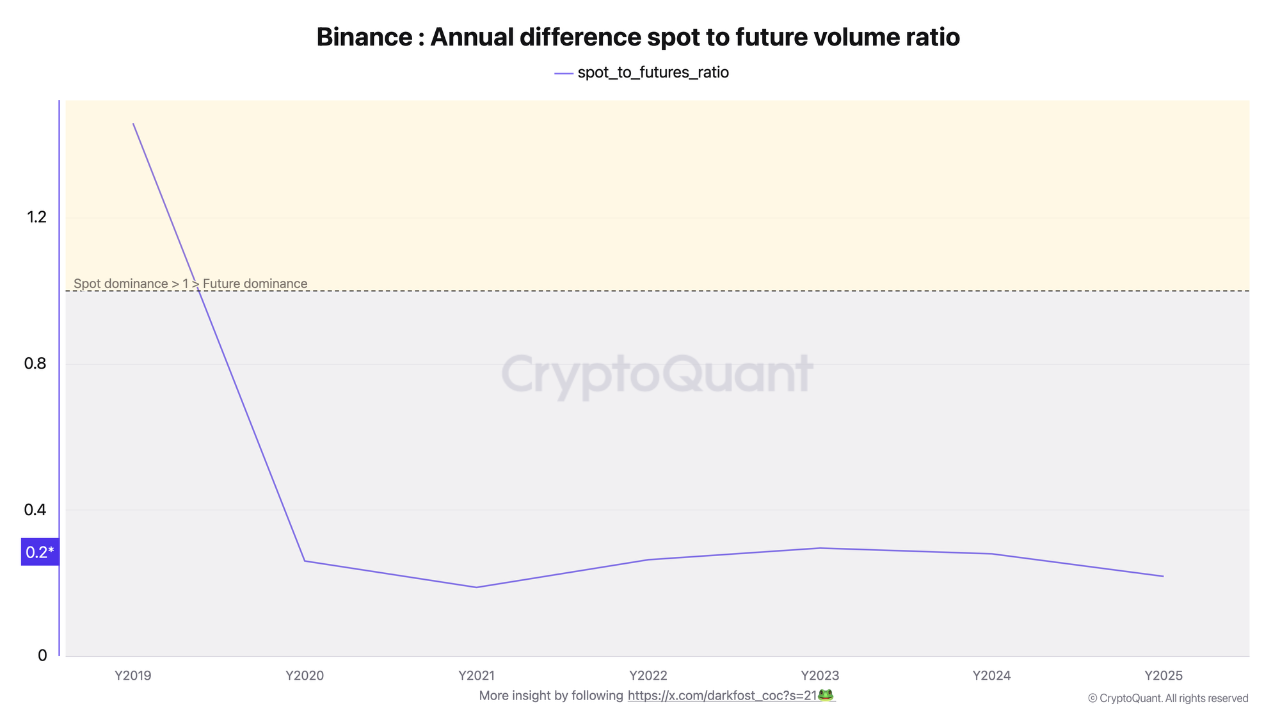

According to new report by CryptoQuant, the data marks a paradigm shift in how Bitcoin is traded, with futures volume now accounting for roughly 75% of total BTC activity on Binance. The current spot-to-futures volume ratio stands at 0.21, or 0.26 when adjusted for refined metrics—underscoring the growing dominance of the derivatives market.

While spot volume is typically associated with long-term investors and conviction-based buying, futures activity reflects short-term speculation, leverage, and rapid capital rotation. This transition is not just about volume—it signals a broader evolution in market behavior.

Binance Leads as Speculative Hub

Binance has become the undisputed leader in Bitcoin derivatives trading. During this cycle, daily BTC futures volume has exceeded $75 billion multiple times, setting new records since the exchange first introduced the product. Such high-frequency trading levels were previously unthinkable in the pre-derivatives era.

The explosive growth of BTC futures highlights not only increased speculation and market volatility, but also Binance’s unmatched role in funneling global liquidity into its derivatives platform.

Why Futures Monitoring Is Now Essential

With the vast majority of Bitcoin trading now concentrated in the derivatives space, analysts emphasize that tracking futures market trends is critical for understanding price movements. Liquidations, funding rates, and open interest now carry far greater weight in forecasting volatility and directional bias.

As the derivatives-fueled cycle continues, Binance remains the heartbeat of speculative Bitcoin trading, and futures volume may increasingly serve as the clearest signal of where the market is headed next.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

Strategy Launches $2 Billion Raise to Buy More Bitcoin

MicroStrategy is doubling down on its Bitcoin strategy with a massive $2 billion fundraising move. Originally planned at $500 million, the company expanded its offering after seeing strong investor demand.

Arkham Intelligence: U.S. Government Holds at Least 198,000 BTC

The U.S. government now holds over 198,000 BTC, valued at approximately $23.5 billion, according to data from Arkham Intelligence.

Tesla Q2 Earnings Surge on Bitcoin Rally and AI Growth

Tesla stunned investors in Q2 2025 with a $1.2 billion profit, nearly tripling its previous quarter’s net income.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read