Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read Kosta Gushterov

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

The dip comes amid falling transaction fees and weaker price action, which are squeezing miner margins following April’s block reward halving.

Despite growing pressure, the expected wave of miner capitulation has not yet appeared.

Miner Selling Activity Remains Muted

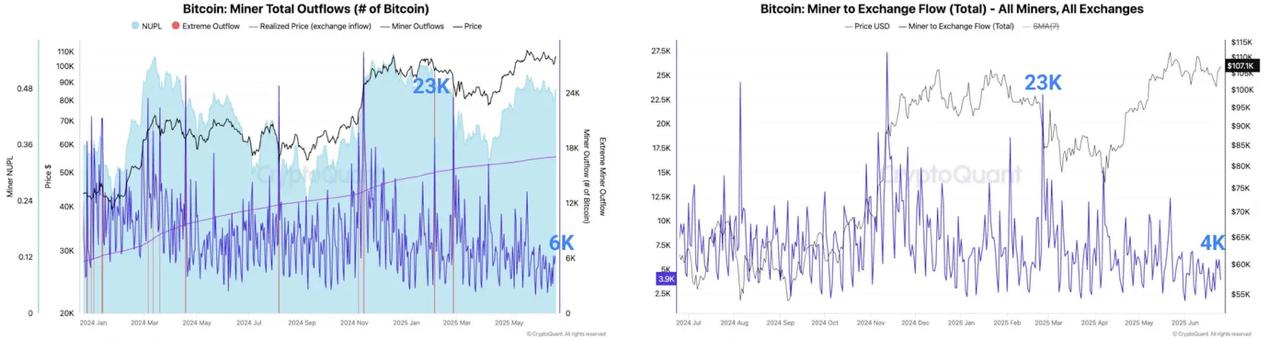

According to CryptoQuant, outflows from miner wallets have dropped sharply — from 23,000 BTC per day in February to just 6,000 BTC currently. Moreover, there have been no major BTC transfer spikes to exchanges, a typical precursor to mass selling.

Wallets linked to Satoshi-era miners have also remained largely inactive, with just 150 BTC sold in 2025, compared to nearly 10,000 BTC in 2024. This suggests long-term holders are staying put.

Miner Reserves Continue to Climb

In a key signal of conviction, miner-held reserves are growing, implying that most miners are choosing to weather the downturn rather than offload their coins at current price levels — with Bitcoin hovering near local lows.

“This further suggests there’s no selling pressure coming from miners at these price levels,” CryptoQuant concluded.

Long-Term Strategy Over Panic

The data paints a picture of a mining sector choosing to hold — either in hopes of a near-term rebound or as a deliberate long-term strategy. Even amid falling incentives, most miners appear willing to burn through cash instead of liquidating BTC at unfavorable levels.

As Bitcoin’s network adjusts post-halving, miner behavior remains surprisingly resilient, reinforcing the notion that supply-side pressure is not a concern — at least for now.

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read -

2

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

5

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read