Bitcoin Dropped Below $60,000 Again – What Could be the Reason?

04.08.2024 18:39 1 min. read Alexander Stefanov

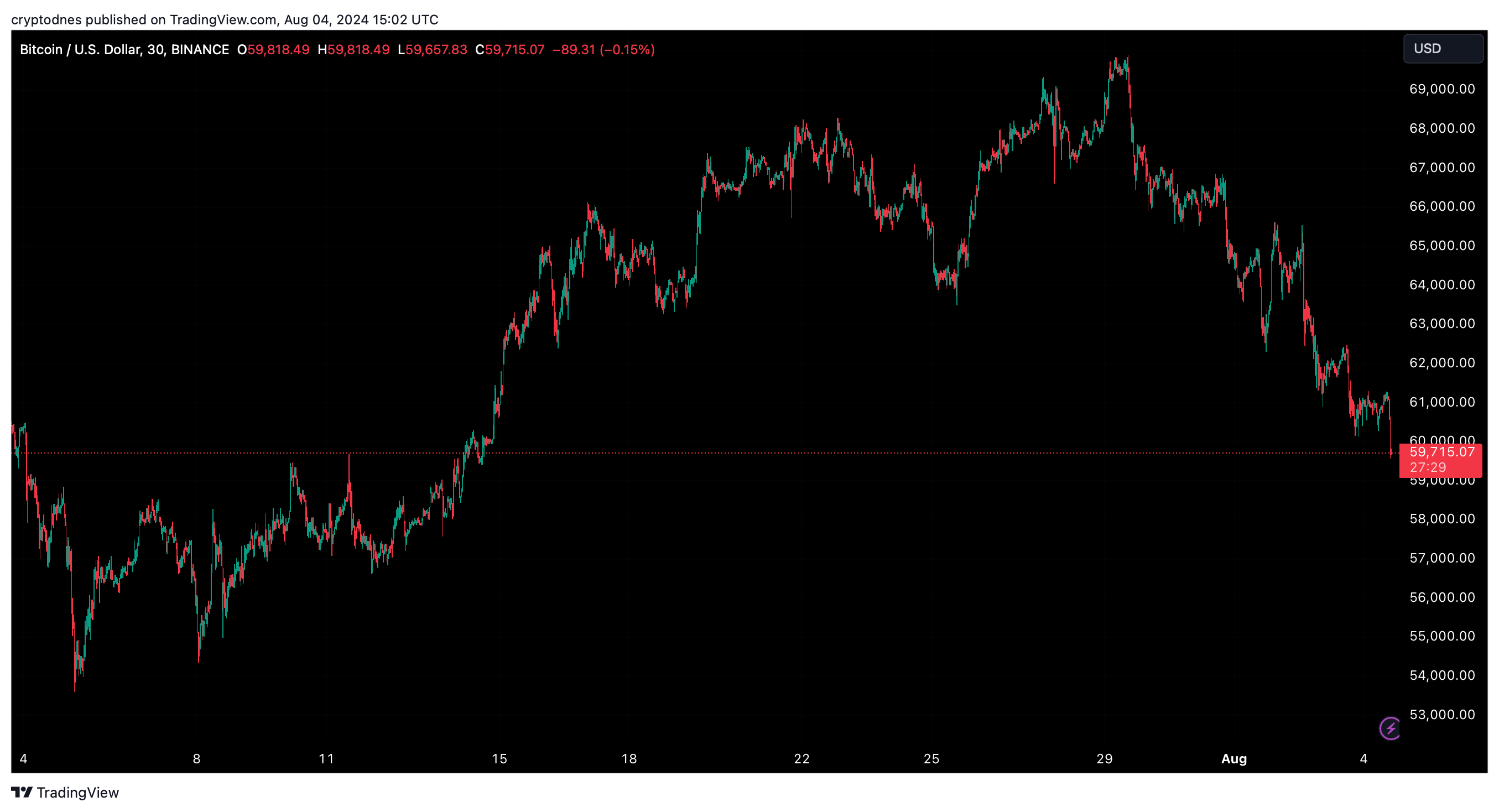

Bitcoin (BTC) saw a significant drop over the weekend, with the token price trying to get back above $60,000.

According to “RLinda,” a crypto trading expert at TradingView, this decline is part of a broader consolidation phase lasting five months.

Bitcoin‘ s losses over the weekend can be attributed to a combination of economic data, market sentiment, significant ETF outflows and the failure to overcome the critical $70,000 resistance level

Macroeconomic indicators played a crucial role in the price decline. The U.S. nonfarm payrolls report released on August 2 showed an increase in unemployment from 4% to 4.3% and rising inflation, which created negative market sentiment. The weak jobs report heightened fears of a recession, leading to a sell-off in Bitcoin.

Additionally, Farside data reveals significant outflows from Bitcoin ETFs, with $237.4 million in outflows on August 2 and $80.4 million for the week.

Additionally, the bankruptcy restructuring of Genesis Trading and the distribution of $4 billion in assets may have contributed to the market’s decline, worsening market sentiment due to emerging concerns of a potential sell-off.

At the time of writing, Bitcoin is trading at $59,700, reflecting a decline of 4% in the last 24 hours and over 11% in the last 7 days

.

.

-

1

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

-

1

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read