Forget the Gold vs. Bitcoin Debate, Kiyosaki Has a Bigger Message for Investors

29.11.2024 22:00 2 min. read Alexander Zdravkov

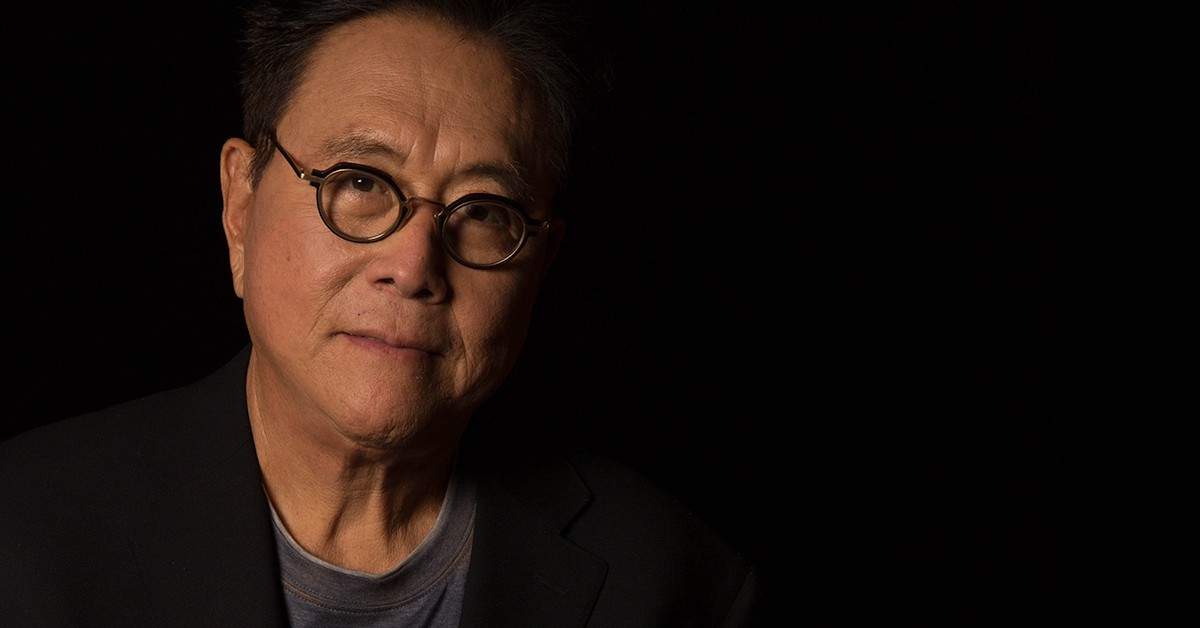

Robert Kiyosaki, the renowned investor and author of Rich Dad Poor Dad, recently shared his thoughts on the ongoing debate between Bitcoin (BTC) and gold.

He expressed amusement at the high-level discussions around which asset is superior, dismissing them as distractions. For Kiyosaki, the real issue is not the debate itself, but the larger forces at play, particularly how individuals are being misled by the government. Reflecting on his experiences from 1965, he recalled first noticing the debasement of silver coins with copper, which led him to believe that people were being misinformed and taken advantage of by the government.

Kiyosaki also took aim at those with advanced academic degrees, humorously referring to PhDs as “Poor, Helpless, and Desperate” instead of “Doctor of Philosophy.” He argues that the true path to financial success lies in taking action—investing in real assets like gold, silver, or Bitcoin—rather than relying on academic theories. Kiyosaki emphasized that while investing may not lead to quick riches, it will help increase one’s financial knowledge and wealth over time.

Reflecting on his own journey, Kiyosaki shared how, in 1965, he began hiding real money as he recognized flaws in the currency system. This evolved into his long-term strategy of accumulating gold and silver, which he continued throughout his life. In 1985, he expanded his investments to include gold and silver mines, and today, he also holds Bitcoin.

Kiyosaki also criticized the U.S. dollar, calling it “fake money.” He connected this to Gresham’s Law, which states that when inferior money enters circulation, it forces out the more valuable kind. For Kiyosaki, the U.S. dollar is an example of this inferior currency, with real money like gold and Bitcoin “hiding” from the system.

Rather than picking one asset over the other, Kiyosaki advocates for a balanced approach, supporting both gold and Bitcoin. Unlike economists such as Peter Schiff, who oppose Bitcoin, Kiyosaki sees the value in both assets. He consistently urges his followers to invest in tangible assets instead of saving in depreciating currencies.

-

1

Swissblock Flags Bitcoin Breakout Potential as Altcoins Near Reset Zone

27.09.2025 10:11 2 min. read -

2

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

3

JPMorgan: US Bitcoin Mining Firms Hit $56 Billion Market Value

01.10.2025 20:39 2 min. read -

4

Strategy Nears $80B in Bitcoin, Closes in on Top U.S. Corporate Treasuries

07.10.2025 22:00 2 min. read -

5

Massive Options Expiry Could Shake Bitcoin and Ethereum Prices Today

10.10.2025 10:00 2 min. read

Coinbase Bets on India and the Middle East with Strategic CoinDCX Investment

Coinbase is turning its attention to emerging crypto regions, revealing a new investment in the Indian exchange CoinDCX as part of a broader effort to anchor itself in fast-growing markets like India and the Middle East.

Confidence Isn’t a Strategy: Lessons from Crypto’s Latest Crashes

For all its innovation, crypto still suffers from one core weakness – it’s built on sentiment, not substance.

NFTs Take a Hit but Show Resilience Amid Broader Crypto Turmoil

The NFT sector is bouncing back after a sharp drop erased roughly $1.2 billion in market value last Friday.

Bitcoin and Ethereum ETFs Recover Momentum on Rate-Cut Speculation

A sudden market pivot has brought US Bitcoin and Ethereum ETFs back into favor after recent turbulence.

-

1

Swissblock Flags Bitcoin Breakout Potential as Altcoins Near Reset Zone

27.09.2025 10:11 2 min. read -

2

Bitcoin Climbs Back Above $120,000: What’s Driving the Rally?

02.10.2025 19:11 2 min. read -

3

JPMorgan: US Bitcoin Mining Firms Hit $56 Billion Market Value

01.10.2025 20:39 2 min. read -

4

Strategy Nears $80B in Bitcoin, Closes in on Top U.S. Corporate Treasuries

07.10.2025 22:00 2 min. read -

5

Massive Options Expiry Could Shake Bitcoin and Ethereum Prices Today

10.10.2025 10:00 2 min. read

Sam Trabucco, former co-CEO of Alameda Research, has agreed to relinquish assets including two San Francisco apartments valued at $8.7 million and a 53-foot yacht in a settlement with FTX.

Shan Hanes, the former CEO of Heartland Tri-State Bank (HTSB), has been implicated in a major fraud scheme involving cryptocurrency, resulting in the bank's collapse.

Changpeng “CZ” Zhao, the former CEO of Binance, has indicated he might welcome a presidential pardon from U.S. President-elect Donald Trump following his recent legal troubles.

Changpeng Zhao, the former CEO of Binance, made his first public appearance at Binance Blockchain Week in Dubai following his recent release.

A former senior employee of Binance Europe has filed a lawsuit against the company, claiming she was wrongfully terminated after blowing the whistle on an alleged bribery incident.

Alex Mashinsky, the former CEO of Celsius serving a 100-year prison sentence, is seeking the testimony of six ex-employees as part of his criminal case.

Alex Mashinsky, co-founder and former CEO of the defunct crypto lending platform Celsius, is scheduled to be sentenced on May 8, 2025, following his guilty plea to two federal criminal charges late last year.

Alex Mashinsky, the co-founder of Celsius Network, has admitted to charges of fraud related to his role in the company's downfall.

Christopher Giancarlo, the former chair of the U.S. Commodity Futures Trading Commission and a prominent advocate for digital assets, has joined Swiss crypto bank Sygnum as a senior adviser.

Christopher Giancarlo, the former chair of the Commodity Futures Trading Commission (CFTC), dismissed rumors suggesting he was being considered for the role of SEC Chair or any position related to crypto within the U.S. Treasury Department.

During a recent interview with FOX Business, former CFTC Chairman Chris Giancarlo, known as "Crypto Dad" for his progressive stance on digital assets, shared his views on the future of U.S. cryptocurrency policy.

Former Chinese billionaire Yang Bin has been sentenced to six years in a Singapore prison for orchestrating a fraudulent crypto investment scheme.

Speaking at the Tsinghua Wudaokou 2024 Chief Economists Forum in Beijing, former Chinese Finance Minister Lu Jiwei urged China to carefully assess the progress and risks associated with cryptocurrencies.

The former CEO of Australian crypto exchange Mine Digital, Grant Colthup, has been charged with fraud for allegedly misappropriating $1.47 million from a customer trying to convert funds into Bitcoin.

Former Dallas Federal Reserve President and ex-Goldman Sachs Vice Chairman Robert Kaplan believes the U.S. central bank is poised to trim interest rates in September, pointing to signs of a softer labor market and cooling demand.

Former hedge fund manager and Republican politician Vivek Ramaswamy has sharply criticized the Federal Reserve and U.S. regulatory practices.

A former JPMorgan employee is facing disciplinary action from the Financial Industry Regulatory Authority (FINRA) for alleged breaches of regulations.

Former Mt. Gox CEO Mark Karpeles plans to launch a new cryptocurrency exchange EllipX later this month, focusing on transparency and user-friendliness.

Ira Auerbach, the former Senior Vice President of Digital Assets at Nasdaq, has made a significant move to Offchain Labs, the team behind Arbitrum.

Michelle Bond, a former Ripple executive, faces charges from the U.S. Department of Justice for allegedly participating in illegal campaign contributions.