History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read Kosta Gushterov

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

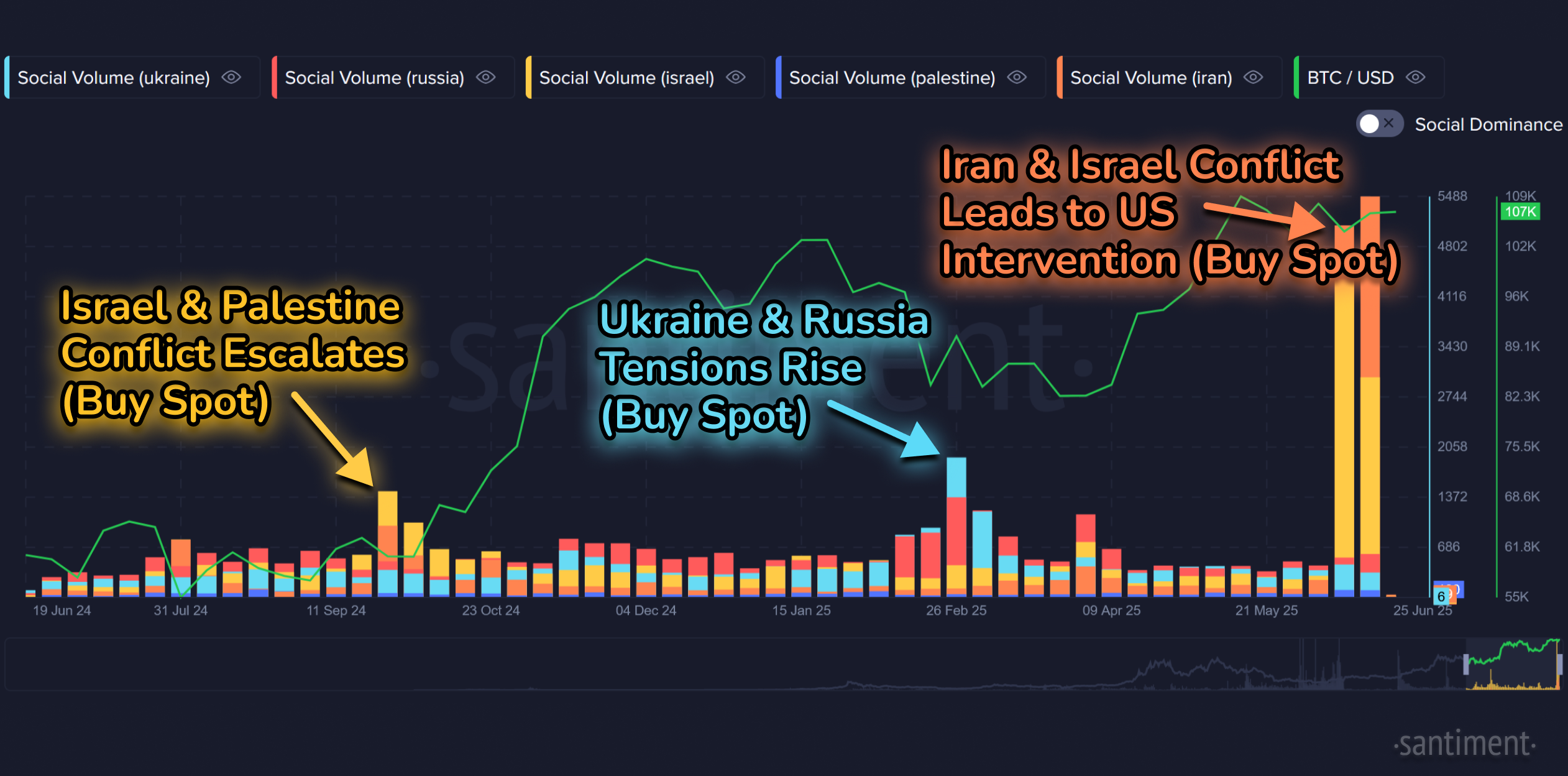

According to data from blockchain analytics firm Santiment, fear-driven reactions to war headlines often create prime opportunities for large investors—while retail traders get left behind.

History Repeats in Global Crises

The crypto market saw a familiar pattern unfold over the past week. The U.S. launched airstrikes on three Iranian nuclear sites, heightening tensions across the Middle East. Iran fired missiles in retaliation. Fears of a wider war surged as U.S. embassies went on high alert and regional airspace closures spread. Yet despite this chaos, Bitcoin bounced back above $108,000 by June 25.

This rebound aligns with earlier cycles. In February 2022, Bitcoin initially plunged when the Russia-Ukraine war broke out—only to rally days later. In October 2024, conflict between Israel and Palestine caused similar short-lived dips before a swift recovery. In each case, prices dropped when war dominated headlines, then rebounded once retail traders had exited in fear.

Santiment’s data shows crowd sentiment often peaks in fear just before markets rally. Mentions of “war” and “conflict” surged as the U.S.–Iran tension escalated. Meanwhile, social media showed a sharp rise in bearish price predictions for Bitcoin—just before it rebounded by 10%.

Panic Selling Benefits the Whales

Santiment’s on-chain metrics indicate retail traders often overreact to geopolitical shocks, while whales quietly accumulate. On June 12, following Israel’s initial strike on Iran, $335 million was liquidated across crypto markets in just one hour. By June 22, President Trump confirmed U.S. airstrikes on Iranian nuclear facilities, which spiked online mentions of “Iran”—but didn’t lead to a major price collapse.

Instead, as smaller traders sold out, the market found support. Bitcoin began climbing just as the majority expected further declines. A ceasefire between Israel and Iran followed, offering a possible turning point. As seen in past events, these de-escalation moments often mark the start of a new bullish phase.

Correlation With Stocks Adds Stability

Unlike past cycles, crypto now moves more closely with equities. Since early 2022, Bitcoin has trended in line with the S&P 500 and Nasdaq-100. This correlation means that broader market strength can provide support even during global crises.

While war-related panic still triggers short-term volatility, macroeconomic conditions—like inflation and stock performance—now play a bigger role in crypto’s direction. That’s why Bitcoin’s rebound has mirrored stock market resilience despite geopolitical headlines.

Don’t Fight the Data

Traders hoping to time war headlines have historically gotten burned. Bitcoin’s current rise—despite rising oil tensions, missile strikes, and U.S. military action—proves once again that emotional trading is costly. As Santiment’s charts show, when fear peaks, it often signals opportunity.

The key takeaway: war-related news doesn’t always mean a sustained crash. In fact, it often sets the stage for rallies. This isn’t to downplay the seriousness of geopolitical conflict—but in markets, sentiment can mislead.

With Bitcoin still near its all-time high and traders divided between fear and greed, the coming weeks will test investor discipline. If the crowd stays fearful, whales may keep accumulating. If the crowd turns euphoric too soon, a pullback could follow.

For now, history suggests this: when war strikes and panic hits the headlines, don’t rush for the exit. Patience—and a level head—tends to win.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

What Are the Key Trends in European Consumer Payments for 2024?

A new report by the European Central Bank (ECB) reveals that digital payment methods continue to gain ground across the euro area, though cash remains a vital part of the consumer payment landscape — particularly for small-value transactions and person-to-person (P2P) payments.

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read