Bitcoin ETFs in the US Slow Down Their Inflows

26.07.2024 15:00 1 min. read Kosta Gushterov

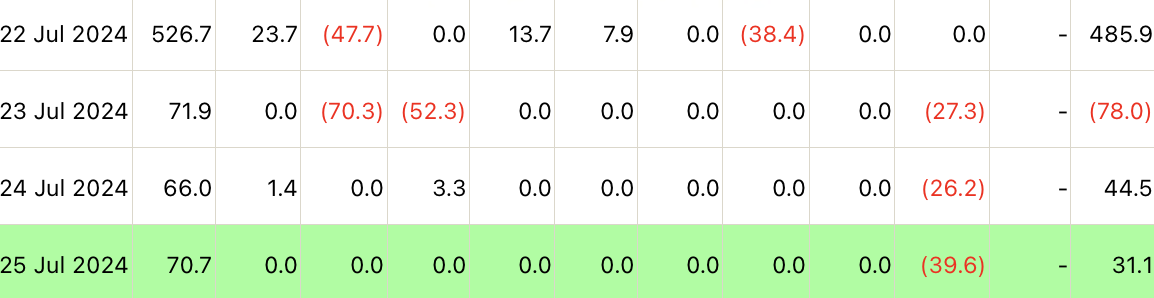

After U.S.-based spot Bitcoin exchange traded funds (ETFs) saw their highest inflows since June 4 on Monday (July 22), momentum slowed toward the end of the week.

Farside reported that spot BTC ETFs received a total of $31.1 million on July 25.

While the results are positive, they are well down from the $485.9 million raised on Monday.

Reportedly, only BlackRock’s iShares Bitcoin Trust (IBIT) recorded inflows equivalent to $70.7 million, while almost all other funds recorded neutral performance.

The exception was Greyscale’s GBTC, which again recorded outflows of $39.6 million.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read