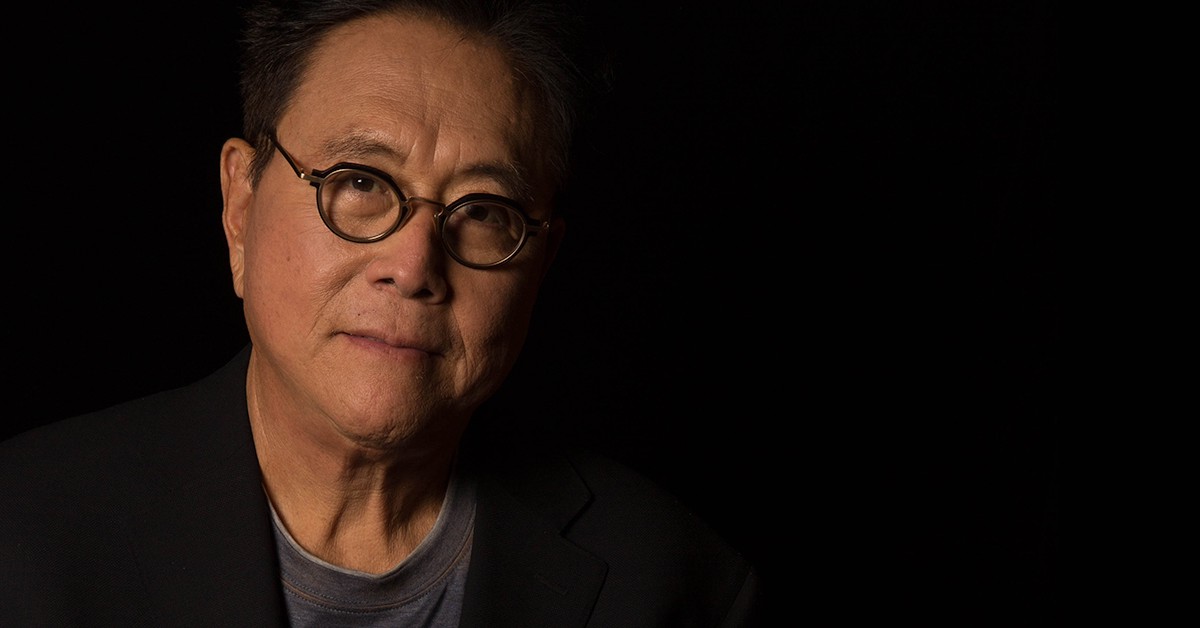

Robert Kiyosaki Warns of Financial Crisis, Sees Bitcoin as a Key Investment

10.09.2024 20:00 1 min. read Alexander Stefanov

Robert Kiyosaki has raised fresh concerns about the global financial system, emphasizing the overburdened state of the bond market.

The well-known financial advisor and Bitcoin proponent argues that the world economy is overly reliant on debt, a situation he finds unsustainable.

Kiyosaki pointed out on X that while bonds are presented as a cornerstone of economic stability, they essentially represent debt. He warned that the collapse of this debt-based system signals deeper economic issues.

According to Kiyosaki, while market crashes are typically evident and offer time to prepare, banking crashes are more insidious and pose greater risks. This aligns with ongoing recession fears in the US.

Kiyosaki, who views an economic downturn as inevitable, has turned to physical assets like Gold, Silver, and Bitcoin as safer investments. He, along with other influential figures like Michael Saylor of MicroStrategy, believes in Bitcoin’s potential as a solid asset, with Saylor predicting a future value of $13 million per Bitcoin.

Despite this optimistic outlook, Bitcoin has seen a 6.30% decline over the past month, hitting a low of $52,598.70. However, recent analysis suggests that Bitcoin may be at its lowest point and could soon rebound. As of now, Bitcoin has increased by 4.76% to $56,871.55, and if this positive trend continues, it might surpass the $60,000 mark in the near future.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

A sharp divergence has emerged between Bitcoin’s exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read