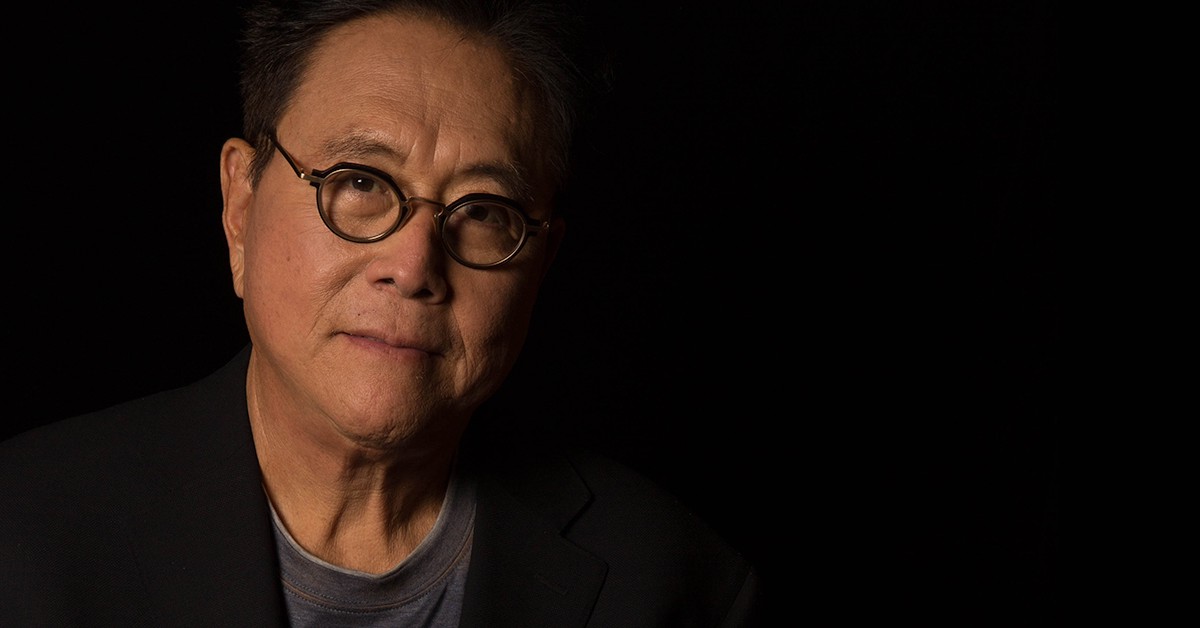

Robert Kiyosaki Faces Disappointment After Bitcoin Poll Falls Flat

28.04.2025 17:00 2 min. read Alexander Stefanov

Robert Kiyosaki, well-known for Rich Dad Poor Dad and his vocal support for Bitcoin, recently faced an unexpected lack of engagement from his X followers.

Over the weekend, Kiyosaki ran a Bitcoin-related poll, but the response was far quieter than he anticipated — a result he later apologized for in a post.

The poll, part of a broader discussion on financial habits, questioned why people tend to spend on wants rather than investing in long-term assets like Bitcoin, gold, or real estate.

Despite having 73,000 followers view the tweet, only about 1,000 users interacted with it, leading Kiyosaki to express disappointment and frustration at the silence. He hinted that this disconnect felt like a silent backlash from the investment community.

The tweet was tied to broader concerns Kiyosaki raised about inflation and economic hardship, noting that even fast-food giants like McDonald’s and Burger King are feeling the strain as lower-income consumers pull back spending. Despite the lukewarm response, Kiyosaki promised to continue engaging with followers, teasing a future question about what wealthy individuals tend to accumulate to grow richer.

Earlier this month, Kiyosaki maintained his bullish stance on Bitcoin’s future, forecasting a minimum price of $180,000 in 2025 and even suggesting that BTC could break past $1 million by 2035. He cited rapid advancements in artificial intelligence and its effects on finance as key factors that could fuel Bitcoin’s long-term rise.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read