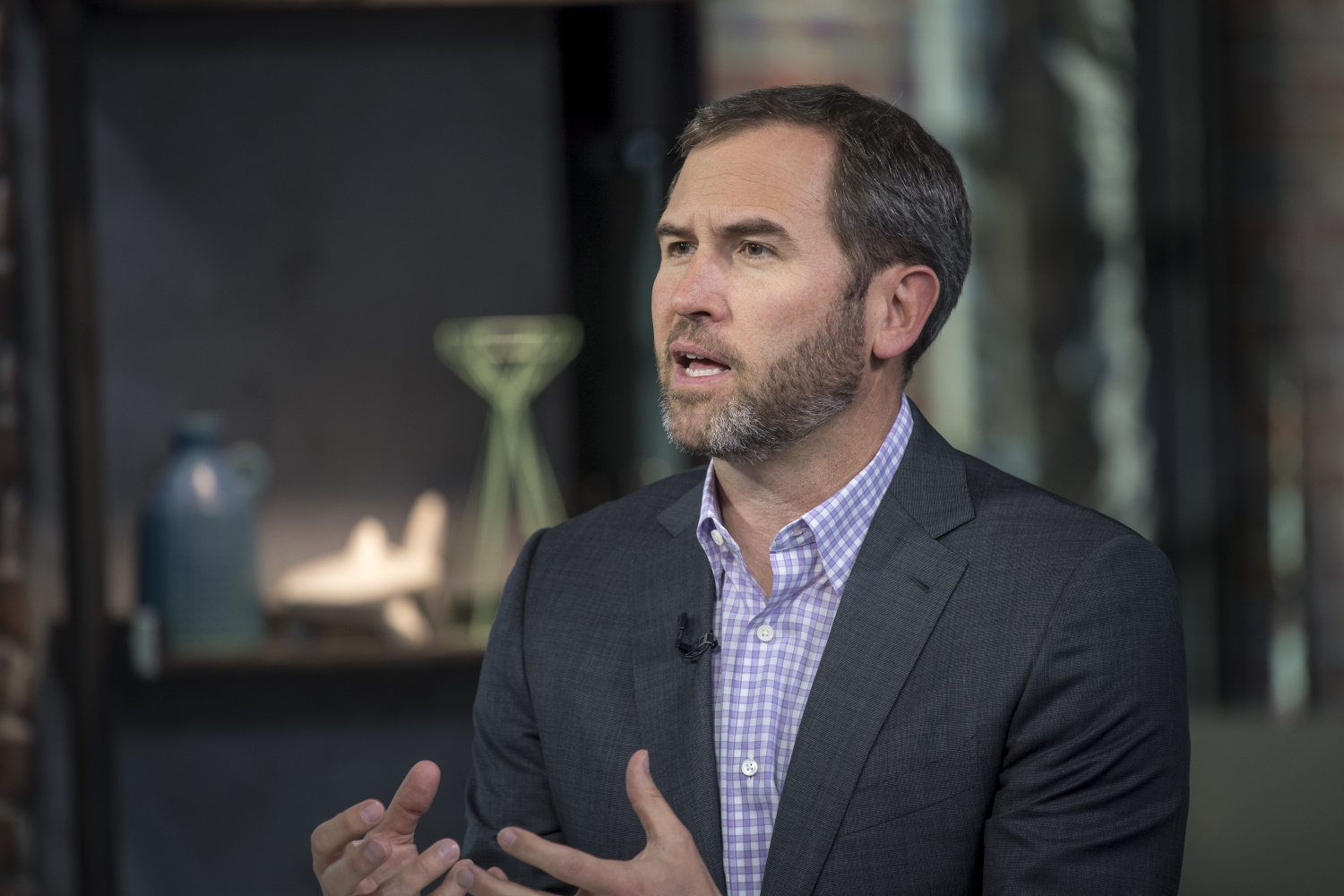

Ripple CEO Criticizes SEC’s Inconsistent Crypto Regulation

01.08.2024 10:30 1 min. read Alexander Stefanov

Ripple's CEO, Brad Garlinghouse, has sharply criticized the SEC's latest legal maneuver against Binance, accusing the regulator of inconsistent and politically motivated actions.

Garlinghouse argues that the SEC’s proposed revisions to its complaint, which involve reclassifying several cryptocurrencies like Solana and Cardano as securities, reflect a troubling lack of clarity and fairness in its regulatory approach.

He asserts that SEC Chair Gary Gensler’s statements about regulatory clarity are at odds with the SEC’s chaotic enforcement tactics, which he believes are fueling industry confusion.

Garlinghouse suggests that these actions may not be driven by genuine legal principles but by political agendas or litigation strategies.

Supporting Garlinghouse, Ripple’s Chief Legal Officer, Stuart Alderoty, points out inconsistencies in the SEC’s treatment of different cases.

Meanwhile, attorney John Deaton, who has been involved in Ripple’s legal battles, has criticized the SEC for causing harm to retail investors and called for Gensler’s resignation. Deaton argues that the SEC’s claims lack legal basis and have led to significant investor losses.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Sberbank Moves to Dominate Russia’s Crypto Custody Sector

Sberbank, Russia’s largest state-owned bank, is preparing to launch custody services for digital assets, marking a significant expansion into the country’s evolving crypto landscape.

-

1

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read -

2

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

29.06.2025 21:00 2 min. read -

3

Ripple Has Applied for a National Banking License

03.07.2025 7:00 2 min. read -

4

What Will Happen With the Stock Market if Trump Reshapes the Fed?

29.06.2025 13:00 2 min. read -

5

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

26.06.2025 8:00 2 min. read