Bitcoin Could Hit $150,000 by Year-End, Says Financial Expert

30.03.2025 18:00 1 min. read Alexander Stefanov

As Bitcoin continues to recover from a significant decline, its price remains just below the $90,000 mark, struggling to break through the $88,000 resistance level as the first quarter of 2025 draws to a close.

Despite this, the cryptocurrency market is still anticipating a potential rally in the coming months.

Nigel Green, the CEO of deVere Group, a prominent global financial consultancy, has projected that Bitcoin could surge to $150,000 by the end of this year. He believes that this growth will be driven in part by the supportive stance that U.S. President Donald Trump has taken toward cryptocurrencies.

Green explained that Trump’s tariff policies could create economic uncertainty, prompting investors to seek out safer assets like Bitcoin. He suggests that many investors may turn to BTC as a digital equivalent of gold, seeing it as a safe-haven asset in times of global instability.

READ MORE:

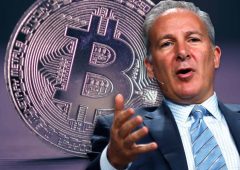

Economist Peter Schiff Criticizes Bitcoin’s “Digital Gold” Claim as Market Pressures Mount

In Green’s view, Bitcoin’s potential to thrive is linked to both the broader macroeconomic landscape and Trump’s crypto-friendly policies.

He believes that, as gold traditionally benefits during uncertain times, Bitcoin could similarly attract investors looking for alternatives, driving its value up significantly in the process.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read