Bitcoin Bull Run is Over, Warns CryptoQuant CEO

18.03.2025 15:00 1 min. read Alexander Zdravkov

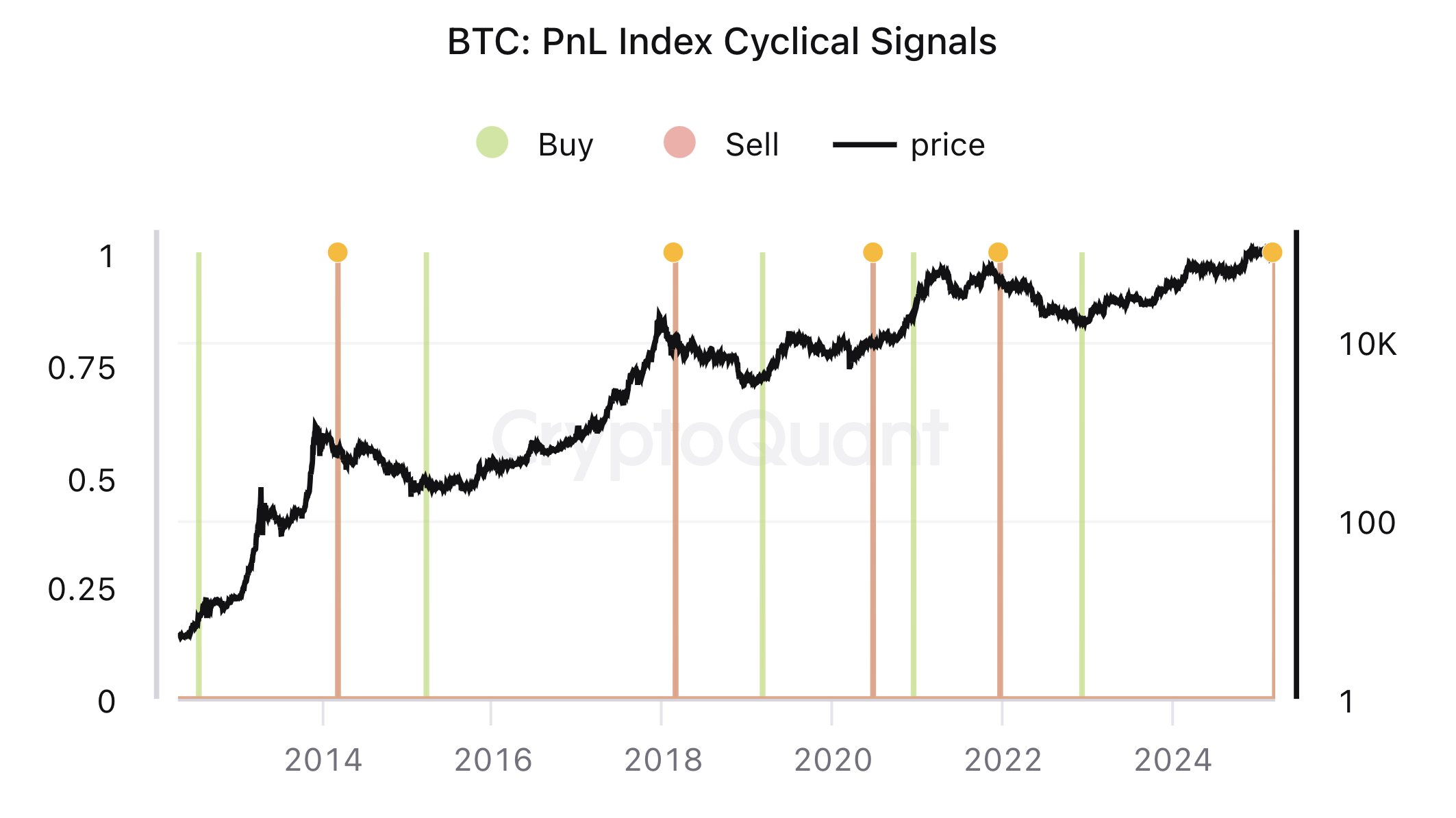

CryptoQuant CEO Ki Young Ju has warned that Bitcoin’s current market cycle may have already peaked, suggesting that traders shouldn’t anticipate a major rally in the next six to twelve months.

According to Ju, multiple on-chain indicators signal a shift toward either a bearish or stagnant trend as liquidity dries up and whales offload their holdings at lower prices.

Ju’s analysis, based on Bitcoin’s Profit and Loss Index, suggests that bullish expectations are unlikely to materialize.

He also applied Principal Component Analysis (PCA) to key on-chain metrics like MVRV, SOPR, and NUPL, using a 365-day moving average to track potential trend reversals.

While some traders acknowledged his insights, others pointed out that his sell signal in 2020 didn’t play out as expected.

Crypto journalist Colin Wu also weighed in on Ju’s perspective, offering his own interpretation of the data.

-

1

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

2

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

3

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

18.06.2025 20:00 1 min. read -

4

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

5

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

Robert Kiyosaki, author of Rich Dad Poor Dad, revealed on July 1 that he purchased another Bitcoin, reaffirming his long-term bullish stance—even if it comes with personal risk.

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

Bitcoin is poised for its strongest dollar rally in history during the second half of 2025, according to Standard Chartered’s latest market outlook.

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

Arizona Governor Katie Hobbs has officially vetoed House Bill 2324, a legislative proposal that aimed to create a state-managed reserve fund for holding seized cryptocurrency assets.

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

Public corporations have dramatically increased their Bitcoin (BTC) holdings in 2025, acquiring more than double the amount bought by exchange-traded funds (ETFs) during the first half of the year.

-

1

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

2

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

3

Bitcoin at Crossroads as Geopolitical Tensions Weigh on Price

18.06.2025 20:00 1 min. read -

4

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

5

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read