Here’s How U.S. Crypto ETFs Performed on Aug. 6 After The Market Crash.

07.08.2024 11:13 1 min. read Kosta Gushterov

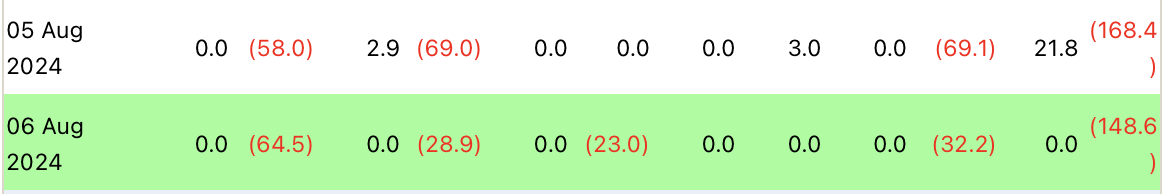

Spot Bitcoin exchange-traded funds in the U.S. recorded net outflows of $148.5 million on Tuesday, continuing Monday's outflows.

According to Farside, Fidelity’s FBTC led the outflows with $64.5 million, followed by Grayscale’s GBTC converted fund with $32.2 million and Ark Invest and 21Shares’ ARKB with $28.9 million.

Franklin Templeton’s Bitcoin fund (EZBC) also declined, losing $23 million.

Interestingly, BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, reported zero flows on Tuesday, along with seven other funds.

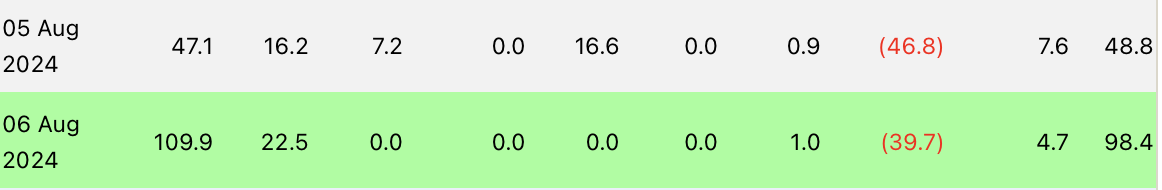

On the other hand, spot Ethereum ETFs saw net inflows on Tuesday, totaling a positive $98.4 million, continuing Monday’s positive results when just under $49 million was raised.

The largest inflow was recorded by BlackRock’s ETHA, which notched $109.9 million. Fidelity’s FETH had inflows of $22.5 million, Grayscale’s minifund (ETH) attracted $4.7 million, and Franklin Templeton’s saw $1 million in inflows.

Grayscale’s ETHE, on the other hand, experienced the weakest outflows since its inception, with just $39.7 million leaving, well down on the $484 million it recorded at launch.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

-

1

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

2

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

3

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read -

4

Nasdaq-Listed Firm Targets HYPE, Solana, and Sui for Reserve Strategy

27.06.2025 19:00 2 min. read -

5

BNB Chain Boosts Transaction Speed and Stability with New Upgrade

30.06.2025 8:00 1 min. read