Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

21.07.2025 12:00 2 min. read Kosta Gushterov

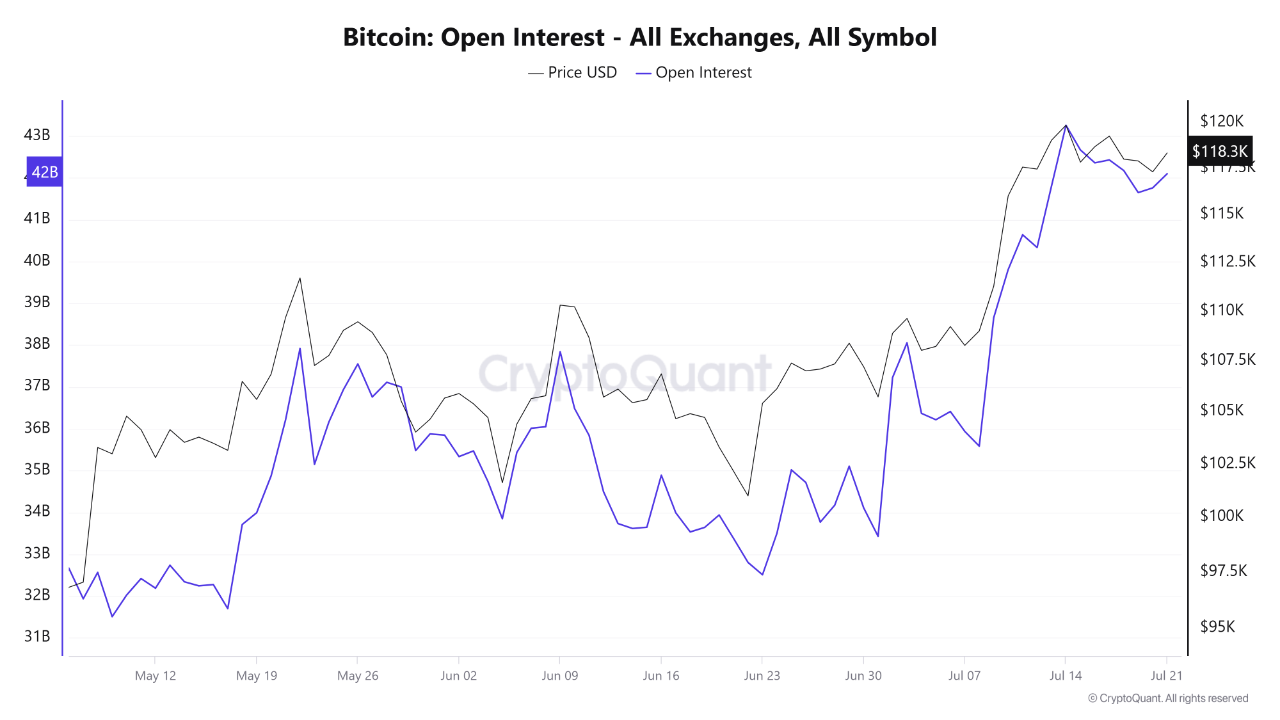

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

According to data shared by CryptoQuant, the market is experiencing a significant uptick in leveraged activity, suggesting both strong bullish sentiment and rising risk of liquidations.

High open interest signals market momentum

Open interest in Bitcoin futures reached a recent peak of $43 billion and now sits just slightly lower at $42 billion—still well within historically elevated territory. This reflects a large volume of outstanding contracts, indicating strong participation in the derivatives market. As BTC trades near $118,300, the growing open interest suggests traders are positioning aggressively ahead of a potential move beyond the $120K resistance.

Historically, spikes in open interest coincide with increased price volatility. A build-up of leveraged positions—especially in tight market conditions—can lead to rapid liquidations when prices swing sharply.

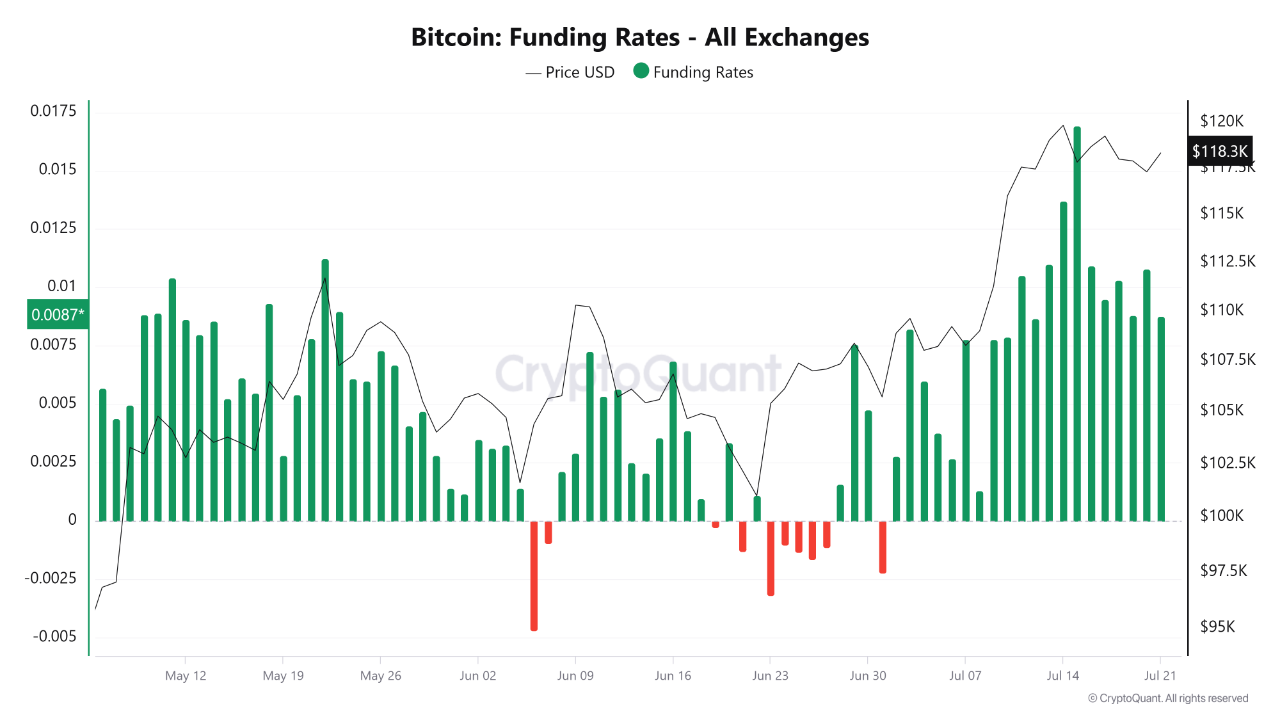

Rising funding rates reflect bullish bias

Funding rates across exchanges are trending higher, confirming that long positions are currently dominating. The more traders are willing to pay to maintain bullish bets, the more upward pressure there is on funding levels. CryptoQuant notes that elevated funding, when combined with high open interest, often reflects excessive optimism.

This dynamic signals a market in “greed mode,” where traders chase momentum. However, it also raises caution flags, as crowded long positions are vulnerable to sudden corrections or liquidation cascades if the price unexpectedly dips.

Leverage risk builds as traders chase the rally

The current setup—high open interest and elevated funding—suggests traders are aggressively deploying leverage to ride the rally. While this can amplify short-term gains, it also increases downside risk. A sudden move against the dominant trend could trigger widespread forced selling and rapid position unwinds.

CryptoQuant analysts warn that exchanges may need to intervene by adjusting margin requirements or temporarily restricting activity if volatility surges. For now, Bitcoin remains near $118K, but derivatives data hints that the next big move—up or down—may come swiftly.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

3

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

3

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read