Bitcoin Short-Term Holders Face Record Losses Amid Market Decline

13.08.2024 8:00 2 min. read

According to the latest "Bitfinex Alpha" report, short-term Bitcoin (BTC) holders are facing their highest level of unrealized losses since the bear market of 2022.

This situation has intensified concerns about a potential sell-off, putting additional downward pressure on prices.

The Short-Term Holder MVRV (Market Value to Realized Value) ratio, which measures the current market value of BTC against the price at which it was last moved on the blockchain, is currently below one. This suggests that if short-term holders were to sell now, they would incur losses, potentially leading to increased selling pressure in a declining market.

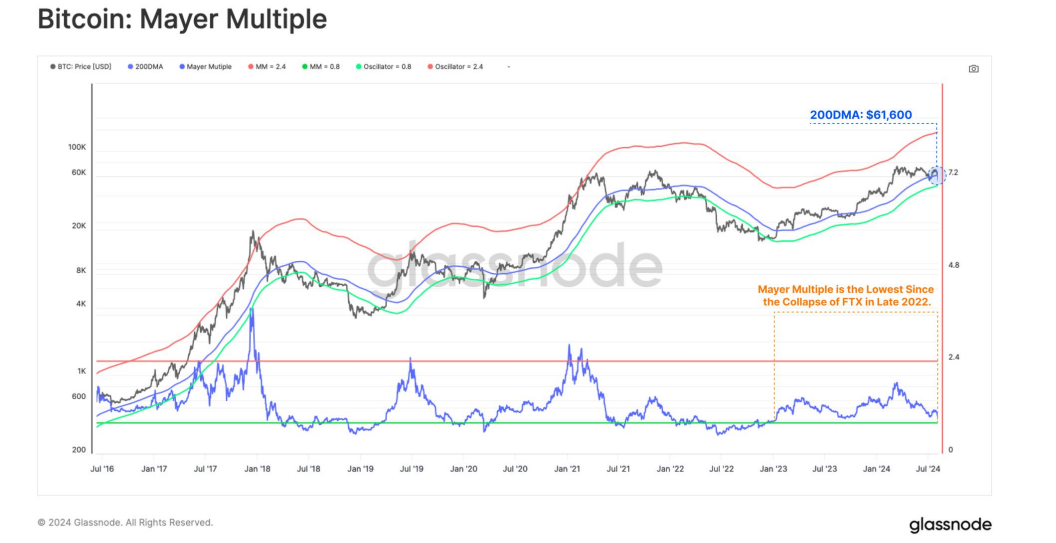

Bitcoin’s price has dropped 33% from its peak of around $73,700, marking the steepest decline in this cycle. The Mayer Multiple, which compares Bitcoin’s current price to its 200-day moving average, has fallen to 0.88. This is the lowest level since the FTX collapse in November 2022.

The Mayer Multiple is a key indicator for assessing Bitcoin price trends relative to its historical average. A low Mayer Multiple signals that Bitcoin is trading significantly below its typical historical value, offering insights into potential market buy or sell signals.

Currently, the Short-Term Holder Realized Price (STH Cost-Basis) is at $64,860, reflecting the average purchase price for those who have held their coins for 155 days or fewer. Bitcoin’s recent spot price has come close to one standard deviation below this level, a situation that has occurred only 7.1% of trading days.

This significant deviation underscores the severity of the recent market downturn and highlights the stress experienced by newer market participants. Assessing this sentiment is crucial for understanding current market dynamics.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

Strategy Launches $2 Billion Raise to Buy More Bitcoin

MicroStrategy is doubling down on its Bitcoin strategy with a massive $2 billion fundraising move. Originally planned at $500 million, the company expanded its offering after seeing strong investor demand.

Arkham Intelligence: U.S. Government Holds at Least 198,000 BTC

The U.S. government now holds over 198,000 BTC, valued at approximately $23.5 billion, according to data from Arkham Intelligence.

Tesla Q2 Earnings Surge on Bitcoin Rally and AI Growth

Tesla stunned investors in Q2 2025 with a $1.2 billion profit, nearly tripling its previous quarter’s net income.

-

1

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

2

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read