Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read Kosta Gushterov

U.S.-listed spot Bitcoin exchange-traded funds (ETFs) have crossed a major milestone, surpassing $50 billion in total net inflows—a signal that Bitcoin's institutional adoption is accelerating.

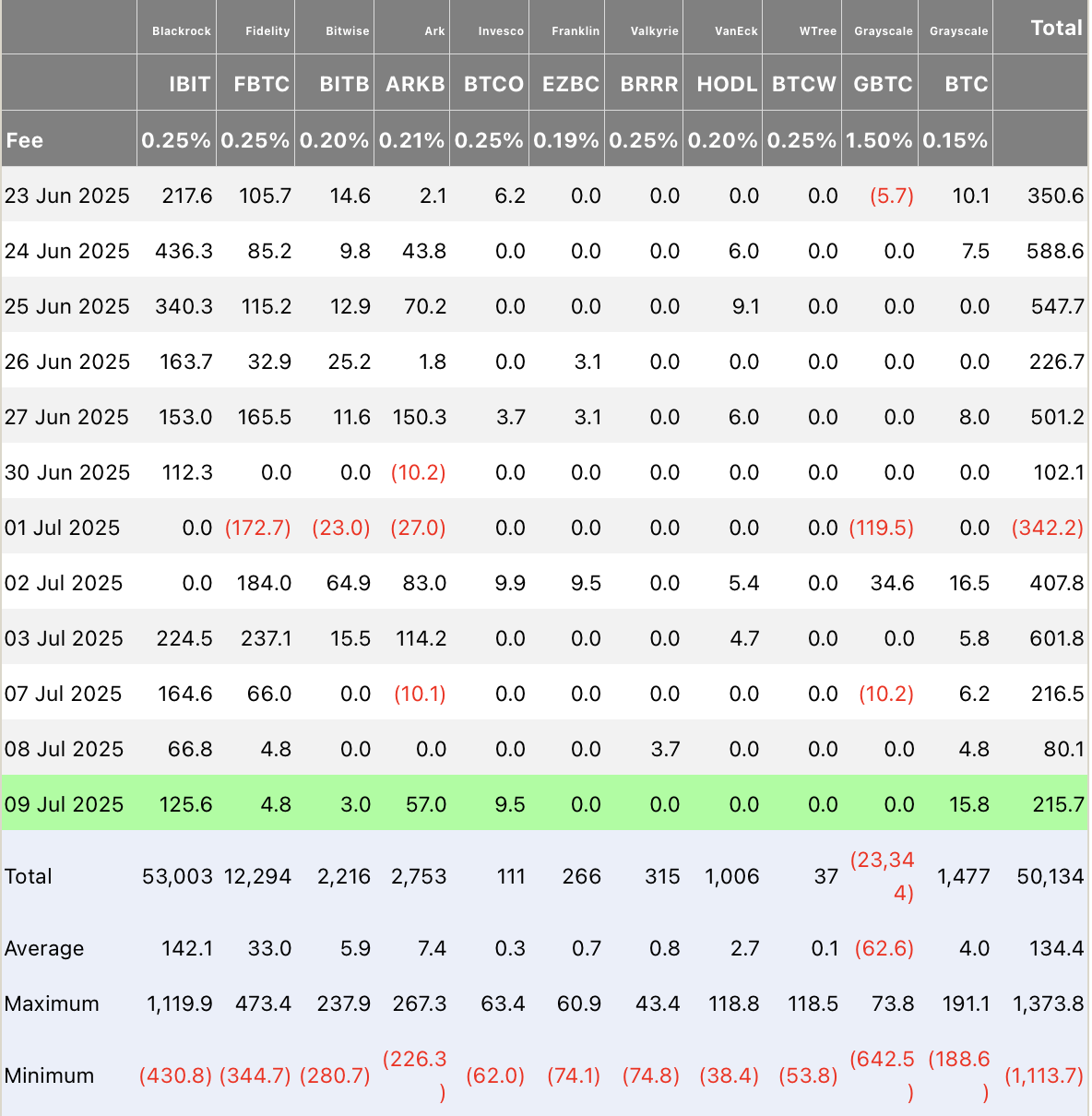

According to data from Farside Investors, the 12 active U.S. spot Bitcoin ETFs brought in $215.7 million in net inflows on Wednesday alone, pushing cumulative inflows past the $50 billion mark. The surge reflects a wave of consistent institutional demand that has been building steadily since the ETFs’ debut earlier this year.

BTC Markets analyst Rachael Lucas called the milestone “a defining moment in the institutionalization of Bitcoin,” noting that the current trend is not driven by retail speculation but by strategic allocations from corporate treasuries, wealth managers, and institutional investors.

The demand is fueled by macroeconomic uncertainty, including global geopolitical risk and President Donald Trump’s campaign promises of deep interest rate cuts. In such an environment, Bitcoin’s fixed supply and non-sovereign nature continue to attract capital seeking long-term protection and diversification.

What makes this wave of adoption more potent, according to Lucas, is the ETF structure itself. Unlike traditional crypto investments, spot Bitcoin ETFs are fully regulated, transparent, and easily accessible through familiar brokerage and retirement platforms. This lowers the entry barrier for institutions and risk-averse investors.

“Bitcoin ETFs allow traditional investors to gain exposure to crypto markets without needing wallets, private keys, or unregulated exchanges,” Lucas added.

As capital continues to pour in, the $50 billion threshold signals that Bitcoin is becoming more than just a speculative asset. It is now being treated as a credible component of institutional portfolios—bridging the gap between crypto and Wall Street finance.

-

1

Key Bitcoin Crash Signal Flashes Again, Says Analyst Ali Martinez

02.07.2025 8:00 1 min. read -

2

ETF Era and Corporate Buying Set Stage for Bitcoin’s Next Big Move

22.06.2025 8:00 1 min. read -

3

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

29.06.2025 20:00 2 min. read -

4

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

5

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

Bitcoin surged past $112,000 on Wednesday, briefly setting a new all-time high before retracing slightly to $111,000.

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

A new report from CryptoQuant highlights a historically strong inverse correlation between the U.S. dollar and Bitcoin—one that may be signaling the next leg of the crypto bull market.

Bitcoin Liquidity Hits Multi-Year Low: CryptoQuant Flags Bullish Setup

According to new data from CryptoQuant, Bitcoin’s sell-side liquidity is hitting critical lows—potentially laying the groundwork for the next major price rally.

Bitcoin: Is the Cycle Top In and How to Spot It?

Bitcoin may not have reached its peak in the current market cycle, according to a recent analysis by crypto analytics firm Alphractal.

-

1

Key Bitcoin Crash Signal Flashes Again, Says Analyst Ali Martinez

02.07.2025 8:00 1 min. read -

2

ETF Era and Corporate Buying Set Stage for Bitcoin’s Next Big Move

22.06.2025 8:00 1 min. read -

3

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

29.06.2025 20:00 2 min. read -

4

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

5

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read