Cryptocurrency Market Drops as Ethereum Faces Bearish Outlook

27.08.2024 14:00 1 min. read Alexander Stefanov

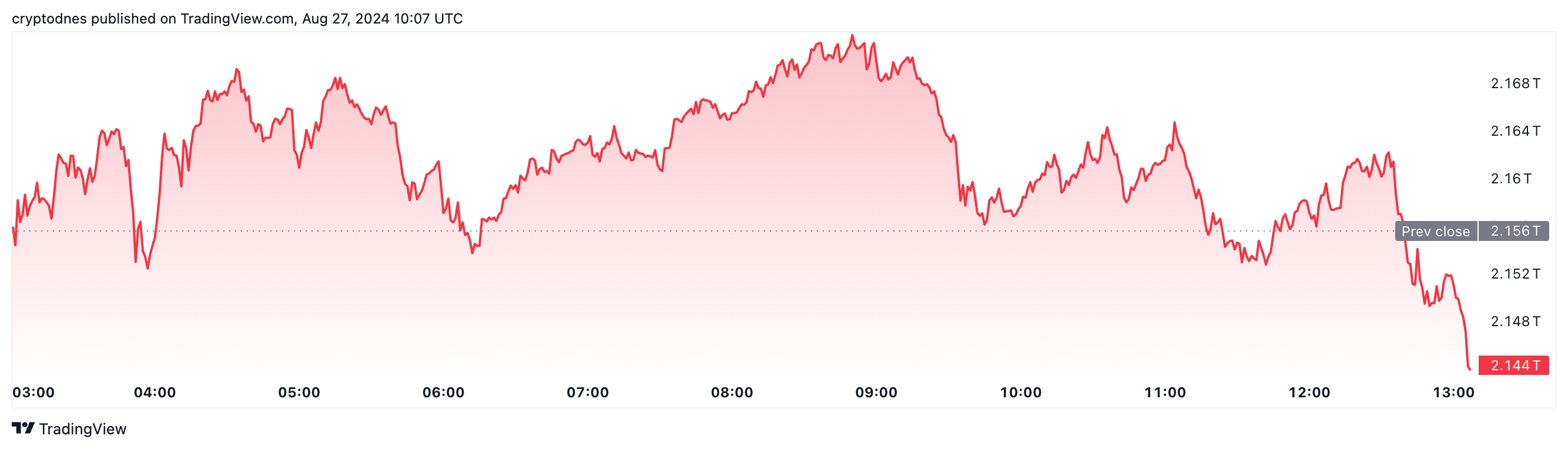

In the last 24 hours, the cryptocurrency market saw a significant drop, with total market capitalization falling by nearly 7% to $2.144 trillion.

This decline was felt across leading altcoins, including Ethereum (ETH), which mirrored Bitcoin’s (BTC) downward trend.

As the month-end approaches, concerns about a potential bearish September are growing, especially given past performance during halving years.

Ethereum’s price has dropped over 4% in the last two days, now sitting at $2,688. Technical indicators suggest a bearish outlook, with the recent “death cross” between the 50-day (blue) and 200-day (yellow) moving averages adding to the negative sentiment.

Resistance remains strong at the $2,827 level, and continued bearish pressure could push ETH down to $2,340.

Ethereum whales have been more active recently, possibly anticipating further declines. Significant ETH deposits have been made to exchanges, and the Ethereum Fear and Greed Index has dropped to 47%.

Additionally, U.S. spot Ethereum ETFs recorded net outflows of around $13.6 million, with Grayscale’s ETHE leading the withdrawals.

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

-

1

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read -

2

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

3

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

18.07.2025 11:14 2 min. read -

4

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read