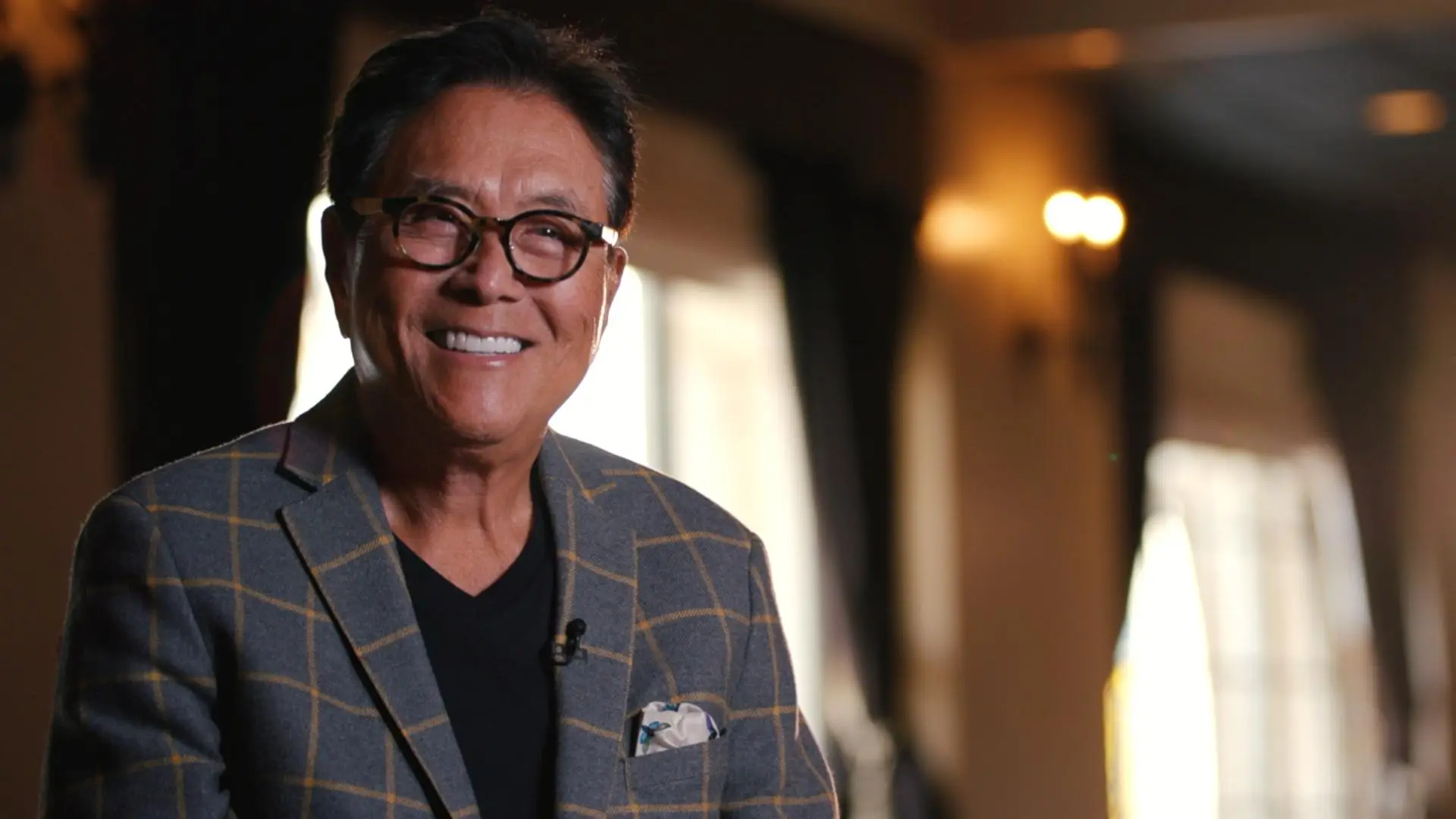

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read Kosta Gushterov

Robert Kiyosaki, author of Rich Dad Poor Dad, revealed on July 1 that he purchased another Bitcoin, reaffirming his long-term bullish stance—even if it comes with personal risk.

In a candid post on X, Kiyosaki acknowledged the possibility that he could be wrong or even “a sucker,” but emphasized he’d rather take that chance than miss out if Bitcoin eventually reaches $1 million per coin.

“Bought another Bitcoin today,” he wrote. “I realize I could be wrong and a sucker… Yet I believe Bitcoin will one day soon… be $1 million a coin.” Kiyosaki added, “I’d rather be a sucker than a loser if Bitcoin does go to $1 million.”

Known for his outspoken views on money, inflation, and fiat currency devaluation, Kiyosaki framed his Bitcoin purchase as part of a broader philosophy shaped by experience. He explained that he’s lost money before and learned from it, claiming he can afford to risk $100,000 without regret. “That’s life. That’s called wisdom and experience… which can be priceless,” he added.

Kiyosaki urged followers not to blindly follow his example, encouraging independent thinking. “Think for yourself… Do not listen to my ramblings,” he cautioned.

While the idea of Bitcoin hitting $1 million remains controversial, Kiyosaki’s latest move signals continued faith in Bitcoin as a hedge against traditional market risks—and an asset worth betting on, even at current elevated prices.

-

1

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

2

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

3

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

4

Bitcoin Rewards Coming to Amex Users Through Coinbase Partnership

14.06.2025 18:00 1 min. read -

5

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

As institutional adoption of Bitcoin accelerates, U.S. asset management giant Franklin Templeton has issued a cautionary note on the growing trend of crypto-based treasury strategies.

Bitcoin Climbs to $109,500: Why the Price is Up?

Bitcoin rose 1.78% over the past 24 hours to reach $109,500 at the time of writing, driven by surging institutional inflows into spot ETFs, easing global trade tensions, and strengthening technical momentum.

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

BlackRock’s spot Bitcoin exchange-traded fund (ETF), known by its ticker IBIT, has surpassed the firm’s flagship S&P 500 ETF in annual revenue, according to a new report from Bloomberg.

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

Bitcoin is poised for its strongest dollar rally in history during the second half of 2025, according to Standard Chartered’s latest market outlook.

-

1

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

2

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

3

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

4

Bitcoin Rewards Coming to Amex Users Through Coinbase Partnership

14.06.2025 18:00 1 min. read -

5

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read