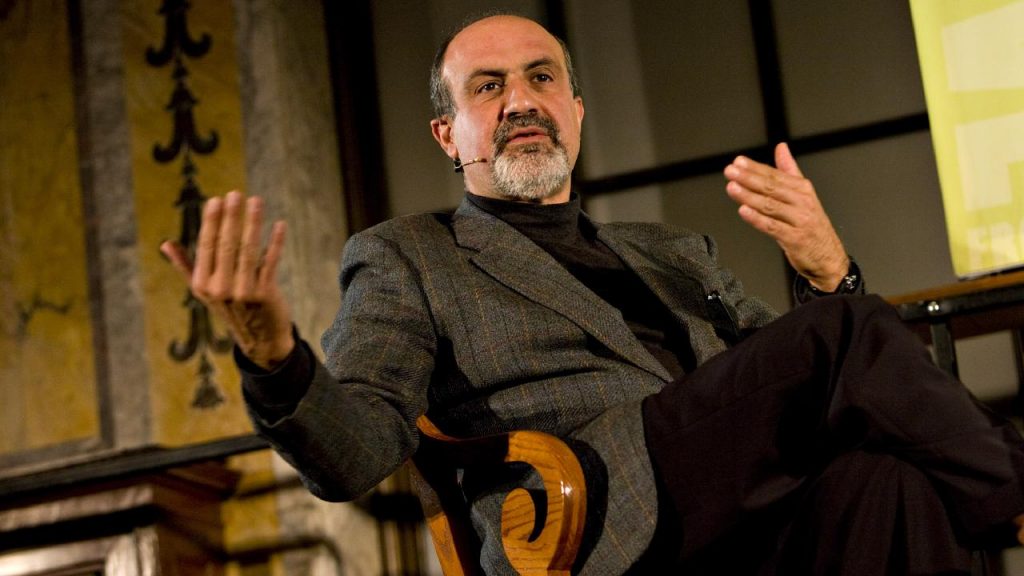

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read Alexander Stefanov

Renowned economist and Black Swan author Nassim Taleb believes the era of the U.S. dollar as the world’s dominant reserve currency is quietly coming to an end. In a recent interview with Bloomberg, Taleb argued that the financial landscape is undergoing a subtle but profound shift—one that favors gold over fiat.

Taleb pointed to the growing discomfort among global players with the political weaponization of the dollar. He specifically cited the U.S.-led sanctions on Russia following its invasion of Ukraine as a turning point.

While the immediate aim was to pressure Moscow, the move had unintended consequences. “When the U.S. froze foreign-held assets, even parties unrelated to Russia began to reconsider their reliance on the dollar and euro,” Taleb said.

According to him, this erosion of trust is now showing up in behavior: governments and institutions are increasingly stockpiling gold, using it as a hedge and silent store of value. While international trade may still be denominated in dollars, Taleb noted that many parties are converting those earnings back into gold, signaling a preference for tangible, politically neutral assets.

He also linked this shift to the broader decline in confidence in the dollar itself. As deficits grow and the U.S. faces rising fiscal risks, Taleb observed that investors are now more inclined to put their money into equities or hard assets rather than sit on a currency that gradually loses purchasing power.

“Gold has reclaimed its role—not officially, but functionally—as the reserve currency,” he concluded. “And the markets are quietly adjusting to that reality.”

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read