Bitcoin Price Falls Below $54,000 After Mt.Gox Transfers $2.7 billion in BTC

05.07.2024 7:00 2 min. read Alexander Stefanov

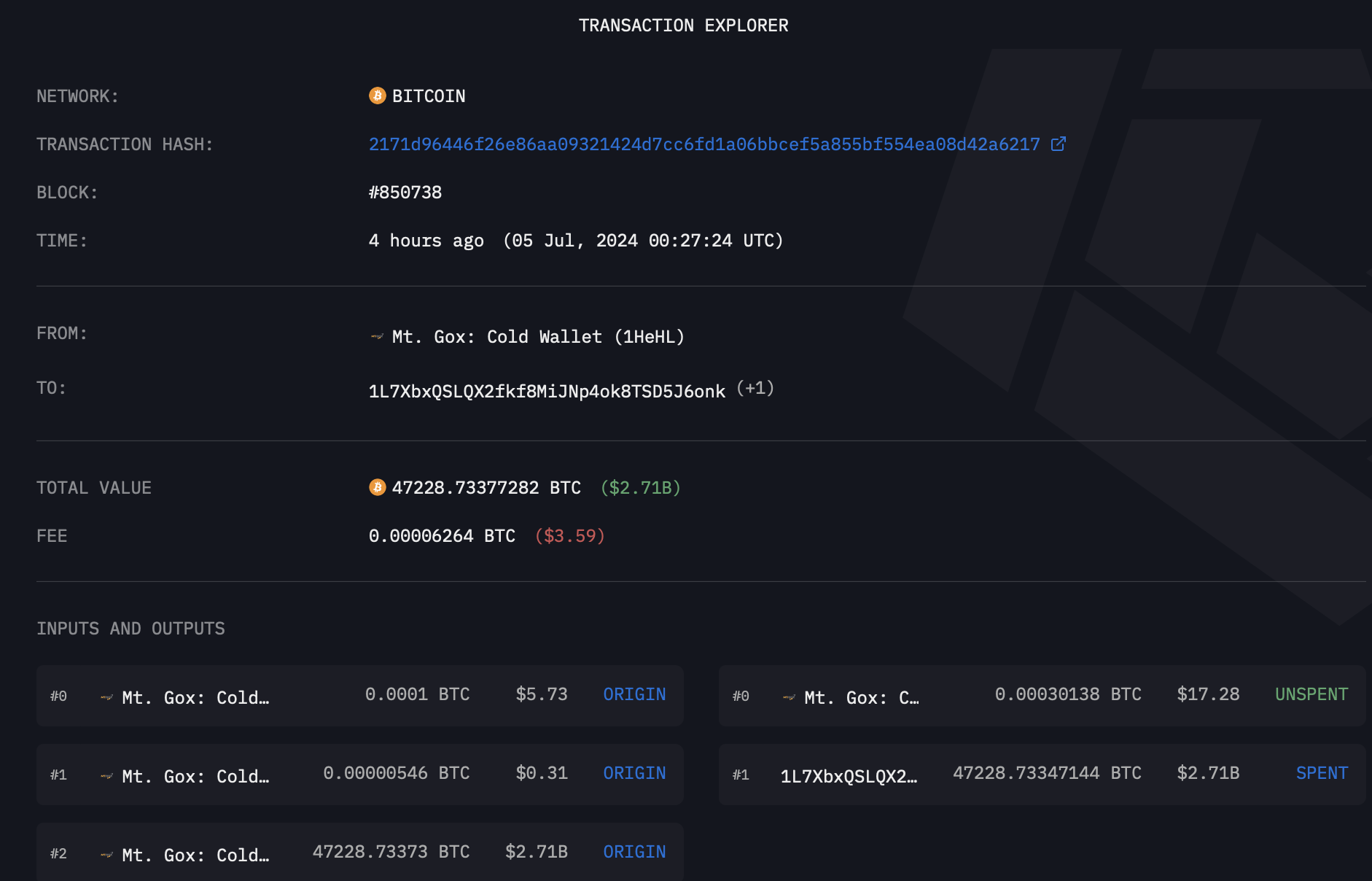

Bankrupt Japanese crypto exchange Mt. Gox has transferred 47,229 BTC (worth approximately $2.71 billion) into a new wallet, making its first significant transaction since May.

This move was undertaken around 00:30 (UTC) on July 5, as reported by blockchain analytics platform Arkham Intelligence.

As of the end of May this year, Mt. Gox’s wallet had transferred around 137,892 BTC, which at the time was worth approximately $9.45 billion. And then the exchange’s actions put selling pressure on the price of Bitcoin.

In recent days, Mt. Gox has conducted several smaller test transactions. This large transfer comes as the exchange prepares to begin repaying its obligations to creditors this month, with BTC tokens totaling about $8.5 billion to be distributed.

Market observers are concerned about the potential impact of putting such a large volume of Bitcoin on the market, fearing a sell-off by Mt. Gox’s creditors who have not had access to their holdings in more than a decade. Still, some analysts suggest that the actual amount likely to be sold is closer to $4.5 billion, which could reduce the risk of a massive market disruption.

Despite these positive predictions, however, at the time of writing Bitcoin is trading at $53,860, reflecting an 8.6% decline in the last 24 hours and over 12.4% for the week.

Since the transfer happened at 00:30 (UTC) it seems that it was the news of it that helped the cryptocurrency’s price fall below the $55,500 level, as the decline began shortly after.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

Strategy, the Bitcoin-centric firm formerly known as MicroStrategy, has temporarily paused its regular Bitcoin purchases.

Second Largest Bank in Spain Rolls out in-app Bitcoin and Ethereum Trading

Spanish banking giant BBVA has expanded its digital services by introducing in-app Bitcoin and Ethereum trading and custody for retail clients.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

‘Nobody Saw This Coming’: Saylor Points to Political Winds Fueling Bitcoin Boom

22.06.2025 10:00 2 min. read