Ethiopia Emerges as a Promising Bitcoin Mining Hub Amid Challenges

11.10.2024 15:00 1 min. read Alexander Zdravkov

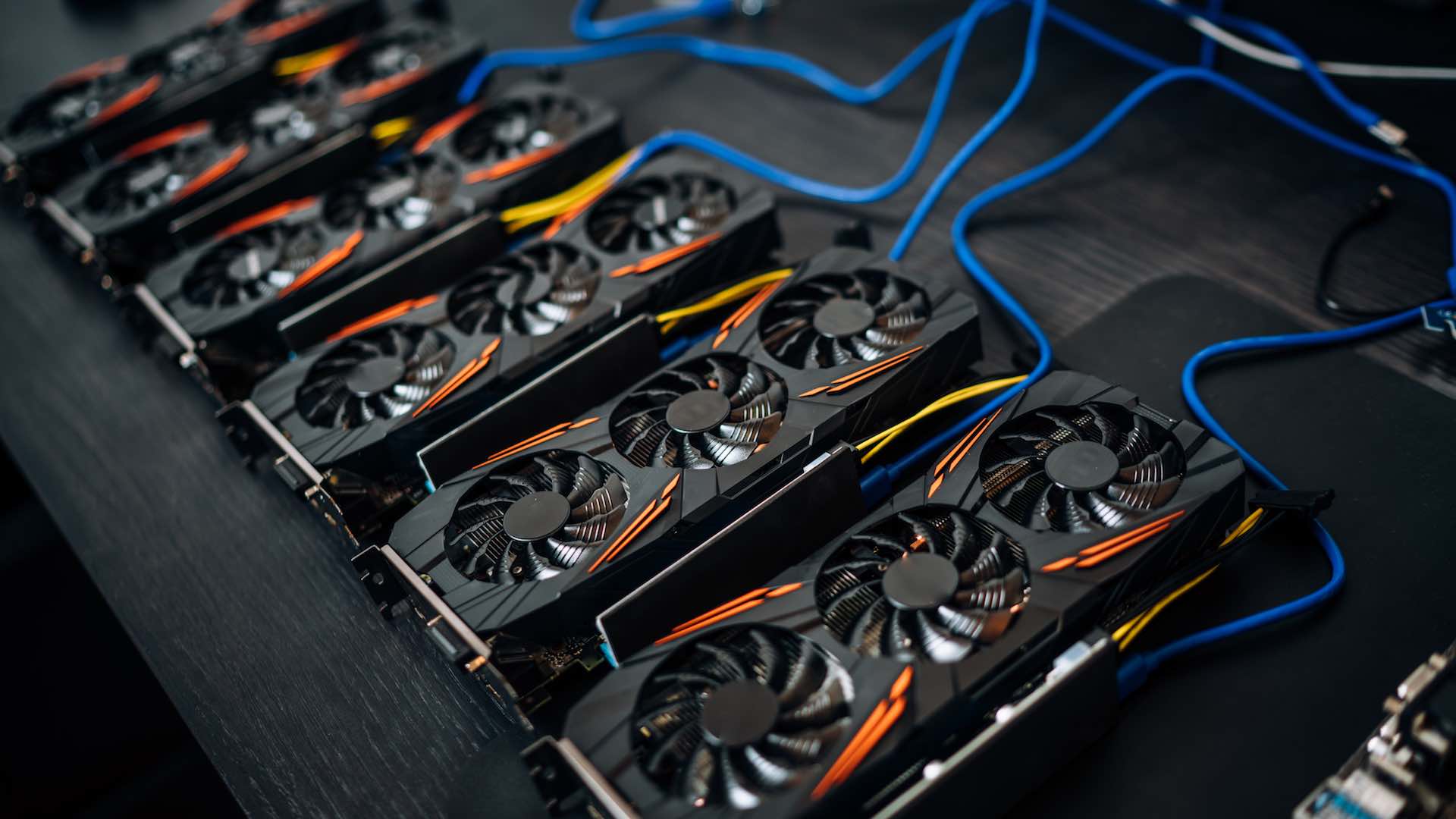

Ethiopia is establishing itself as a key player in Bitcoin mining due to its extensive hydroelectric resources and low energy costs.

Currently, the country utilizes about 600 megawatts of electricity, positioning itself as a preferred destination for cryptocurrency miners in Africa.

To promote this sector, the Ethiopian government has initiated significant partnerships, such as a $250 million agreement with West Data Group, aimed at enhancing digital infrastructure. This move is part of a broader strategy to leverage technology for economic advancement, particularly after China’s recent crypto restrictions.

With electricity prices around 3.14 cents per kilowatt-hour, Ethiopia is attractive for miners using equipment like Bitmain’s S19J Pro, which is both cost-efficient and energy-saving. Additionally, the country’s cooler climate reduces cooling expenses for mining operations.

The potential economic boost from Bitcoin mining is considerable, with projections estimating contributions of $2 billion to $4 billion. However, challenges remain, as nearly half of the population lacks reliable electricity. The government must find a way to balance the energy demands of miners with those of the general populace while navigating regulatory uncertainties.

New legislation is in the works to clarify Bitcoin mining regulations, which could address some of the existing concerns. Yet, the risk of sudden regulatory changes still looms large.

-

1

Ukraine Considers Bitcoin as Part of National Reserves

11.06.2025 17:00 2 min. read -

2

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

16.06.2025 19:50 1 min. read -

3

Texas Joins the Bitcoin Reserve Club, Authorizes State-Level BTC Holdings

22.06.2025 11:00 2 min. read -

4

Anthony Pompliano Unveils Bitcoin Treasury Giant After Landmark Merger

23.06.2025 17:30 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

Mexican billionaire and Bitcoin enthusiast Ricardo Salinas has renewed his warning about the risks of fiat currency systems, urging people to reconsider their financial strategies in light of what he believes is an impending monetary collapse.

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

A remarkable on-chain event has caught the crypto market’s attention: 10,000 BTC, untouched for over 14 years, were moved earlier today, according to a new report from CryptoQuant.

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

Bitcoin’s market structure has undergone a dramatic transformation, with Binance surpassing $650 trillion in BTC futures volume since launching the product in September 2019.

-

1

Ukraine Considers Bitcoin as Part of National Reserves

11.06.2025 17:00 2 min. read -

2

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

16.06.2025 19:50 1 min. read -

3

Texas Joins the Bitcoin Reserve Club, Authorizes State-Level BTC Holdings

22.06.2025 11:00 2 min. read -

4

Anthony Pompliano Unveils Bitcoin Treasury Giant After Landmark Merger

23.06.2025 17:30 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read