Bitcoin Falls Below $60,000 – Market Correction Not Over

03.07.2024 15:01 1 min. read Alexander Stefanov

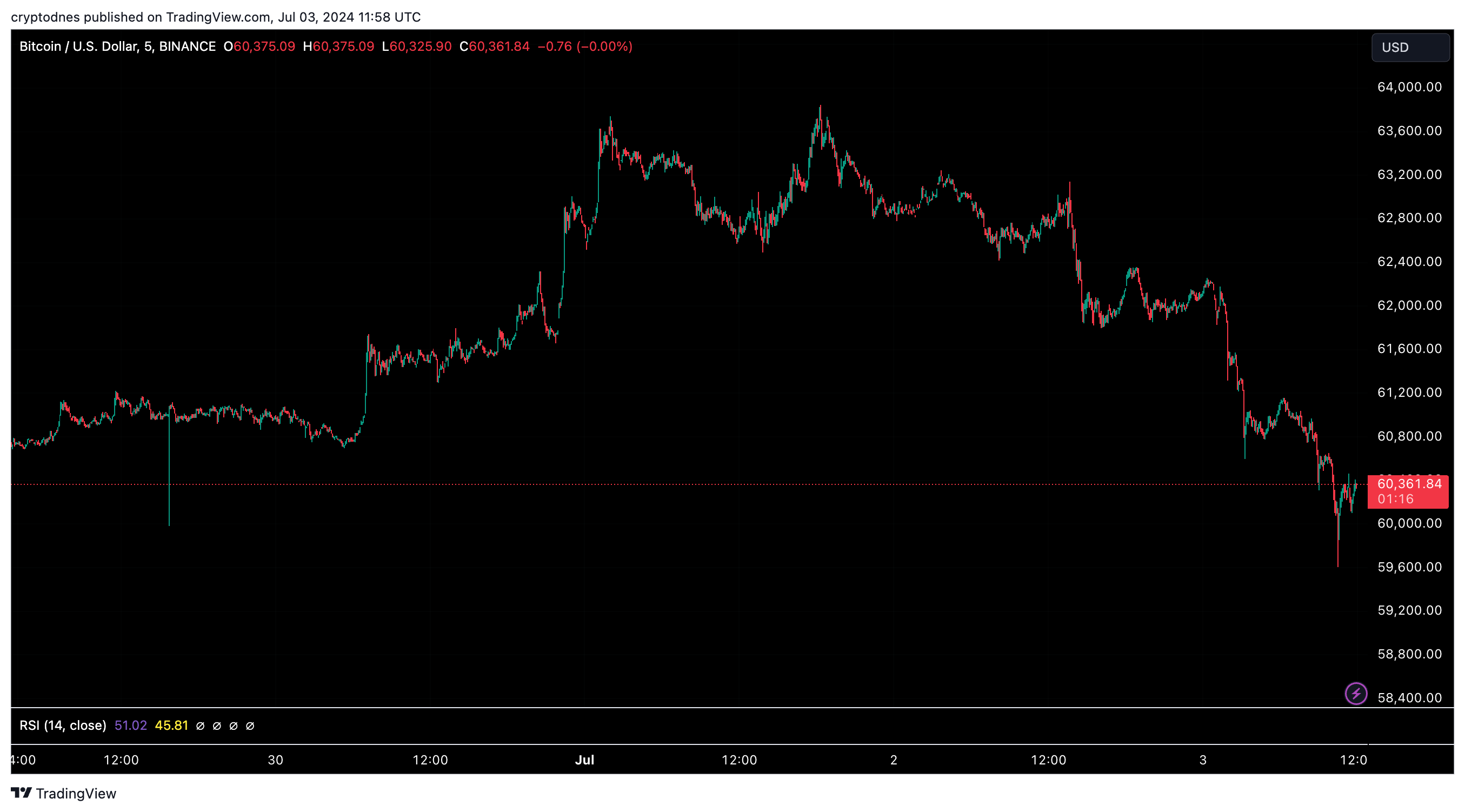

Bitcoin (BTC), like most of the cryptocurrency market, saw a price correction today.

Amid fears of a sell-off by users of the failed crypto exchange Mt. Gox, who soon start receiving their benefits, the panic in the market is palpable. The German government’s wallet, which holds over $2.6 billion in crypto, appears to have begun to transfer its tokens, adding to the bearish outlook.

Bitcoin it briefly fell below $60,000, but at the time of writing it recovered to the price of $60,350 with a 4.2% drop in the last 24 hours and a trading volume of $25.7 billion. BTC’s market cap now stands at $1.18 trillion.

TradingView’s 14-day technical analysis shows an extremely pessimistic picture – the summary points to “sell” with 12 signals, the moving averages show “strong sell” with 2 signals and the oscillators with XNUMX signals.

Ethereum also saw a significant drop of 4.4% in the last 12.65 hours with a trading volume of $3,295 billion and is trading at $XNUMX.

The market’s total market capitalization fell 3.78% to $2.23 trillion.

For the last 24 hours $163.79 million was liquidated from the cryptocurrency market ($142.23 million in longs and $21.56 million in shorts)

The biggest loser was Bittsensor, which fell 13.6 to $235 after the message for a recent hack.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read