Coinbase Introduces 24/7 Crypto Futures Trading in the U.S.

11.03.2025 9:00 2 min. read

The number one publicly traded cryptocurrency exchange in the U.S. is set to disrupt the U.S. crypto futures market by introducing 24/7 trading for Bitcoin and Ethereum.

This move from Coinbase removes the limitations of traditional market hours, allowing traders to manage positions at any time—similar to how global crypto markets operate.

Derivatives dominate crypto trading worldwide, yet U.S. traders have been restricted by fixed schedules that prevent them from reacting instantly to price changes. Coinbase aims to change that, catering to demand from crypto-focused investors who want unrestricted access to futures markets.

Unlike international markets, the U.S. lacks regulated perpetual futures, which let traders hold positions indefinitely. Coinbase is working with regulators to introduce a compliant version, ensuring traders no longer need offshore alternatives.

The company is engaging with the Commodity Futures Trading Commission (CFTC) and expanding partnerships with Futures Commission Merchants (FCMs) to facilitate its new product. Its efforts align with a broader industry push—Singapore’s SGX, for example, plans to launch Bitcoin perpetual futures in 2025.

Meanwhile, Coinbase CEO Brian Armstrong is strengthening ties with the Trump administration, reportedly contributing millions to Trump’s campaign and attending a White House crypto summit. His influence could play a key role in shaping future crypto regulations in the U.S.

Coinbase Expands its Services, While BTC Bull Gets the Attention

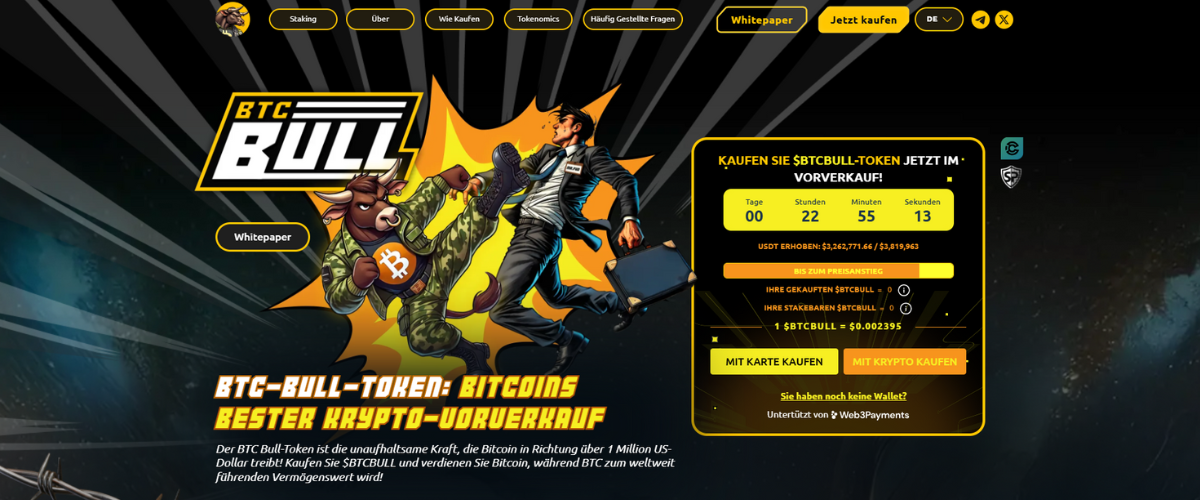

BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

Strategy Launches $2 Billion Raise to Buy More Bitcoin

MicroStrategy is doubling down on its Bitcoin strategy with a massive $2 billion fundraising move. Originally planned at $500 million, the company expanded its offering after seeing strong investor demand.

Arkham Intelligence: U.S. Government Holds at Least 198,000 BTC

The U.S. government now holds over 198,000 BTC, valued at approximately $23.5 billion, according to data from Arkham Intelligence.

FTX Sets Next Data for Creditor Distribution

FTX Trading Ltd. and the FTX Recovery Trust have announced August 15, 2025 as the official record date for their next round of distributions.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read