Decrease in Crypto Correlations Highlights New Market Trends, Says Report

01.08.2024 16:40 1 min. read Alexander Stefanov

A significant shift in cryptocurrency market dynamics has emerged, according to a recent report.

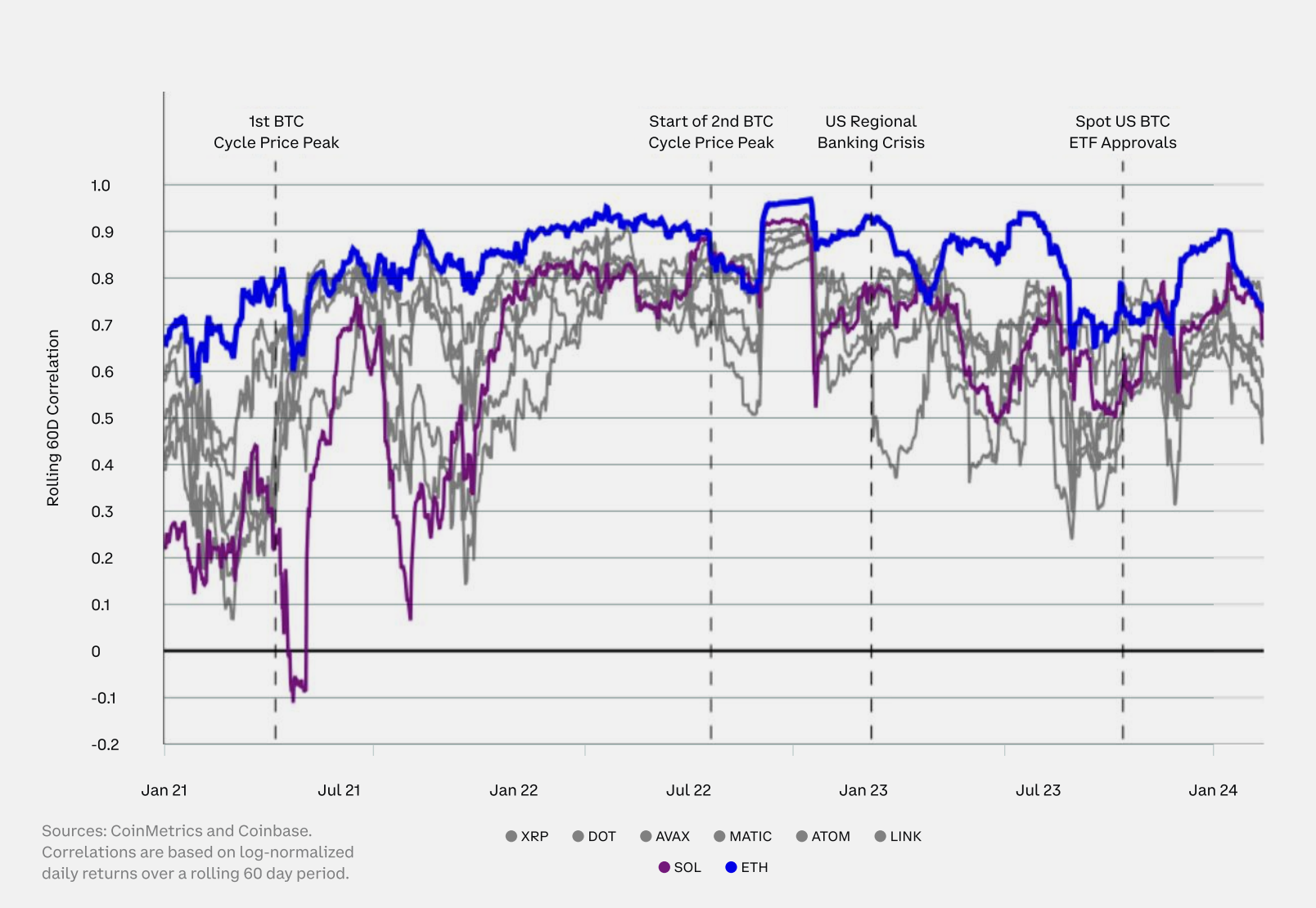

A notable trend observed in the second quarter is the decrease in correlations among various crypto assets, with coefficients now ranging from 0.7 for Ethereum to below 0.5 for some altcoins.

This trend suggests that diversifying into cryptocurrencies could be an effective strategy for portfolio management, according to David Duong, Head of Institutional Research at Coinbase.

Interestingly, this decline in correlations is distinct from past patterns, as it was not preceded by a rise in Bitcoin’s price.

This shift may be attributed to the increasing acceptance of cryptocurrencies, which has enhanced the understanding of differences among various tokens.

The introduction of spot Ethereum ETFs in the US might have also contributed to this trend, though historically, major Ethereum events such as the Merge or Shapella upgrades have led to only brief periods of decreased correlation.

The current six-week trend of reduced correlation highlights that the crypto market is likely still in a growth phase, with interest spread across different assets.

Looking ahead, greater regulatory clarity and growing institutional investment could further decrease correlations among cryptocurrencies over time.

-

1

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

16.06.2025 19:50 1 min. read -

2

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

3

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

4

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

5

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read

Esports Giant Moves Into Bitcoin Mining

The parent company behind the iconic esports brand Ninjas in Pyjamas (NIP) is taking a sharp turn into the world of Bitcoin mining, signaling a significant evolution from pure entertainment to digital infrastructure.

Billionaire Says ‘Sell Your House, Buy Bitcoin’: Fiat Collapse Is Coming

Mexican billionaire and Bitcoin enthusiast Ricardo Salinas has renewed his warning about the risks of fiat currency systems, urging people to reconsider their financial strategies in light of what he believes is an impending monetary collapse.

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

A remarkable on-chain event has caught the crypto market’s attention: 10,000 BTC, untouched for over 14 years, were moved earlier today, according to a new report from CryptoQuant.

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

Pepe (PEPE) has been trending lower in the past few days and has underperformed some of its peers as investors seem to have been increasingly drawn to Solana-based tokens. The launch of the first Solana ETF in the United States along with key paperwork submissions for a Pudgy Penguins (PENGU) ETF has pushed PEPE temporarily […]

-

1

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

16.06.2025 19:50 1 min. read -

2

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

3

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

4

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

5

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read