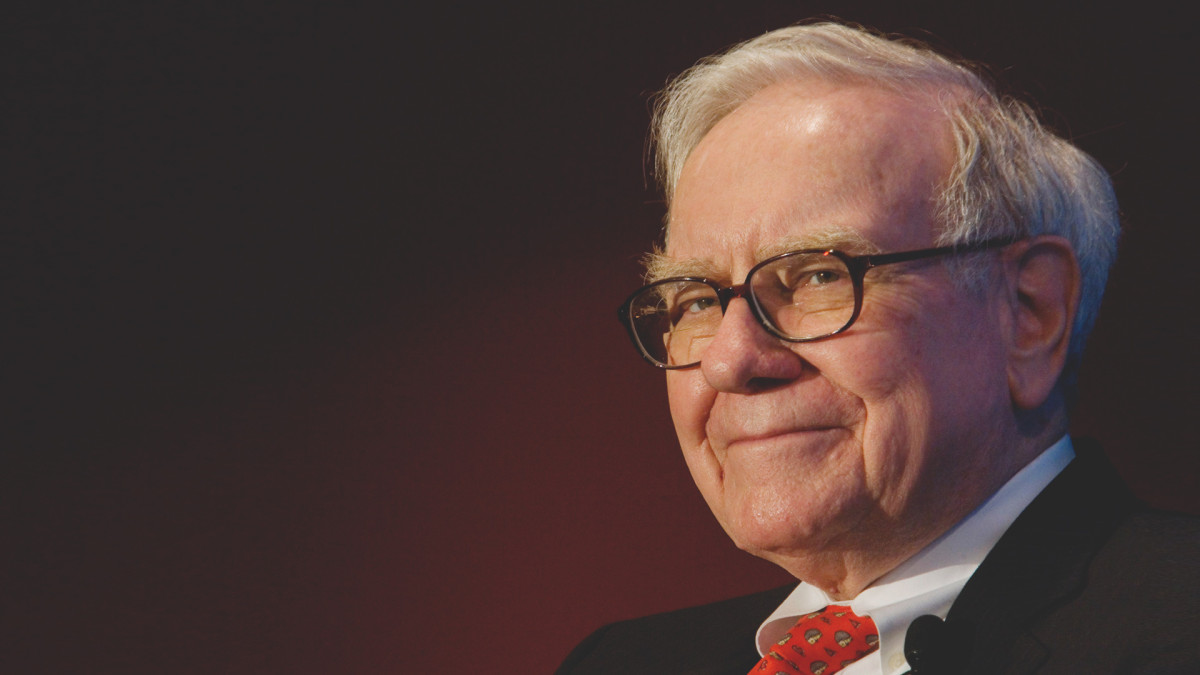

Warren Buffett Invests $120 Billion in These Two Stocks

15.12.2024 13:00 2 min. read Alexander Zdravkov

Warren Buffett, CEO of Berkshire Hathaway, has allocated $120 billion of the firm’s portfolio to just two major assets.

The allocation went to the tech giant Apple and American Express, according to recent SEC filings. These two holdings together account for 40.1% of Berkshire’s investments, reflecting Buffett’s strong confidence in their long-term prospects.

Berkshire’s involvement with Apple began in 2016, and while the firm has adjusted its stake over the years, including some reductions in 2024, the tech giant remains its largest single holding. American Express, on the other hand, has been a cornerstone of the portfolio since the mid-1990s.

Despite Berkshire’s significant pullback from the U.S. banking sector, including exits from positions in JPMorgan Chase, Wells Fargo, and Bank of America, Buffett has maintained a steadfast commitment to American Express, citing its strong brand, loyal customers, and reliable profitability.

Bank of America, though diminished in Buffett’s portfolio, still holds the third-largest position with $35 billion invested, representing 11.7% of the total. Meanwhile, other notable investments include Coca-Cola, Chevron, Occidental Petroleum, Moody’s, and Kraft Heinz. Altogether, Berkshire Hathaway’s investments amount to roughly $300 billion.

Buffett’s cautious stance on the market is evident in the firm’s cash reserves, which now stand at $325 billion—almost double the amount held at the end of 2023. This significant liquidity suggests Buffett is prepared for potential opportunities amid market uncertainties.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read

Citigroup Explores Launching Stablecoin as Banks Embrace Crypto Shift

Citigroup is evaluating the potential launch of its own U.S. dollar-backed stablecoin, signaling a growing shift in sentiment among traditional financial institutions toward digital assets.

JPMorgan CEO Jamie Dimon Comments Stablecoins

JPMorgan Chase CEO Jamie Dimon remains skeptical of stablecoins—but says ignoring them isn’t an option for the world’s most powerful bank.

Crypto Cycles are Evolving: Analyst Explains Why Old Patterns no Longer Work

According to crypto analyst Atlas, the traditional four-year cycle that once defined Bitcoin and altcoin market behavior is now obsolete.

Kraken Launches U.S. Crypto Derivatives Platform, Eyes Broader Market Expansion

Kraken has officially launched its U.S.-regulated crypto derivatives platform, marking a major step toward merging traditional finance tools with digital asset markets.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read