Bitcoin ETFs in the US Slow Down Their Inflows

26.07.2024 15:00 1 min. read Kosta Gushterov

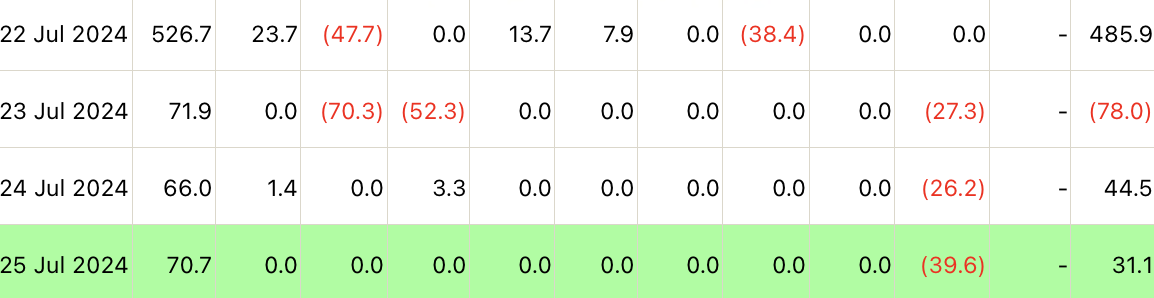

After U.S.-based spot Bitcoin exchange traded funds (ETFs) saw their highest inflows since June 4 on Monday (July 22), momentum slowed toward the end of the week.

Farside reported that spot BTC ETFs received a total of $31.1 million on July 25.

While the results are positive, they are well down from the $485.9 million raised on Monday.

Reportedly, only BlackRock’s iShares Bitcoin Trust (IBIT) recorded inflows equivalent to $70.7 million, while almost all other funds recorded neutral performance.

The exception was Greyscale’s GBTC, which again recorded outflows of $39.6 million.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Bitcoin: Historical Trends Point to Likely Upside Movement

Bitcoin may be gearing up for a significant move as its volatility continues to tighten, according to on-chain insights from crypto analyst Axel Adler.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

-

1

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

2

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

3

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read -

4

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read -

5

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

23.06.2025 17:00 1 min. read