Record Bitcoin ETF Inflows Signal Growing Institutional Interest

29.11.2024 14:00 1 min. read Alexander Stefanov

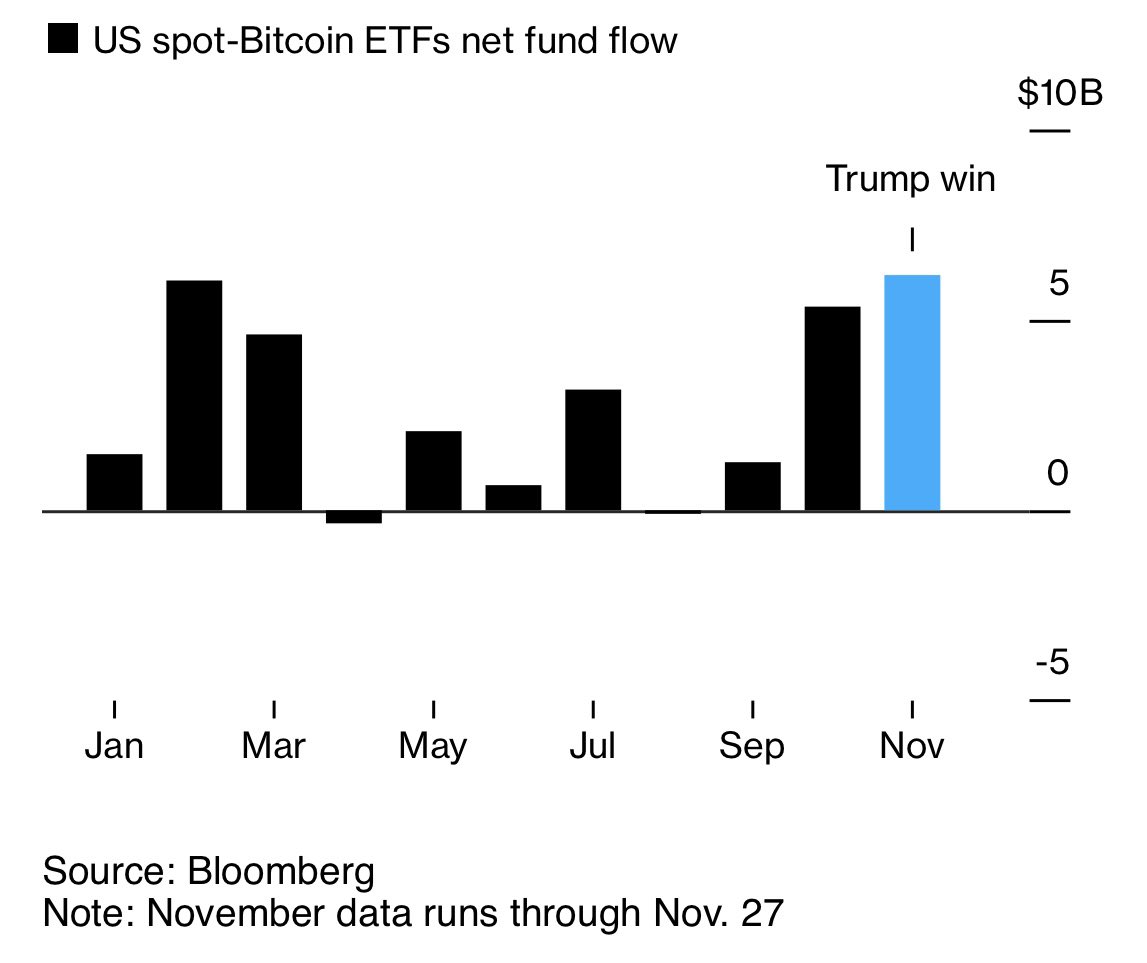

November marked a historic moment for Bitcoin spot ETFs, with net inflows skyrocketing to $6.2 billion, setting a new monthly record.

These financial instruments, which provide institutional investors regulated exposure to Bitcoin, surpassed their previous peak set in February, fueled by shifting political dynamics and growing market confidence.

The record-breaking inflows align with a surge in optimism following the election of Donald Trump, whose administration has signaled strong support for cryptocurrencies. Promises of pro-crypto policies, including regulatory reforms and the creation of a strategic Bitcoin reserve, have bolstered sentiment. This wave of enthusiasm drove Bitcoin close to $100,000 and triggered unprecedented demand for Bitcoin-linked ETFs.

Major players like BlackRock’s iShares Bitcoin Trust led the charge, recording over $1 billion in inflows in a single day after the election. Collectively, Bitcoin ETFs now hold nearly 1 million BTC, rivaling the estimated holdings of Bitcoin’s pseudonymous creator, Satoshi Nakamoto. Such milestones underscore the growing role of ETFs in mainstreaming Bitcoin as an institutional asset.

Additionally, developments such as the introduction of options trading for Bitcoin ETFs have expanded the toolkit available to investors. With approvals from the Options Clearing Corporation, these products allow for sophisticated hedging and speculation strategies, further encouraging institutional participation.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read