Cryptocurrency Market Drops as Ethereum Faces Bearish Outlook

27.08.2024 14:00 1 min. read Alexander Stefanov

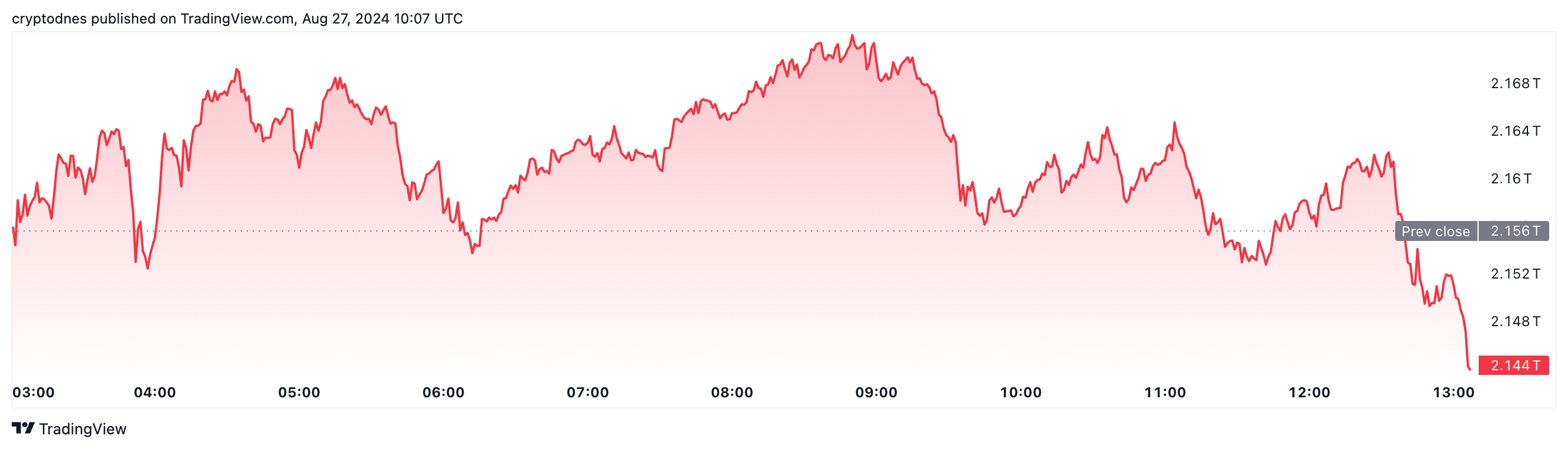

In the last 24 hours, the cryptocurrency market saw a significant drop, with total market capitalization falling by nearly 7% to $2.144 trillion.

This decline was felt across leading altcoins, including Ethereum (ETH), which mirrored Bitcoin’s (BTC) downward trend.

As the month-end approaches, concerns about a potential bearish September are growing, especially given past performance during halving years.

Ethereum’s price has dropped over 4% in the last two days, now sitting at $2,688. Technical indicators suggest a bearish outlook, with the recent “death cross” between the 50-day (blue) and 200-day (yellow) moving averages adding to the negative sentiment.

Resistance remains strong at the $2,827 level, and continued bearish pressure could push ETH down to $2,340.

Ethereum whales have been more active recently, possibly anticipating further declines. Significant ETH deposits have been made to exchanges, and the Ethereum Fear and Greed Index has dropped to 47%.

Additionally, U.S. spot Ethereum ETFs recorded net outflows of around $13.6 million, with Grayscale’s ETHE leading the withdrawals.

-

1

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

2

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

3

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

4

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

5

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read

Which Crypto ETFs Could Get SEC Approval in 2025? Here Are the Chances

With the U.S. Securities and Exchange Commission (SEC) already greenlighting spot Bitcoin and Ethereum ETFs, attention is now turning to the next wave of crypto-backed exchange-traded funds.

Top Trending Cryptocurrencies Today

As crypto markets navigate another week of volatility and shifting sentiment, traders are increasingly turning their attention to emerging altcoins and high-momentum tokens.

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

A new milestone in cryptocurrency investment products is set to unfold this Wednesday, as REX Shares prepares to launch the first-ever U.S.-listed staked crypto exchange-traded fund (ETF), according to a company announcement shared on X.

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

XRP (XRP) has gone up by 1.2% in the past 24 hours but, behind that mild price increase, there has been a significant spike in trading volumes. During this period, $2.4 billion worth of XRP has exchanged hands, representing an 83% increase. Just hours ago, Ripple announced the official launch of its Ethereum-compatible sidechain called […]

-

1

Bitcoin Holds Above $100K, But Analyst Sees Trouble Brewing

07.06.2025 17:00 1 min. read -

2

South Korea’s New President Pushes for Domestic Stablecoins

11.06.2025 16:00 2 min. read -

3

Is a New Altcoin Cycle Brewing in 2025?

13.06.2025 12:00 1 min. read -

4

Pi Token Squeezes Higher After Brief Collapse—Path to $10 Still Murky

16.06.2025 14:00 1 min. read -

5

Solana Exchange Balances Surge as Bearish Signals Grow

13.06.2025 18:25 1 min. read