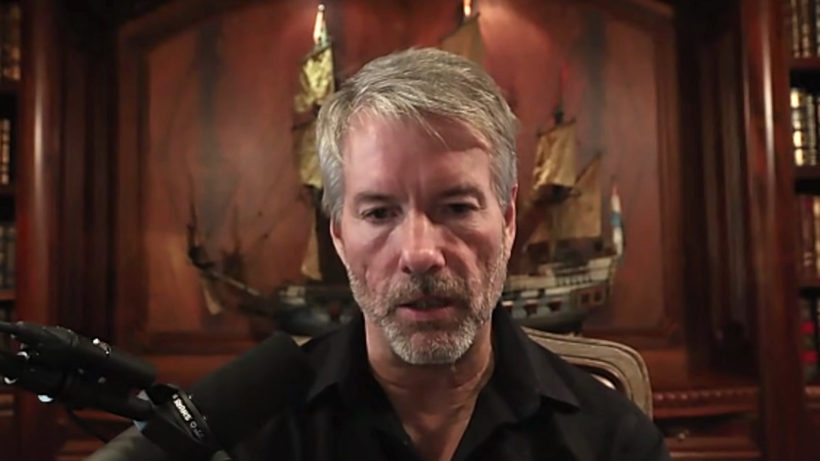

Top Economist Warns of a Major Risk for Michael Saylor’s Bitcoin Strategy

26.02.2025 18:14 1 min. read Kosta Gushterov

Peter Schiff, a prominent critic of Bitcoin, has identified large-scale withdrawals from Bitcoin exchange-traded funds (ETFs) as the biggest threat to Michael Saylor’s strategy.

Schiff believes that these redemptions would significantly impact Bitcoin’s price, driving it lower, which in turn would cause even greater losses for companies like MicroStrategy (MSTR), which holds substantial Bitcoin reserves.

Schiff argues that many of the investors buying into Bitcoin ETFs are newcomers to the crypto space, viewing their purchases more as speculative trades than long-term investments.

He points out that these traders may quickly pull out if Bitcoin’s price falls, leading to a sharp drop in value.

This, he suggests, is why Saylor’s decision to heavily leverage MSTR in Bitcoin investments is a risky move. Recently, Bitcoin’s price tumbled to a multi-month low of $86,141, and MicroStrategy’s stock saw a steep decline, falling more than 11%.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

5

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

While Bitcoin’s recent stagnation has triggered debate over what’s really influencing the market, analysts at K33 Research say exchange-traded fund flows are still the dominant force — far more so than the activity from corporate treasuries.

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

Stablecoins are failing where it matters most, says the Bank for International Settlements (BIS), which sharply criticized the asset class in its latest annual report.

Barclays Blocks Crypto Credit Card Payments in Latest Blow to Retail Investors

Barclays has announced it will prohibit the use of its credit cards for cryptocurrency purchases starting June 27, marking a significant shift in its stance on digital assets.

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

Institutional interest in Bitcoin is heating up again, with major asset managers making massive moves.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

5

Bitcoin Supply Crunch Deepens as Institutions Tighten Their Grip

05.06.2025 8:00 2 min. read