Bitcoin at a Crossroads: Is the Bull Run Still Alive?

23.03.2025 9:00 2 min. read Alexander Zdravkov

Bitcoin’s recent price movement has kept traders on edge, hovering between $81,000 and $86,000 without a clear direction.

While some indicators hint at bearish momentum, fresh data suggests that the market may still have room to push higher.

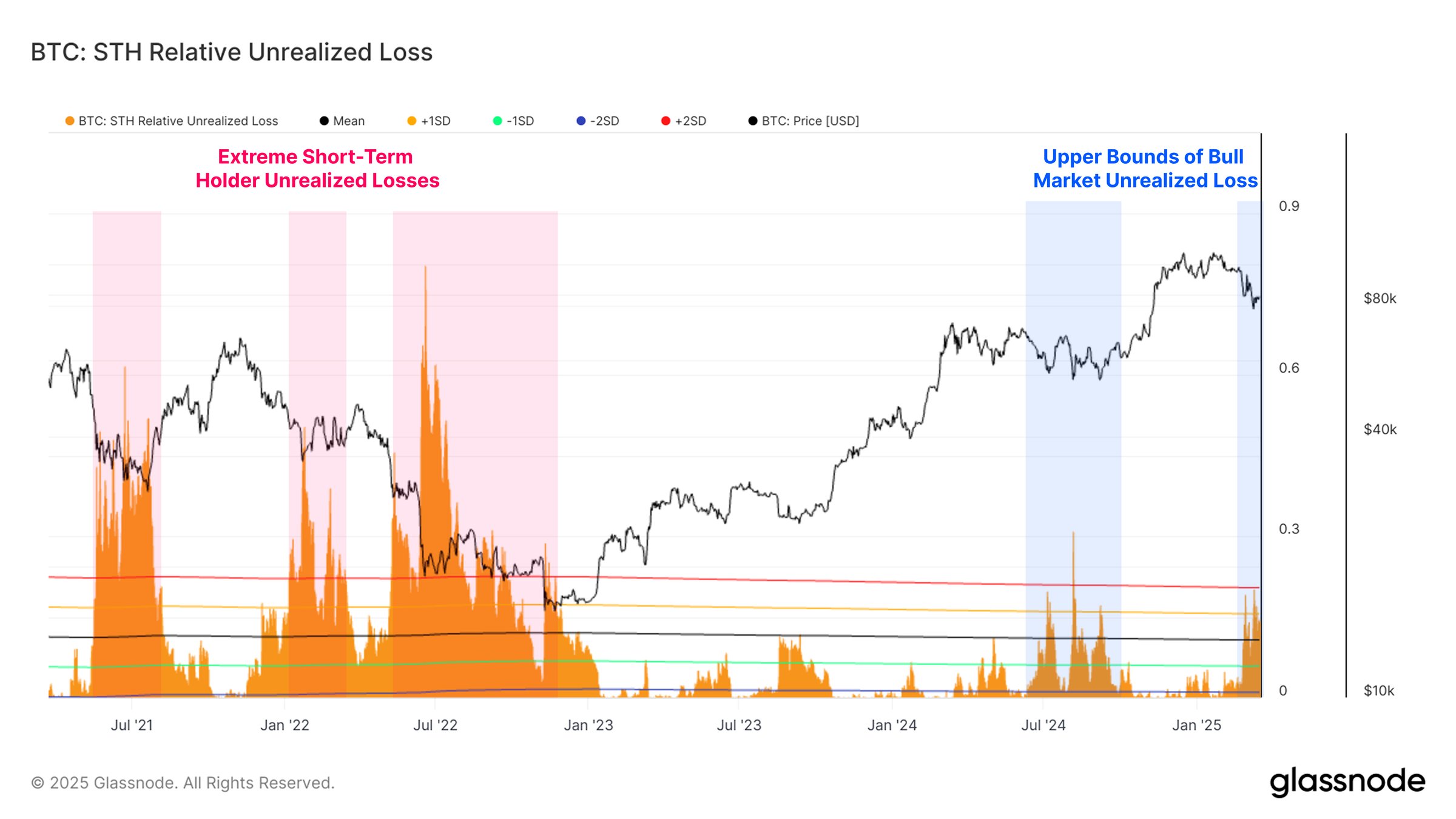

Blockchain analytics firm Glassnode has highlighted growing pressure on short-term Bitcoin holders, who are now facing significant unrealized losses. These losses, which exist only on paper until assets are sold, have reached levels that in the past have signaled increased selling activity.

Despite this, Glassnode points out that the magnitude of these losses is still within the range typically seen in bullish phases. Compared to the heavy sell-offs of 2021, the current downturn appears far less severe, indicating that the broader market trend may not have fully reversed.

Losses Are Growing, But Not Like Before

Over the past month, realized losses among short-term Bitcoin investors have surged past $7 billion—making it the most prolonged loss event of this cycle. However, this figure remains well below previous market collapses.

For context, Bitcoin sell-offs in 2021 and 2022 saw realized losses climb as high as $19.8 billion and $20.7 billion, respectively. Since the current losses don’t match those extreme levels, widespread panic may not have set in yet.

What’s Next for Bitcoin?

With uncertainty still looming, Bitcoin’s next major move remains unclear. If selling accelerates, a deeper decline could follow. However, if history is any indication, the market may not be done rallying just yet.

-

1

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read -

2

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

3

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

18.06.2025 16:00 1 min. read -

4

Metaplanet Surpasses Coinbase with 10,000 Bitcoin in Treasury

17.06.2025 6:30 1 min. read -

5

Bitcoin Still on El Salvador’s Agenda Despite $1.4B IMF Agreement

17.06.2025 11:00 1 min. read

Arthur Hayes Warns of Bitcoin Pullback to $90,000: Here is Why

BitMEX co-founder Arthur Hayes has issued a cautious outlook for Bitcoin and the broader crypto market, predicting a possible short-term downturn as the U.S. government shifts its liquidity strategy.

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

Bitcoin’s bullish undercurrent continues to strengthen as on-chain data and derivatives market behavior reveal aggressive accumulation from long-term holders and whales.

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

As institutional adoption of Bitcoin accelerates, U.S. asset management giant Franklin Templeton has issued a cautionary note on the growing trend of crypto-based treasury strategies.

Bitcoin Climbs to $109,500: Why the Price is Up?

Bitcoin rose 1.78% over the past 24 hours to reach $109,500 at the time of writing, driven by surging institutional inflows into spot ETFs, easing global trade tensions, and strengthening technical momentum.

-

1

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read -

2

Quantum Advances Put Bitcoin’s Security to the Test

16.06.2025 13:00 2 min. read -

3

Why Rising Energy Prices Could Supercharge Bitcoin, According to Expert

18.06.2025 16:00 1 min. read -

4

Metaplanet Surpasses Coinbase with 10,000 Bitcoin in Treasury

17.06.2025 6:30 1 min. read -

5

Bitcoin Still on El Salvador’s Agenda Despite $1.4B IMF Agreement

17.06.2025 11:00 1 min. read