Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read Kosta Gushterov

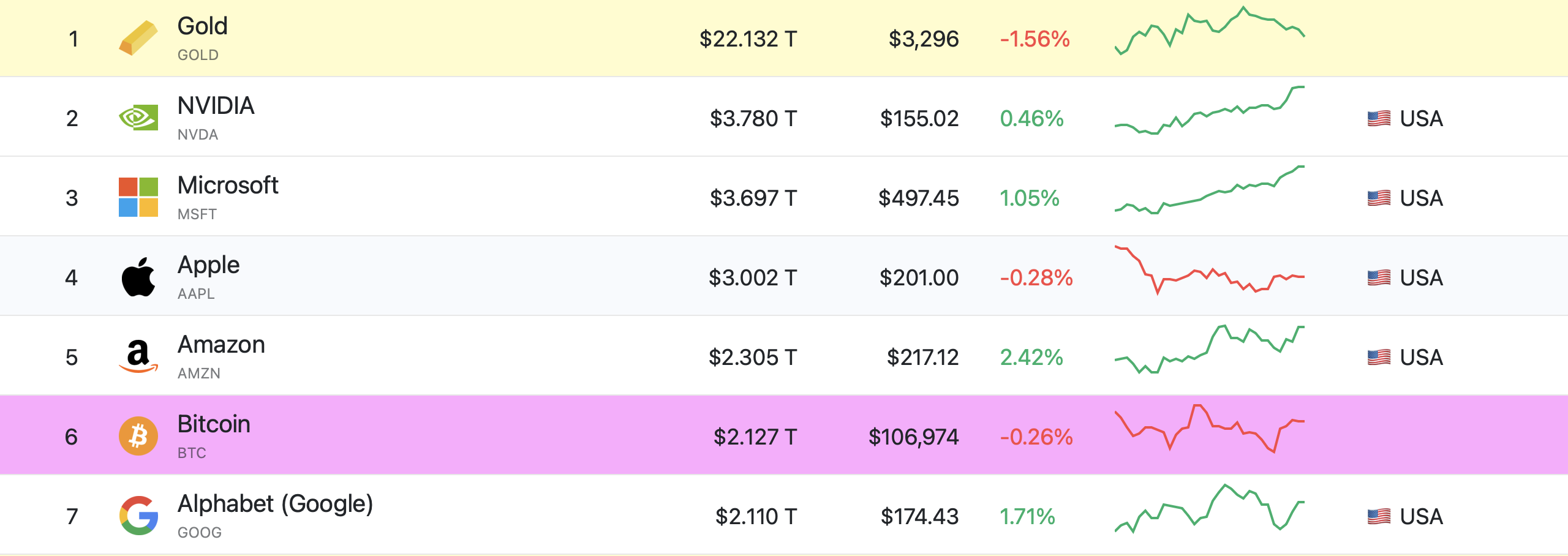

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

As of early Friday, Bitcoin’s market capitalization reached $2.127 trillion, narrowly edging past Alphabet’s $2.11 trillion. The digital asset now sits just one spot below Amazon, which holds a $2.305 trillion valuation.

This development comes amid a surge in crypto market momentum, boosted by Coinbase stock gains and anticipation of stablecoin legislation in the U.S., both of which are reinforcing the idea that Bitcoin is becoming a mainstream macro asset.

Global Asset Rankings by Market Cap

- Gold – $22.13 trillion

- NVIDIA – $3.78 trillion

- Microsoft – $3.697 trillion

- Apple – $3.002 trillion

- Amazon – $2.305 trillion

- Bitcoin – $2.127 trillion

- Alphabet (Google) – $2.11 trillion

With BTC now just ~$180 billion behind Amazon, it may soon break into the top five most valuable assets globally.

The climb reflects growing institutional participation, increased ETF exposure, and regulatory clarity on the horizon — all reinforcing the idea that Bitcoin is no longer speculative, but structural.

President Trump’s pro-crypto stance is also playing a key role in Bitcoin’s rise. His administration has embraced digital assets as part of the U.S. economic future, supporting crypto-friendly policies, regulatory clarity, and innovation in blockchain finance. This political backing has boosted institutional confidence and helped position Bitcoin as a mainstream asset class.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read