Bitcoin Whales Pull Back – What’s Next for the Price?

24.12.2024 10:00 1 min. read Kosta Gushterov

Bitcoin’s value has dropped by 7% over the past week, reflecting a concerning lack of momentum in the market.

While the broader cryptocurrency landscape is under pressure, a key factor behind Bitcoin’s decline is the noticeable inactivity of large-scale investors, commonly known as whales, who are critical to sustaining price stability.

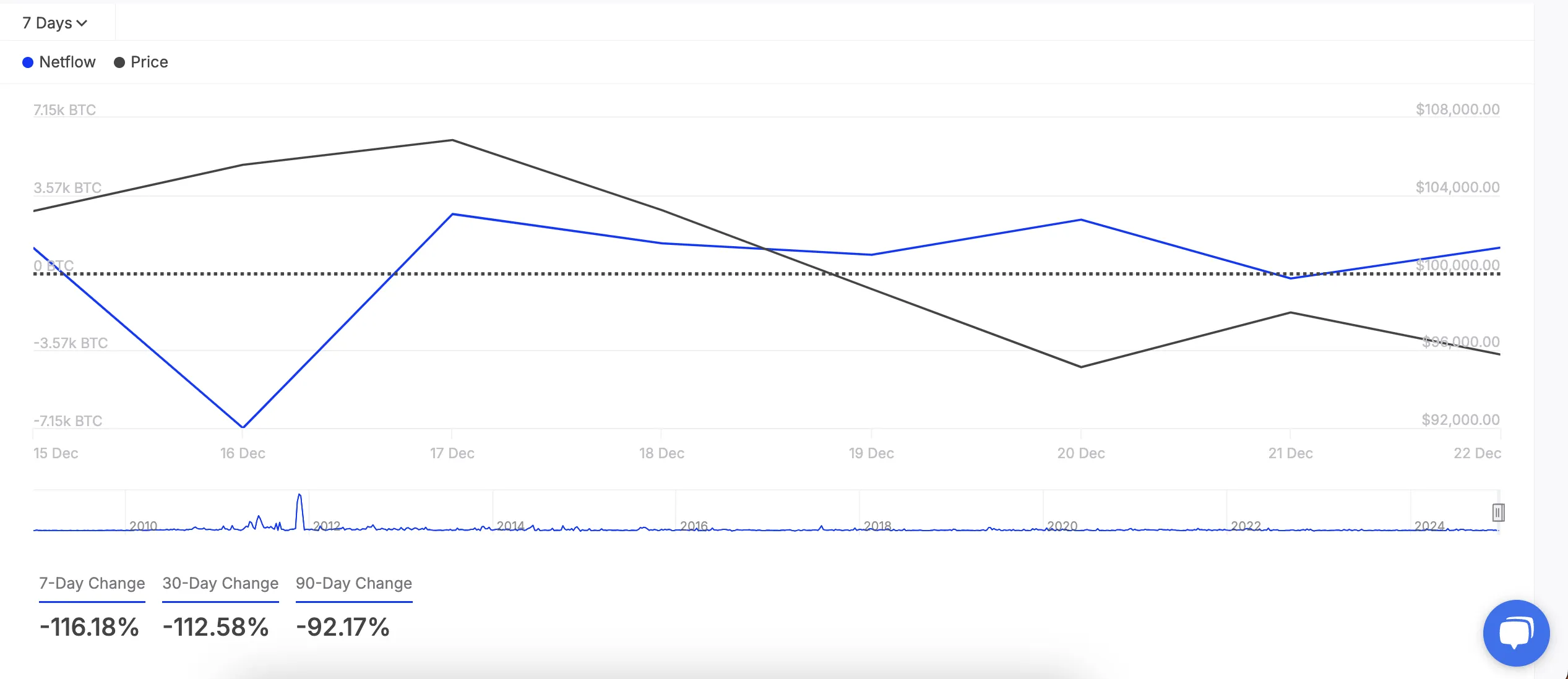

Recent data reveals that major Bitcoin holders are significantly scaling back their activity. Over the last seven days, net inflows to whale wallets have sharply decreased, signaling a preference for selling rather than accumulating. This shift, as tracked by IntoTheBlock, suggests a growing reluctance among these investors to bet on Bitcoin’s short-term performance.

Additionally, the frequency of large Bitcoin transactions has nosedived. Transfers valued between $100,000 and $1 million have seen a 48% reduction, while transactions exceeding $1 million but below $10 million have dropped by 50%. Such a decline in high-value trades indicates weakened confidence from these influential market participants, creating less upward pressure on Bitcoin’s price.

Bitcoin is currently trading around $94,000. However, if the current lack of whale activity persists, this support could crumble. Analysts caution that a break below this point might trigger a rapid descent.

With major investors seemingly hesitant to reengage, the outlook for Bitcoin appears precarious. The coming days will likely determine whether the market can stabilize or if deeper losses are ahead.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

BlackRock’s iShares Bitcoin Trust (IBIT) has officially crossed the 700,000 BTC mark, reinforcing its position as one of the fastest-growing exchange-traded funds in financial history.

Bitcoin: Historical Trends Point to Likely Upside Movement

Bitcoin may be gearing up for a significant move as its volatility continues to tighten, according to on-chain insights from crypto analyst Axel Adler.

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

Two major developments are converging in July that could shape the future of Bitcoin in the United States—both tied to President Trump’s administration and its expanding crypto agenda.

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

Digital asset investment products recorded $1.04 billion in inflows last week, pushing total assets under management (AuM) to a record high of $188 billion, according to the latest report from CoinShares.

-

1

Real Estate Giant Plans $300M Bitcoin Purchase

22.06.2025 13:00 2 min. read -

2

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

25.06.2025 10:00 1 min. read -

3

Bitcoin Dominates Portfolios as Institutional Adoption Surges

25.06.2025 8:00 2 min. read -

4

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

21.06.2025 16:00 2 min. read -

5

Strategy’ Michael Saylor Drops Another Cryptic Bitcoin Message

24.06.2025 21:00 1 min. read