Bitcoin’s Correlation With Gold Hits 11-Month Low

13.11.2024 19:30 1 min. read Alexander Zdravkov

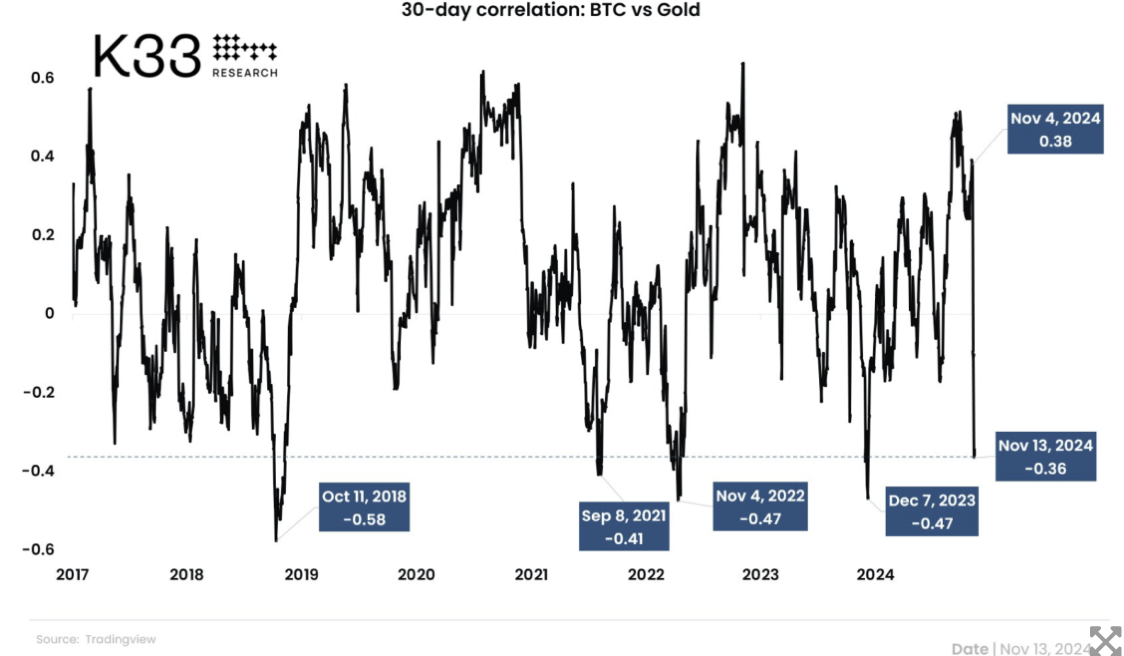

Since the recent US presidential election, gold has fallen by around 5%, while Bitcoin has risen by over 20%, indicating a marked change in the relationship between these two assets.

Analysts believe that capital may move from traditional safe assets such as gold to BTC as investors reassess their strategies in uncertain economic times.

Analysts at QCP Capital say Bitcoin, often referred to as “digital gold“, is increasingly attracting capital that could traditionally flow into gold, signaling a structural shift toward digital assets as alternative safe havens.

With a market capitalization of about $1.73 trillion, Bitcoin recently surpassed the total value of silver, but still lags far behind gold, which has a market valuation of $17.5 trillion. However, QCP Capital analysts believe that a small change – such as shifting just 1% of gold’s capital to Bitcoin – could boost the cryptocurrency’s price to nearly $97,000.

In parallel, head ofresearchat K33 Vetle Lunde pointed out that Bitcoin’s correlation with gold has fallen to an 11-month low, supporting the idea that BTC is establishing a standalone position in the market. The thirty-day correlation between the two assets has also reached a similar low, illustrating this divergence in performance.

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

What the Crypto Community is Thinking as Bitcoin Slips

Traders are growing cautious, and the crypto mood is beginning to shift. Bitcoin has stalled near $115,500, and momentum is no longer as confident as it was earlier this month.

Bitcoin Drops 2.5% to $115,200 as Whales Move Millions to Exchanges

Bitcoin slipped 2.56% in the past 24 hours, falling below key short-term support levels. The decline comes amid a combination of large whale transactions, cooling technical momentum, and weak performance across the broader crypto market.

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read