Inflows to US Bitcoin ETFs Decline

12.07.2024 9:07 1 min. read Kosta Gushterov

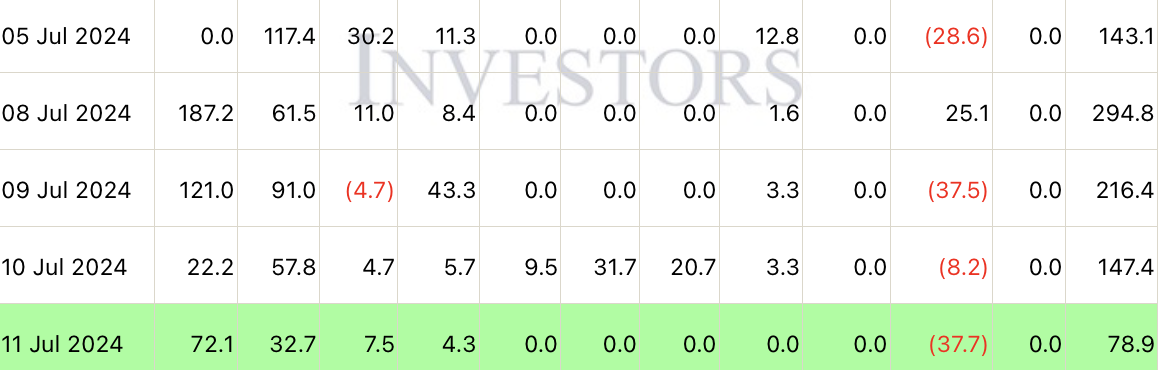

After the U.S.-based spot Bitcoin ETFs recorded two trading days with a higher net income of $200 million this week, they continued the positive streak on July 11, but more modestly.

Registering $295 million on July 8, $216 million the day after and $147 million on July 10, yesterday all-U.S. ETFs attracted just $78.9 million.

On July 11, BlackRock’s ETF, the iShares Bitcoin Trust, attracted $72.1 million, and Fidelity’s Wise Origin Bitcoin Fund followed with $32.7 million.

Bitwise’s BITB ranked third with inflows of just $7.5 million. In total, all U.S. spot Bitcoin exchange-traded funds attracted $78.9 million on the day.

Although the last four trading days saw positive overall results – Grayscale Bitcoin Trust (GBTC) again registered outflows of $37.7 million.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Arkham Intelligence: U.S. Government Holds at Least 198,000 BTC

The U.S. government now holds over 198,000 BTC, valued at approximately $23.5 billion, according to data from Arkham Intelligence.

Tesla Q2 Earnings Surge on Bitcoin Rally and AI Growth

Tesla stunned investors in Q2 2025 with a $1.2 billion profit, nearly tripling its previous quarter’s net income.

Biggest Bitcoin Miner Will Raise $850M To Buy Bitcoin

MARA Holdings, Inc. (NASDAQ: MARA), a leading digital infrastructure and Bitcoin mining firm, announced plans to raise $850 million through a private offering of 0.00% convertible senior notes due 2032.

Crypto Market Slips on Senate Bill and Altcoin Leverage Risk

The crypto market dropped 1.82% over the last 24 hours, ending a multi-day streak of gains.

-

1

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

2

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

3

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read