Trump Implements Global Tariff Plan, Triggering Bitcoin Price Drop

03.04.2025 0:37 1 min. read Alexander Stefanov

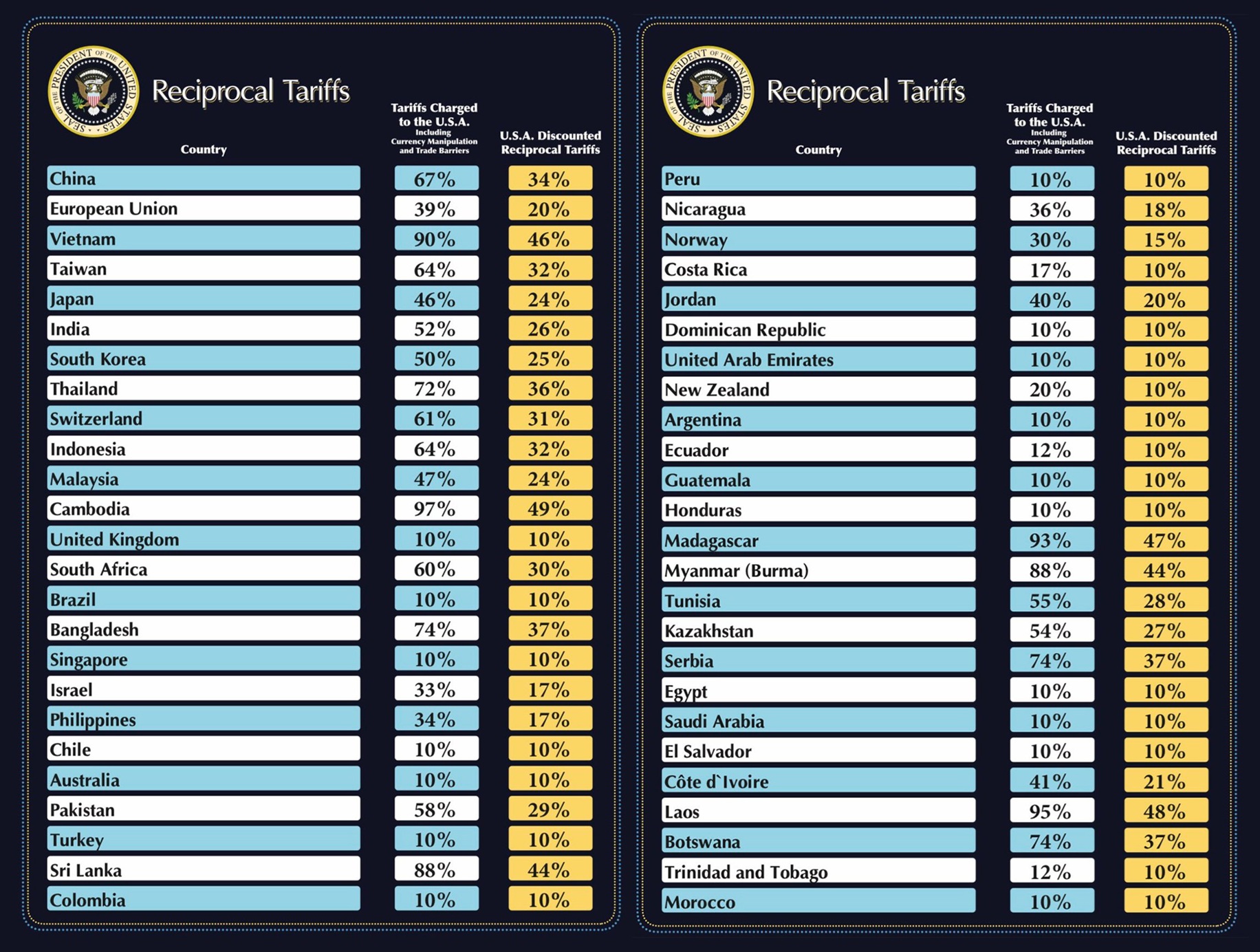

In a recent live address, U.S. President Donald Trump declared that a new base tariff of 10% would be applied universally to all countries.

However, he also outlined specific measures targeting certain nations, specifying different customs duties based on perceived trade practices.

Trump emphasized that he expects foreign leaders to halt tariffs imposed on the United States and begin purchasing American-made products.

For countries that fail to meet this standard, he plans to calculate the total impact, including non-monetary trade barriers, and enforce retaliatory measures at half the rate of their existing customs duties.

Among the targeted regions, the European Union will face a 20% tariff on goods from each member country, while imports from Japan will be hit with a 24% duty.

Initially, the proposed 10% tariff seemed relatively mild, but once the more detailed measures became clear, the market reaction was swift. Bitcoin’s value dropped abruptly, reflecting the uncertainty sparked by these aggressive trade policies.

Despite hitting a high above $87,000 earlier, Bitcoin’s price declined to $86,500 after Trump’s announcement.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

5

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read