Bitcoin ETF Demand Stays Strong With Five-Day Inflow Streak

25.04.2025 13:30 1 min. read Kosta Gushterov

U.S. spot Bitcoin exchange-traded funds (ETFs) continued their strong run on Thursday, logging a fifth consecutive day of net inflows as institutional interest in regulated BTC products remained firm.

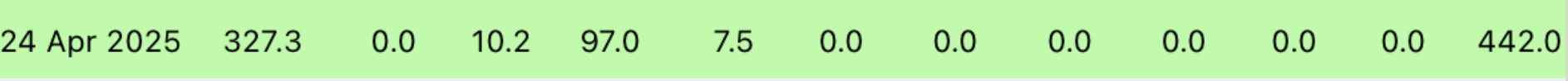

According to Farside data, the total net inflows reached $442 million across the 12 spot ETFs, with BlackRock’s IBIT once again leading the pack. The fund attracted $327.3 million in fresh capital, while ARK Invest and 21Shares’ ARKB followed with $97 million. Bitwise’s BITB added $10.2 million, and Invesco’s BTCO saw $7.5 million in net inflows.

The streak follows two blockbuster sessions earlier in the week, with inflows of $936.4 million on Tuesday and $916.9 million on Wednesday. Despite Thursday’s healthy inflow figures, total ETF trading volume dropped to $2 billion from $4 billion the previous day.

Momentum Builds Despite Market Volatility

The sustained inflows underscore persistent institutional demand for Bitcoin exposure via regulated channels. Analysts suggest this trend may signal growing investor confidence in Bitcoin ETFs as long-term vehicles, even amid broader market uncertainty.

With continued momentum and capital flows, Bitcoin ETFs are proving to be a key force in the current market cycle.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read