Here’s How U.S. Crypto ETFs Performed on Aug. 6 After The Market Crash.

07.08.2024 11:13 1 min. read Kosta Gushterov

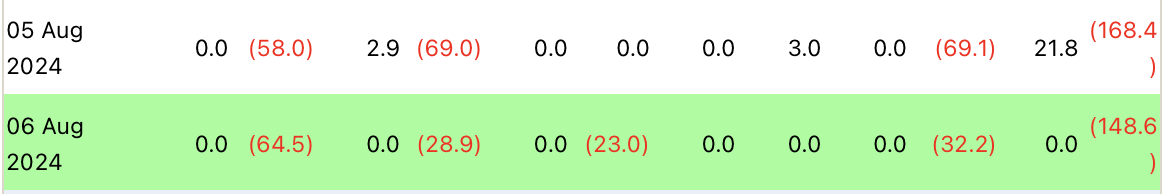

Spot Bitcoin exchange-traded funds in the U.S. recorded net outflows of $148.5 million on Tuesday, continuing Monday's outflows.

According to Farside, Fidelity’s FBTC led the outflows with $64.5 million, followed by Grayscale’s GBTC converted fund with $32.2 million and Ark Invest and 21Shares’ ARKB with $28.9 million.

Franklin Templeton’s Bitcoin fund (EZBC) also declined, losing $23 million.

Interestingly, BlackRock’s IBIT, the largest spot Bitcoin ETF by net asset value, reported zero flows on Tuesday, along with seven other funds.

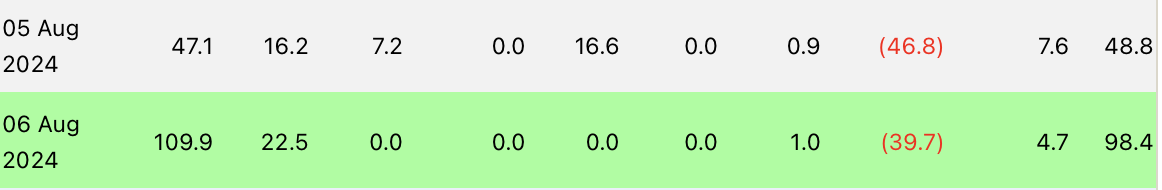

On the other hand, spot Ethereum ETFs saw net inflows on Tuesday, totaling a positive $98.4 million, continuing Monday’s positive results when just under $49 million was raised.

The largest inflow was recorded by BlackRock’s ETHA, which notched $109.9 million. Fidelity’s FETH had inflows of $22.5 million, Grayscale’s minifund (ETH) attracted $4.7 million, and Franklin Templeton’s saw $1 million in inflows.

Grayscale’s ETHE, on the other hand, experienced the weakest outflows since its inception, with just $39.7 million leaving, well down on the $484 million it recorded at launch.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Chainlink Bounces From Key Support, Eyes Breakout From Downtrend

Cryptocurrency analytics firm MakroVision has shared its technical assessment of Chainlink (LINK) price action.

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

-

1

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

2

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read -

3

Top 4 Cryptos to Watch This Summer, Offering 1000x Growth Potential

16.06.2025 13:43 4 min. read -

4

Uphold Wants to Pay Yield on XRP – Here’s the Work-Around

15.06.2025 19:00 2 min. read -

5

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read