Crypto News

Solana Analysis

July 18, 2024

Biggest Gainer

27 Jul

Solana Analysis

July 18, 2024

Biggest Gainer

27 Jul

Conflux

$0.1462237

15.33%

Biggest Loser

27 Jul

Conflux

$0.1462237

15.33%

Biggest Loser

27 Jul

Mog Coin

$0.000001

-8.83%

Mog Coin

$0.000001

-8.83%

Bitcoin Breaks $68K, After Recent Price Slump

26.07.2024 23:01 1min. readBinance Sees Surge in Bitcoin Inflows, Potential Price Impact Looms

26.07.2024 22:00 1min. readStablecoin Risks Rise in Emerging Markets, FSB Warns

26.07.2024 21:00 1min. readHere’s How Much Trump’s Campaign Has Raised in Crypto Donations

26.07.2024 20:00 1min. readElon Musk’s X Removed Bitcoin and Crypto Emojis

26.07.2024 19:00 1min. readPress Release

LATEST NEWS

-

1

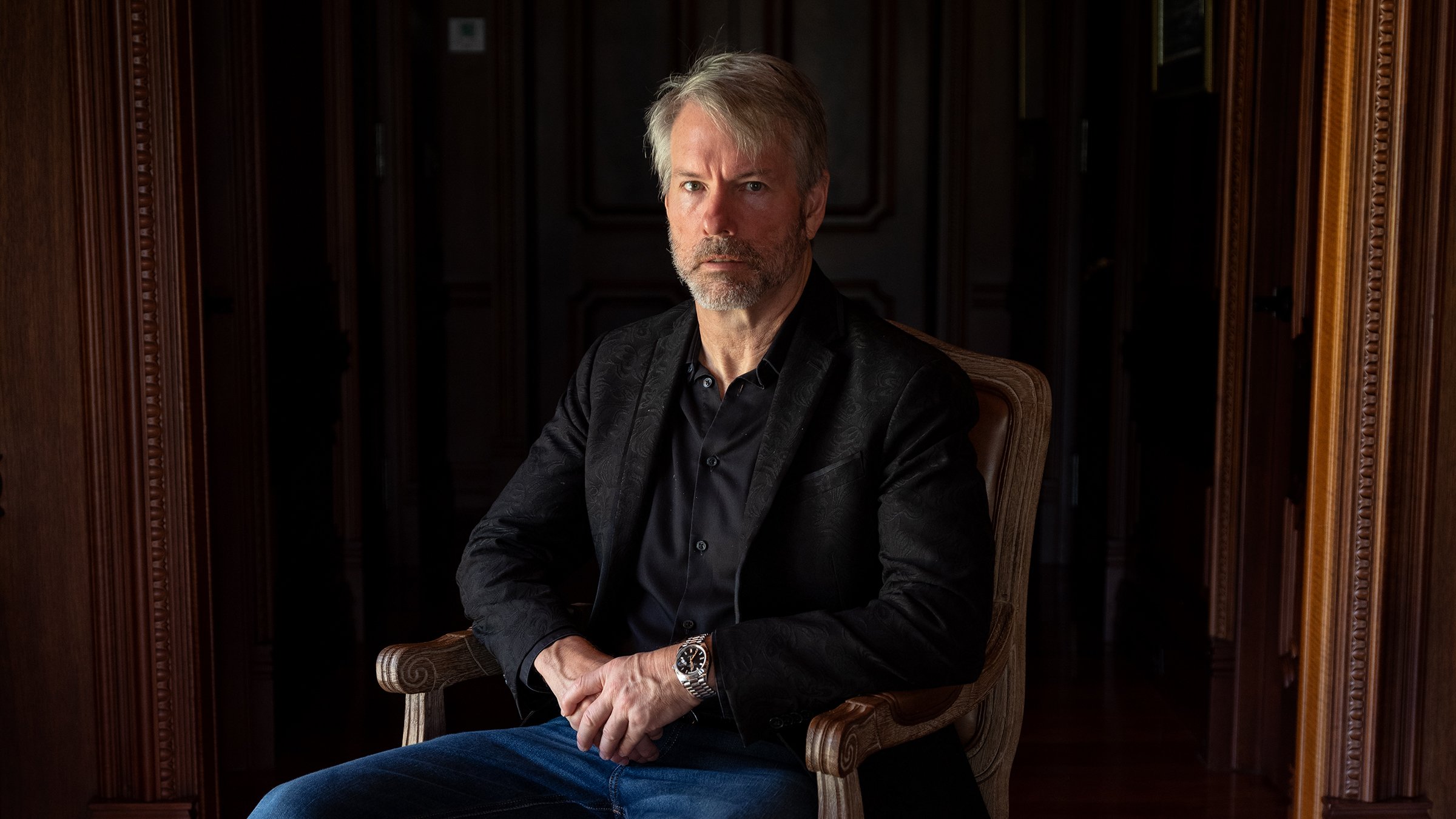

MicroStrategy’s Founder Reveals Radical Bitcoin Vision

13.07.2024 9:00 1min. read -

2

Bitcoin Experiences High Volatility After Biden Dropped Out of Presidential Race

21.07.2024 21:31 1min. read -

3

Wall Street Analysts Predict Major Declines for Top AI Stocks

07.07.2024 7:30 2min. read -

4

Best Time to Get Rich is Approaching – Robert Kiyosaki

22.07.2024 10:00 2min. read -

5

Crypto Market Poised for 90% Increase in Trading Volume by 2024

14.07.2024 7:00 1min. read

FINTECH NEWS

Ripple Has Expanded to 80+ Countries Worldwide

Ripple has successfully expanded its liquidity network to over 80 markets globally. By building innovative liquidity pathways, the fintech company aims to make cross-border payments faster, more affordable, and seamless.

CBDC: COTI Selected for Bank of Israel’s Digital Shekel Challenge

COTI, along with 14 other fintech firms, has been selected to participate in the Bank of Israel’s Digital Shekel Challenge, which aims to explore the feasibility of a central bank digital currency (CBDC).

Thailand to Launch Digital Wallet Program for Social Benefits

Thailand’s Finance Minister, Pichai Chunhavajira, announced that a new digital wallet initiative will start on August 1, distributing 10,000 baht (around $280) to up to 45 million Thais.

Swiss Banks Launch New Crypto Payment Solutions After US Bank Failures

Swiss banks are stepping up with new real-time crypto payment solutions in response to the recent collapses of US crypto-friendly banks.

Top Investment Company Launches Private Credit Fund on Solana

A startup specializing in financial tokenization is set to introduce several blockchain-based funds to the Solana network.

-

1

Swiss Banks Launch New Crypto Payment Solutions After US Bank Failures

24.07.2024 10:30 1min. read -

2

Ripple Has Expanded to 80+ Countries Worldwide

25.07.2024 21:32 1min. read -

3

Ripple Aims to Lead in Digital Asset Infrastructure for Financial Services

23.07.2024 8:00 1min. read -

4

Mastercard Partners with Alchemy Pay to Boost Security and Fight Fraud

12.07.2024 8:30 1min. read -

5

Fintech Giant Ripple Exits Key Crypto Investments

16.07.2024 8:30 1min. read