Bitcoin ETF Demand Stays Strong With Five-Day Inflow Streak

25.04.2025 13:30 1 min. read Kosta Gushterov

U.S. spot Bitcoin exchange-traded funds (ETFs) continued their strong run on Thursday, logging a fifth consecutive day of net inflows as institutional interest in regulated BTC products remained firm.

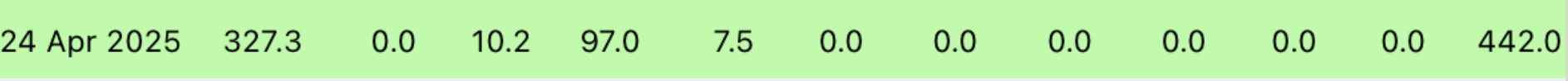

According to Farside data, the total net inflows reached $442 million across the 12 spot ETFs, with BlackRock’s IBIT once again leading the pack. The fund attracted $327.3 million in fresh capital, while ARK Invest and 21Shares’ ARKB followed with $97 million. Bitwise’s BITB added $10.2 million, and Invesco’s BTCO saw $7.5 million in net inflows.

The streak follows two blockbuster sessions earlier in the week, with inflows of $936.4 million on Tuesday and $916.9 million on Wednesday. Despite Thursday’s healthy inflow figures, total ETF trading volume dropped to $2 billion from $4 billion the previous day.

Momentum Builds Despite Market Volatility

The sustained inflows underscore persistent institutional demand for Bitcoin exposure via regulated channels. Analysts suggest this trend may signal growing investor confidence in Bitcoin ETFs as long-term vehicles, even amid broader market uncertainty.

With continued momentum and capital flows, Bitcoin ETFs are proving to be a key force in the current market cycle.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

Bitcoin Reaches New All-Time High Above $116,000

Bitcoin surged past $116,000 on July 11, marking a new all-time high amid intense market momentum.

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

Veteran trader Peter Brandt has weighed in on Bitcoin’s recent price structure, offering a nuanced take that blends cautious skepticism with long-term conviction.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read