Gold on the Rise: Can It Hit $4,000 Amid Market Turmoil?

24.03.2025 16:00 2 min. read Alexander Stefanov

Gold’s upward trajectory has caught the attention of Bloomberg’s Mike McGlone, who sees the potential for the metal to reach unprecedented highs.

With gold already surpassing $3,000, McGlone suggests that the next major target could be $4,000, driven by a combination of falling Treasury yields, declining risk asset prices, and heightened economic uncertainty.

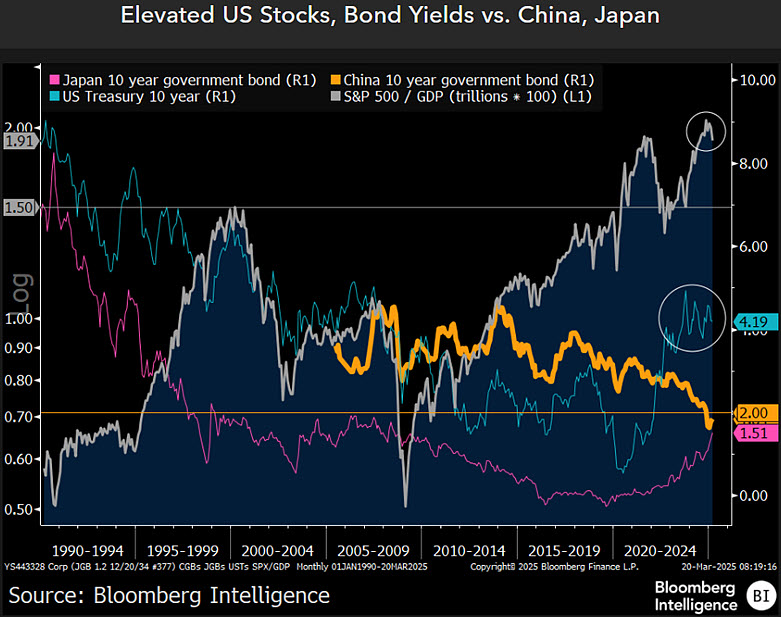

One key factor supporting this outlook is the possibility of lower U.S. Treasury yields. Currently around 4%, these yields could experience further declines, especially when compared to their much lower counterparts in China and Japan, which remain under 2%. A drop in yields would likely make gold more attractive to investors searching for alternatives to traditional financial assets.

At the same time, the stock market remains in a precarious position, with investors wary of potential downturns. While equities have shown resilience in recent sessions, broader concerns persist, particularly surrounding economic policies and ongoing trade tensions. Should stocks face renewed selling pressure, gold’s status as a safe-haven asset could attract increased capital flows, reinforcing its upward momentum.

Additionally, McGlone points out that if riskier investments, including cryptocurrencies, struggle to maintain their value, capital could shift toward gold. This redirection of funds may provide further support for the metal’s climb toward the $4,000 milestone. He previously warned that if the outflow from assets like Bitcoin continues, the leading digital currency could retreat to as low as $10,000.

Despite its strong performance, gold has momentarily paused its rally after touching $3,000. At the latest update, it was trading at $3,023, reflecting a slight daily decline of 0.68%, though still up 1.2% over the past week.

Technical indicators suggest gold is at a crucial juncture. Analyst Aksel Kibar highlights that the metal is currently testing resistance near the upper boundary of its rising trend channel. A failure to break through could lead to a pullback toward $2,500, but a successful breakout may clear the path for even higher valuations.

Geopolitical tensions, particularly ongoing conflicts and economic instability, continue to fuel bullish sentiment around gold. As investors seek stability amid global uncertainty, the precious metal remains a favored hedge against volatility, with many watching closely to see if it can sustain its historic climb.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

Binance CEO Reveals What’s Fueling the Next Global Crypto Boom

Binance CEO Richard Teng shared an optimistic outlook on the future of cryptocurrencies during an appearance on Mornings with Maria, highlighting growing global acceptance, regulatory progress, and strategic reserve integration.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

5

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read