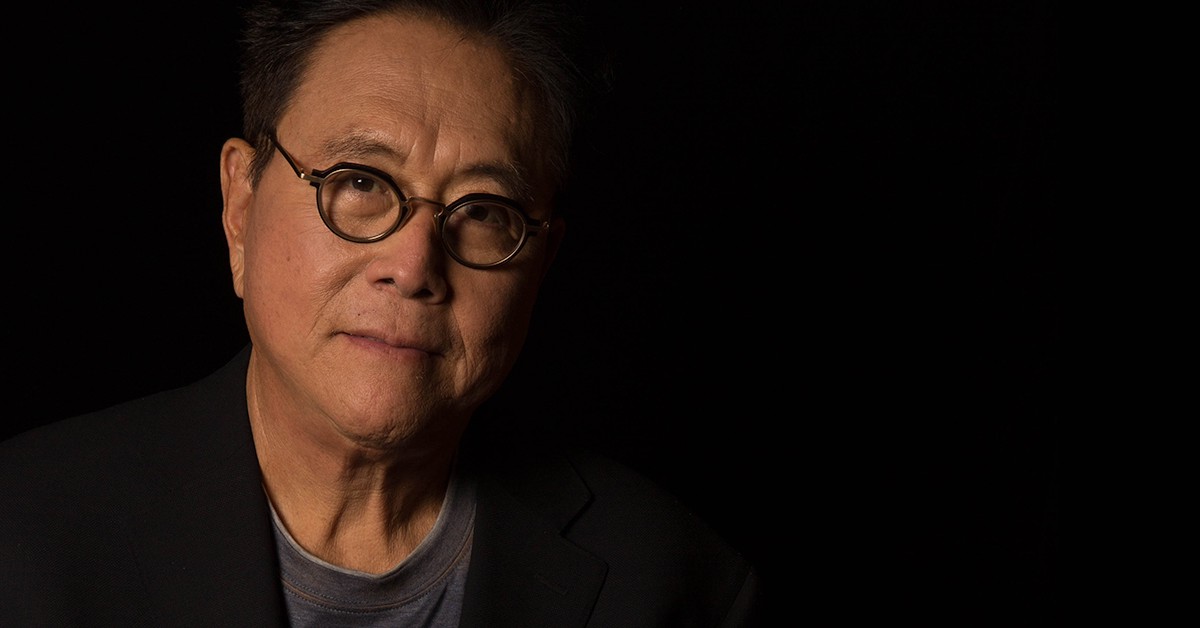

Robert Kiyosaki Warns of Financial Crisis, Sees Bitcoin as a Key Investment

10.09.2024 20:00 1 min. read Alexander Stefanov

Robert Kiyosaki has raised fresh concerns about the global financial system, emphasizing the overburdened state of the bond market.

The well-known financial advisor and Bitcoin proponent argues that the world economy is overly reliant on debt, a situation he finds unsustainable.

Kiyosaki pointed out on X that while bonds are presented as a cornerstone of economic stability, they essentially represent debt. He warned that the collapse of this debt-based system signals deeper economic issues.

According to Kiyosaki, while market crashes are typically evident and offer time to prepare, banking crashes are more insidious and pose greater risks. This aligns with ongoing recession fears in the US.

Kiyosaki, who views an economic downturn as inevitable, has turned to physical assets like Gold, Silver, and Bitcoin as safer investments. He, along with other influential figures like Michael Saylor of MicroStrategy, believes in Bitcoin’s potential as a solid asset, with Saylor predicting a future value of $13 million per Bitcoin.

Despite this optimistic outlook, Bitcoin has seen a 6.30% decline over the past month, hitting a low of $52,598.70. However, recent analysis suggests that Bitcoin may be at its lowest point and could soon rebound. As of now, Bitcoin has increased by 4.76% to $56,871.55, and if this positive trend continues, it might surpass the $60,000 mark in the near future.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read