Gold on the Rise: Can It Hit $4,000 Amid Market Turmoil?

24.03.2025 16:00 2 min. read Alexander Stefanov

Gold’s upward trajectory has caught the attention of Bloomberg’s Mike McGlone, who sees the potential for the metal to reach unprecedented highs.

With gold already surpassing $3,000, McGlone suggests that the next major target could be $4,000, driven by a combination of falling Treasury yields, declining risk asset prices, and heightened economic uncertainty.

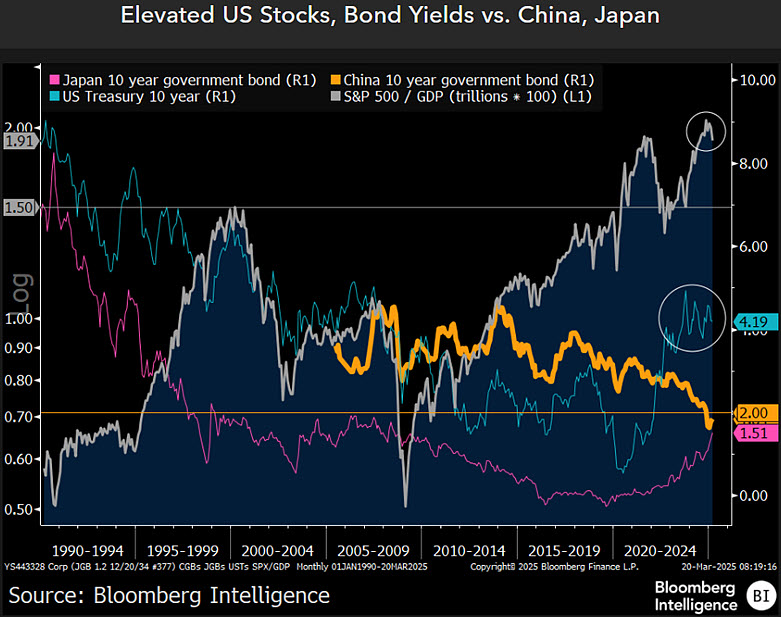

One key factor supporting this outlook is the possibility of lower U.S. Treasury yields. Currently around 4%, these yields could experience further declines, especially when compared to their much lower counterparts in China and Japan, which remain under 2%. A drop in yields would likely make gold more attractive to investors searching for alternatives to traditional financial assets.

At the same time, the stock market remains in a precarious position, with investors wary of potential downturns. While equities have shown resilience in recent sessions, broader concerns persist, particularly surrounding economic policies and ongoing trade tensions. Should stocks face renewed selling pressure, gold’s status as a safe-haven asset could attract increased capital flows, reinforcing its upward momentum.

Additionally, McGlone points out that if riskier investments, including cryptocurrencies, struggle to maintain their value, capital could shift toward gold. This redirection of funds may provide further support for the metal’s climb toward the $4,000 milestone. He previously warned that if the outflow from assets like Bitcoin continues, the leading digital currency could retreat to as low as $10,000.

Despite its strong performance, gold has momentarily paused its rally after touching $3,000. At the latest update, it was trading at $3,023, reflecting a slight daily decline of 0.68%, though still up 1.2% over the past week.

Technical indicators suggest gold is at a crucial juncture. Analyst Aksel Kibar highlights that the metal is currently testing resistance near the upper boundary of its rising trend channel. A failure to break through could lead to a pullback toward $2,500, but a successful breakout may clear the path for even higher valuations.

Geopolitical tensions, particularly ongoing conflicts and economic instability, continue to fuel bullish sentiment around gold. As investors seek stability amid global uncertainty, the precious metal remains a favored hedge against volatility, with many watching closely to see if it can sustain its historic climb.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

What Are the Key Trends in European Consumer Payments for 2024?

A new report by the European Central Bank (ECB) reveals that digital payment methods continue to gain ground across the euro area, though cash remains a vital part of the consumer payment landscape — particularly for small-value transactions and person-to-person (P2P) payments.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read -

5

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read