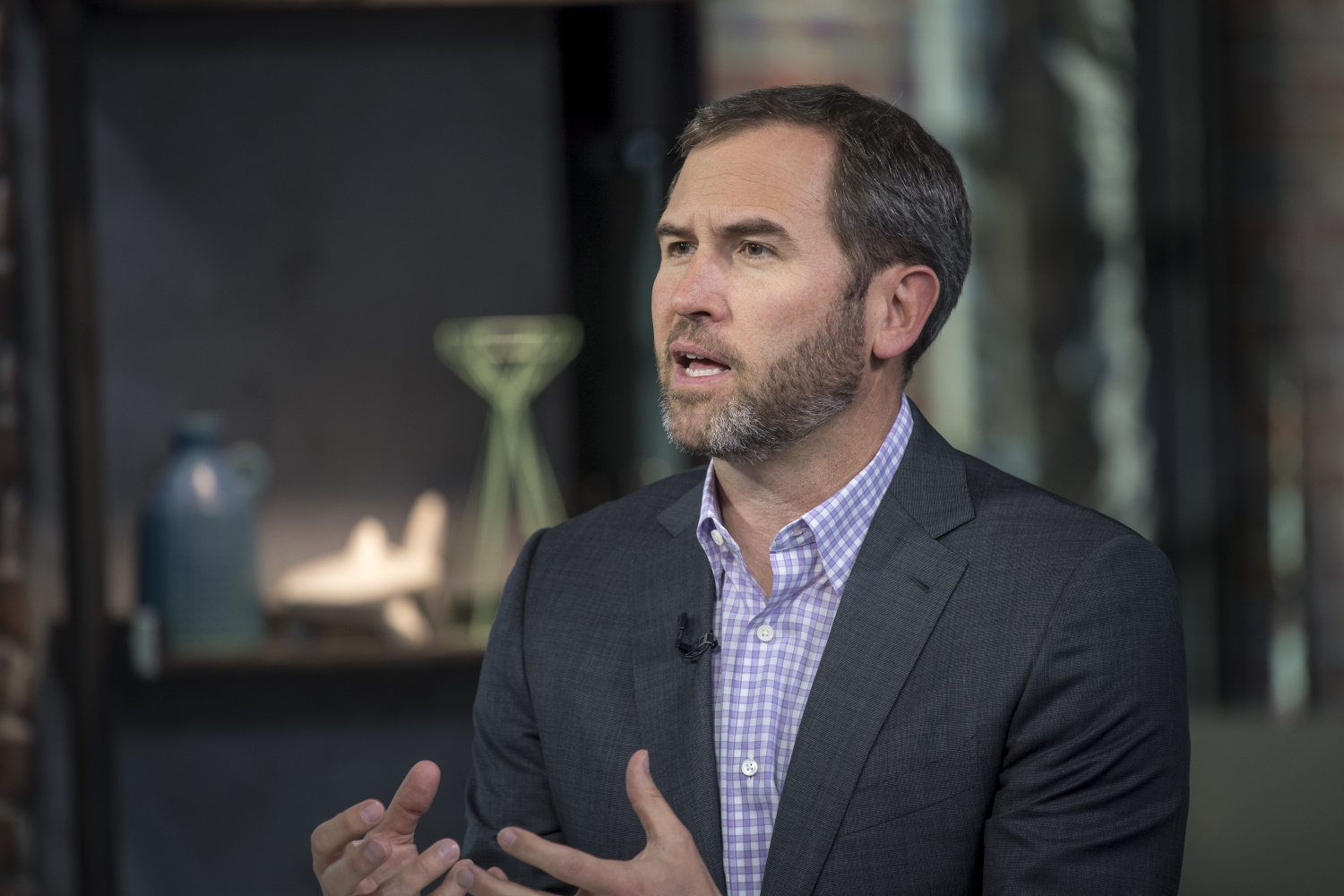

Ripple CEO Criticizes SEC’s Inconsistent Crypto Regulation

01.08.2024 10:30 1 min. read Alexander Stefanov

Ripple's CEO, Brad Garlinghouse, has sharply criticized the SEC's latest legal maneuver against Binance, accusing the regulator of inconsistent and politically motivated actions.

Garlinghouse argues that the SEC’s proposed revisions to its complaint, which involve reclassifying several cryptocurrencies like Solana and Cardano as securities, reflect a troubling lack of clarity and fairness in its regulatory approach.

He asserts that SEC Chair Gary Gensler’s statements about regulatory clarity are at odds with the SEC’s chaotic enforcement tactics, which he believes are fueling industry confusion.

Garlinghouse suggests that these actions may not be driven by genuine legal principles but by political agendas or litigation strategies.

Supporting Garlinghouse, Ripple’s Chief Legal Officer, Stuart Alderoty, points out inconsistencies in the SEC’s treatment of different cases.

Meanwhile, attorney John Deaton, who has been involved in Ripple’s legal battles, has criticized the SEC for causing harm to retail investors and called for Gensler’s resignation. Deaton argues that the SEC’s claims lack legal basis and have led to significant investor losses.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

What Are the Key Trends in European Consumer Payments for 2024?

A new report by the European Central Bank (ECB) reveals that digital payment methods continue to gain ground across the euro area, though cash remains a vital part of the consumer payment landscape — particularly for small-value transactions and person-to-person (P2P) payments.

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read