Cardano Faces Pressure as Whales Scale Back and Bearish Sentiment Grows

05.02.2025 19:30 1 min. read Alexander Stefanov

Cardano's largest investors, often referred to as ADA whales, have been scaling back their trading activity, indicating a shift in sentiment around the altcoin.

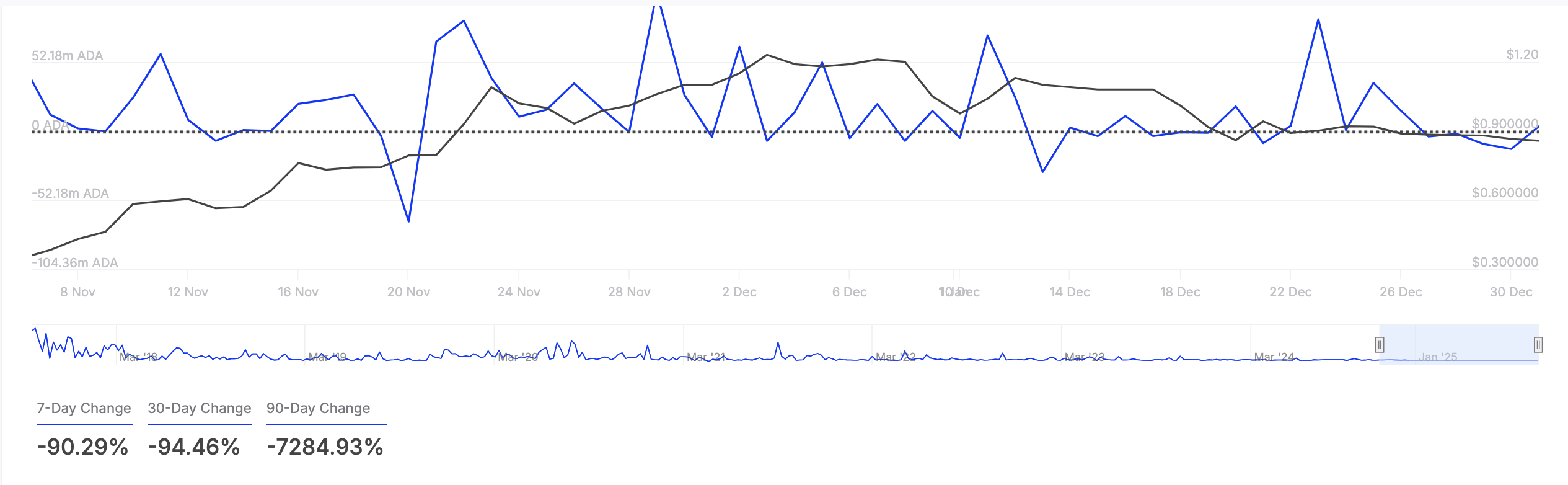

Over the past week, on-chain data from IntoTheBlock has shown a staggering 90% decrease in the netflow of ADA from these major holders. This decline suggests that these large investors are either offloading their holdings or refraining from adding more to their positions.

The drop in whale activity could be a red flag for ADA, as it may lead to lower liquidity and increased price volatility.

With these key players pulling back, there is less buying pressure, which could contribute to a further decline in the coin’s value. This change in behavior aligns with a growing bearish outlook on ADA.

Adding to the negative sentiment is the increasing demand for short positions in ADA’s futures market, highlighted by its negative funding rate of -0.005%.

A negative funding rate indicates that more traders are betting against the asset, further suggesting a lack of confidence in ADA’s short-term performance. As the market sentiment continues to sour and whale activity remains subdued, ADA faces the risk of prolonged downward pressure unless new buying momentum materializes.

-

1

TRUMP Token Dives as $309M Unlock Floods the Market

19.04.2025 17:00 2 min. read -

2

Altcoins Could Rebound in Q2 as Regulation Boosts Market Confidence, Sygnum Says

19.04.2025 20:00 2 min. read -

3

Binance Expands USDC Offerings With New Pairs and Automated Trading Tools

21.04.2025 17:00 1 min. read -

4

Bitcoin Surge Fuels XRP Comeback Hopes

23.04.2025 21:00 2 min. read -

5

XRP Futures Go Live on Coinbase, Opening Doors to Institutional Investors

22.04.2025 8:00 2 min. read

Cardano Eyes Comeback With Bullish Momentum Building

After a sharp decline in March, Cardano is showing signs of strength, climbing to $0.79 after a 17% jump in just a few days.

XRP Faces Selling Pressure After $130M Worth Sent to Coinbase

XRP’s recent climb toward the $2.50 resistance may be facing headwinds as on-chain activity reveals massive whale transactions directed to Coinbase.

How This Trader Made $46 Million Betting on Bitcoin and Meme Coins

An anonymous crypto trader going by the name James Wynn has stunned the trading community with jaw-dropping gains on Hyperliquid, a decentralized exchange gaining traction among high-risk players.

TRUMP Meme Coin Under Fire as Insiders Reap Massive Profits

A massive token transfer by the team behind the TRUMP meme coin has reignited concerns about transparency, insider profits, and whether retail investors are being left behind.

-

1

TRUMP Token Dives as $309M Unlock Floods the Market

19.04.2025 17:00 2 min. read -

2

Altcoins Could Rebound in Q2 as Regulation Boosts Market Confidence, Sygnum Says

19.04.2025 20:00 2 min. read -

3

Binance Expands USDC Offerings With New Pairs and Automated Trading Tools

21.04.2025 17:00 1 min. read -

4

Bitcoin Surge Fuels XRP Comeback Hopes

23.04.2025 21:00 2 min. read -

5

XRP Futures Go Live on Coinbase, Opening Doors to Institutional Investors

22.04.2025 8:00 2 min. read