Bitcoin ETFs Register Their Best Performance in 48 Days

23.07.2024 12:39 1 min. read Kosta Gushterov

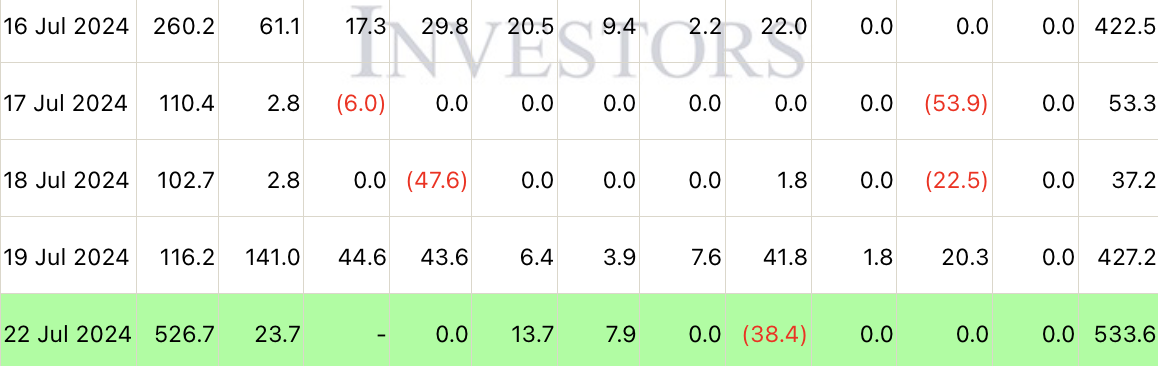

On Monday (July 22), US-based spot Bitcoin exchange traded products (ETFs) saw their highest inflows since June 4.

Farside reported that a total of $533.6 million flowed into spot BTC ETFs on Monday, marking the start of the third consecutive week in which these investment products have recorded positive inflows.

The majority of these inflows, amounting to $526.7 million, were attributable to BlackRock’s iShares Bitcoin Trust (IBIT).

Additionally, the Fidelity (FBTC), Invesco (BTCO) and Franklin Templeton (EZBC) funds saw inflows of $23.7 million, $13.7 million and $7.9 million, respectively.

Despite upbeat market sentiment, VanEck’s ETF (HODL) saw outflows of $38.4 million. Other products, including BTCW, ARK,BRRR, GBTC and DEFI, remained neutral.

-

1

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

2

Michael Saylor Signals Fresh BTC Buy as Strategy Rides Out Geopolitical Turbulence

16.06.2025 8:00 1 min. read -

3

Metaplanet Surpasses Coinbase with 10,000 Bitcoin in Treasury

17.06.2025 6:30 1 min. read -

4

South Korea Moves Toward Spot Crypto ETFs and Stablecoin Oversight

20.06.2025 15:00 1 min. read -

5

Corporate Bitcoin Adoption Still in Early Days, Says Bitwise CIO

13.06.2025 10:00 1 min. read

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

While altcoins are enjoying a strong performance across markets, it is Bitcoin that continues to dominate crypto social media chatter, according to a July 3 report by on-chain analytics firm Santiment.

Arthur Hayes Warns of Bitcoin Pullback to $90,000: Here is Why

BitMEX co-founder Arthur Hayes has issued a cautious outlook for Bitcoin and the broader crypto market, predicting a possible short-term downturn as the U.S. government shifts its liquidity strategy.

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

Bitcoin’s bullish undercurrent continues to strengthen as on-chain data and derivatives market behavior reveal aggressive accumulation from long-term holders and whales.

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

As institutional adoption of Bitcoin accelerates, U.S. asset management giant Franklin Templeton has issued a cautionary note on the growing trend of crypto-based treasury strategies.

-

1

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

2

Michael Saylor Signals Fresh BTC Buy as Strategy Rides Out Geopolitical Turbulence

16.06.2025 8:00 1 min. read -

3

Metaplanet Surpasses Coinbase with 10,000 Bitcoin in Treasury

17.06.2025 6:30 1 min. read -

4

South Korea Moves Toward Spot Crypto ETFs and Stablecoin Oversight

20.06.2025 15:00 1 min. read -

5

Corporate Bitcoin Adoption Still in Early Days, Says Bitwise CIO

13.06.2025 10:00 1 min. read