MicroStrategy’s Bitcoin Bet Yields Explosive Return, Surpassing Crypto Gains

30.09.2024 15:00 1 min. read Kosta Gushterov

MicroStrategy’s early investment in Bitcoin has proven highly successful, delivering a 36-fold return and cementing its status as the largest public holder of the cryptocurrency.

While Bitcoin has surged by around 150% over the past year, MicroStrategy’s stock (MSTR) has seen an even steeper rise, nearly doubling that percentage with a 300% gain.

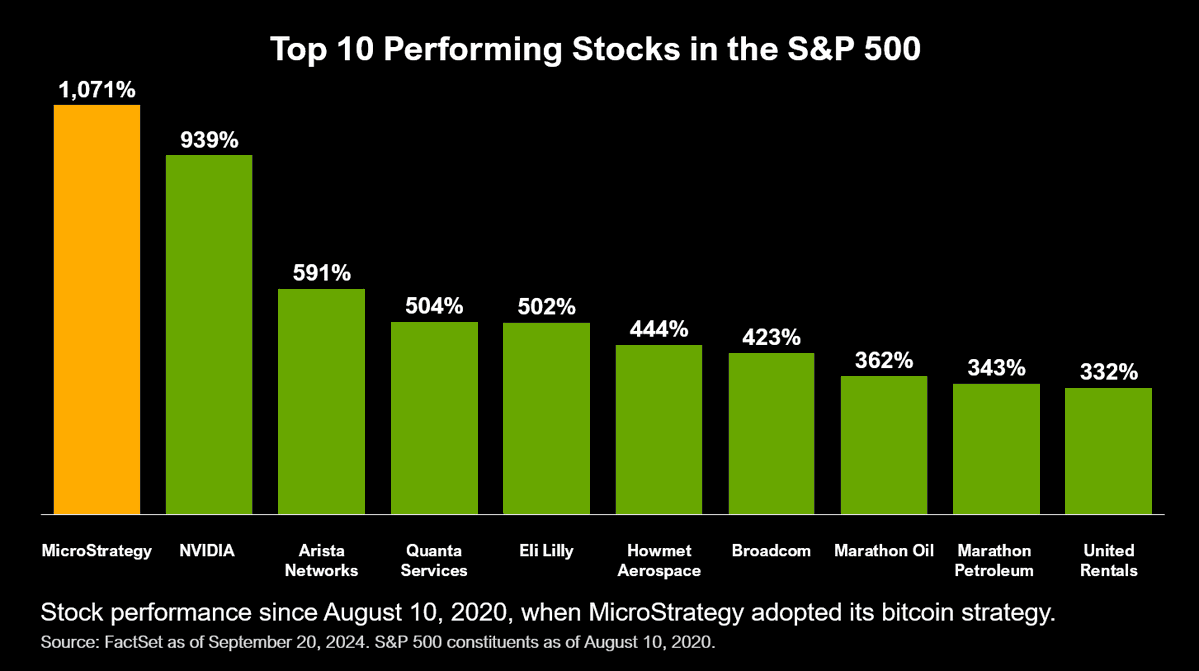

Despite its high volatility, MSTR’s stock has outperformed Bitcoin in terms of risk-adjusted returns, according to investment metrics. The company’s BTC holdings have contributed significantly to its growth, with a return of over 1,000% since adopting a Bitcoin-focused strategy.

MicroStrategy’s substantial Bitcoin reserves, totaling 252,220 BTC, are worth about $458 million and account for nearly half of its market capitalization. The company has led performance in the S&P 500, outpacing competitors like Nvidia, while mining firms such as Marathon and Riot also rank high.

Even though Bitcoin remains slightly below its all-time high of $73K, MicroStrategy’s stock has continued to rise, buoyed by new Bitcoin purchases. With institutional investors increasingly interested in Bitcoin—74% handling it in some capacity—the outlook for both the company and the cryptocurrency remains positive.

CEO Phong Le attributes the company’s success to Bitcoin adoption and growing business in AI and cloud solutions, reinforcing its strong market position moving forward.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read