Bitcoin Bull Run is Over, Warns CryptoQuant CEO

18.03.2025 15:00 1 min. read Alexander Zdravkov

CryptoQuant CEO Ki Young Ju has warned that Bitcoin’s current market cycle may have already peaked, suggesting that traders shouldn’t anticipate a major rally in the next six to twelve months.

According to Ju, multiple on-chain indicators signal a shift toward either a bearish or stagnant trend as liquidity dries up and whales offload their holdings at lower prices.

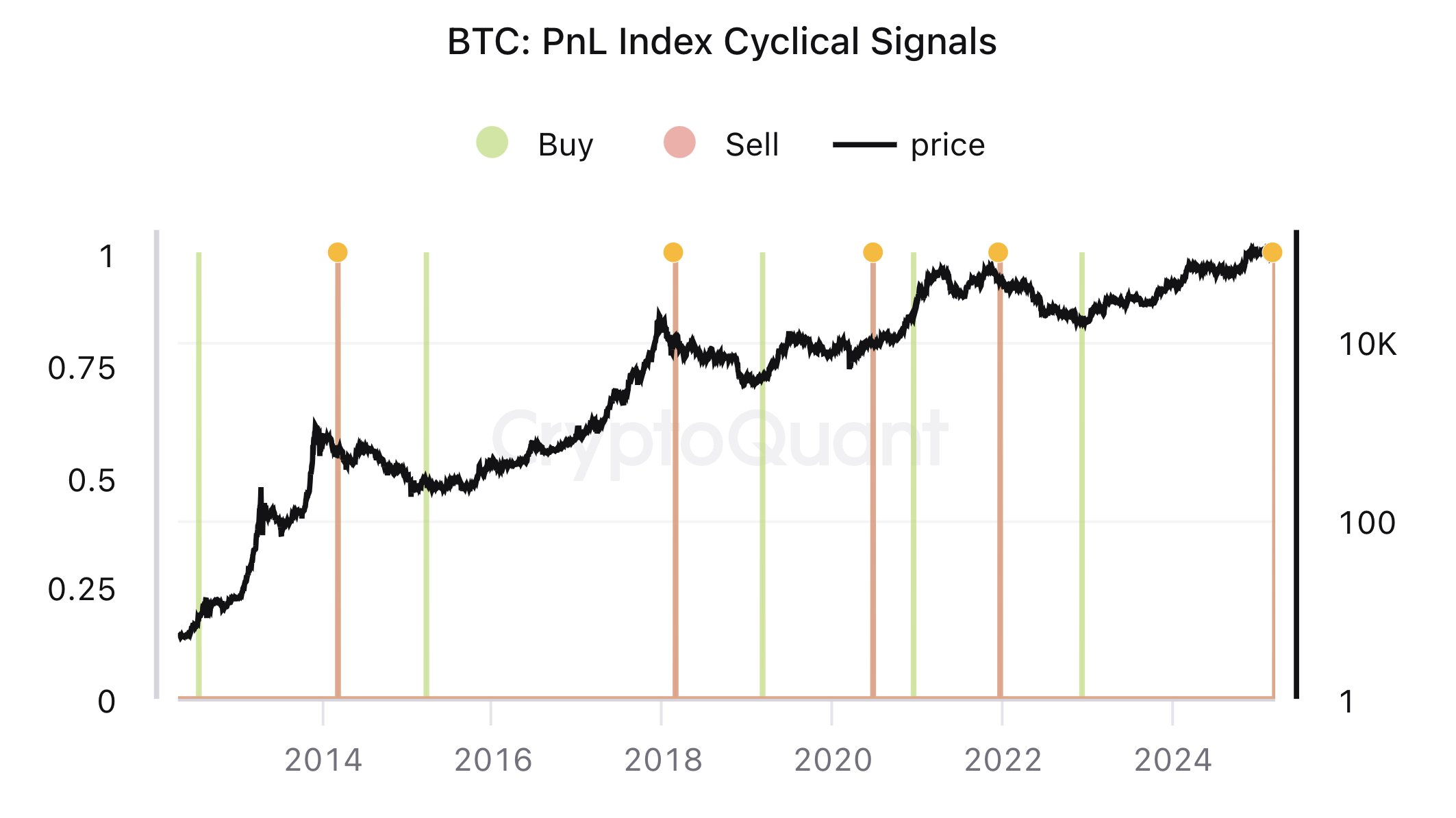

Ju’s analysis, based on Bitcoin’s Profit and Loss Index, suggests that bullish expectations are unlikely to materialize.

He also applied Principal Component Analysis (PCA) to key on-chain metrics like MVRV, SOPR, and NUPL, using a 365-day moving average to track potential trend reversals.

While some traders acknowledged his insights, others pointed out that his sell signal in 2020 didn’t play out as expected.

Crypto journalist Colin Wu also weighed in on Ju’s perspective, offering his own interpretation of the data.

-

1

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

2

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

3

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

4

Bitcoin Rewards Coming to Amex Users Through Coinbase Partnership

14.06.2025 18:00 1 min. read -

5

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read

Bitcoin Climbs to $109,500: Why the Price is Up?

Bitcoin rose 1.78% over the past 24 hours to reach $109,500 at the time of writing, driven by surging institutional inflows into spot ETFs, easing global trade tensions, and strengthening technical momentum.

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

BlackRock’s spot Bitcoin exchange-traded fund (ETF), known by its ticker IBIT, has surpassed the firm’s flagship S&P 500 ETF in annual revenue, according to a new report from Bloomberg.

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

Robert Kiyosaki, author of Rich Dad Poor Dad, revealed on July 1 that he purchased another Bitcoin, reaffirming his long-term bullish stance—even if it comes with personal risk.

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

Bitcoin is poised for its strongest dollar rally in history during the second half of 2025, according to Standard Chartered’s latest market outlook.

-

1

Bitcoin’s Parabolic Trend Still Intact – But for How Long?

12.06.2025 12:00 1 min. read -

2

Bitcoin Power Struggle: Strategy and BlackRock Now Control Over 1.3 Million BTC

17.06.2025 17:00 1 min. read -

3

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

4

Bitcoin Rewards Coming to Amex Users Through Coinbase Partnership

14.06.2025 18:00 1 min. read -

5

SEC Approves Trump Media’s $2.3B Bitcoin Treasury Move

15.06.2025 7:00 1 min. read