Bitcoin Could Face a Major Crash, Analyst Warns

13.11.2024 13:00 1 min. read Kosta Gushterov

Bitcoin's recent surge to nearly $90,000 has ignited a wave of excitement, but a sudden 4% dip has left many wondering whether a correction is imminent.

Retail interest in the cryptocurrency has reached record levels, raising concerns among analysts who warn that a potential pullback could be on the way.

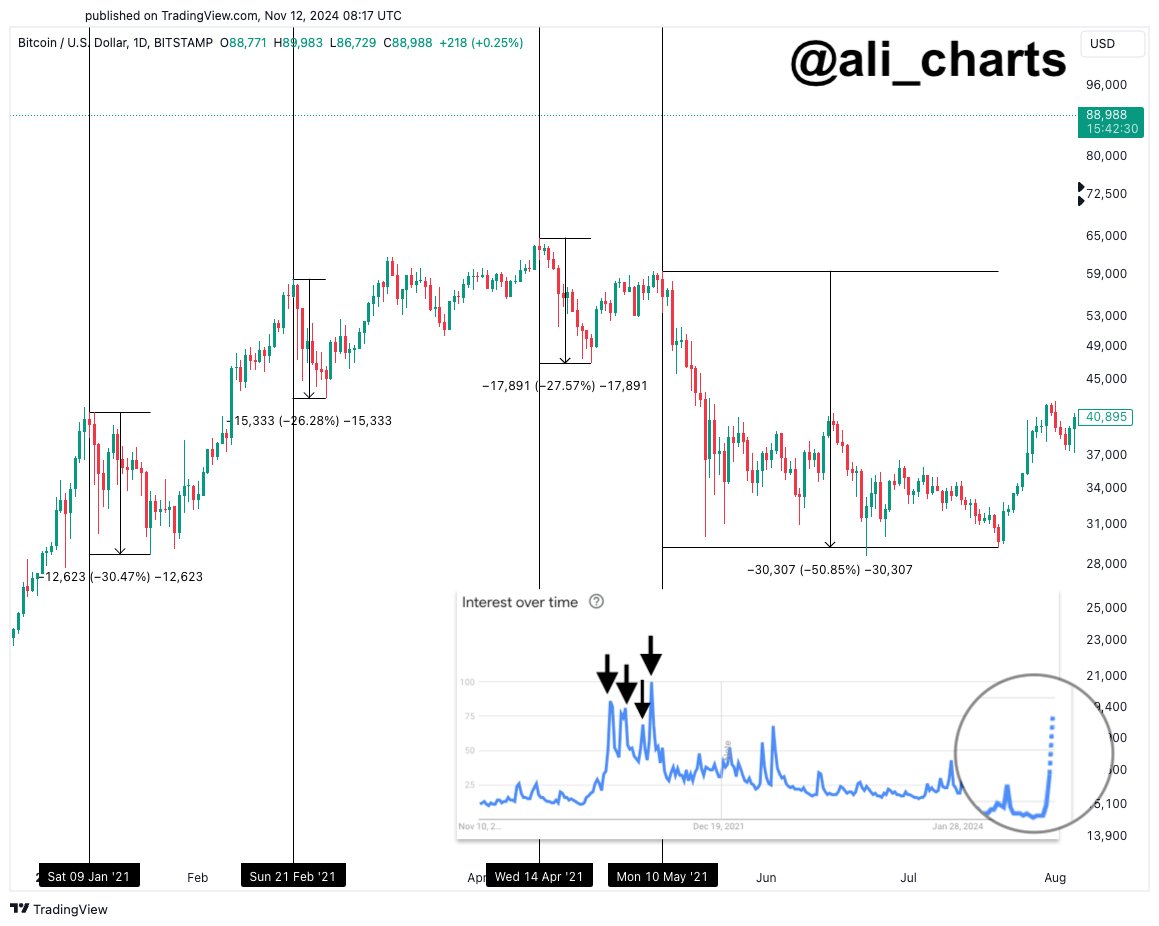

One such analyst, Ali Martinez, points out a troubling historical trend: when Bitcoin’s search interest spikes, significant price drops—sometimes as steep as 50%—often follow.

Martinez believes that the current flood of retail investors into Bitcoin could signal the market is nearing its peak.

Drawing comparisons to 2021, when similar surges in search activity preceded sharp price reversals, he suggests that the influx of inexperienced buyers may make the market more vulnerable to downturns. In these instances, more experienced investors often take advantage of the hype by cashing out, leading to a price correction.

With Bitcoin’s price showing signs of hesitation, Martinez urges investors to be cautious. He advises against buying based solely on price momentum or popular trends, instead recommending a more strategic approach that takes Bitcoin’s notorious volatility into account.

-

1

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

2

BlackRock’s Bitcoin ETF Sees Largest Daily Withdrawal, Ending Month-Long Inflow Streak

31.05.2025 19:00 1 min. read -

3

Bitcoin’s Drop Sparks New Focus on Money Supply Trends

02.06.2025 12:00 2 min. read -

4

Will Musk Double Down on Bitcoin as U.S. Debt Soars?

04.06.2025 12:00 2 min. read -

5

Crypto Trader Faces $100 Million Loss on Bitcoin Bet

30.05.2025 22:00 2 min. read

Saylor Urges U.S. to Stockpile Bitcoin Before the World Catches Up

Michael Saylor, co-founder of the company now called Strategy and one of Bitcoin’s most vocal champions, says the next great migration of wealth will happen on the Bitcoin network.

Is Bitcoin Becoming the New Core Holding for Investors?

Bitcoin’s roller-coaster days may be fading, and that shift could push the world’s largest digital asset into more professional portfolios, according to Coatue Management founder Philippe Laffont.

Trump’s Truth Social Files for Dual Bitcoin and Ethereum ETF

Truth Social, Donald Trump’s social-media platform, has quietly lodged paperwork for a fund that would hold both Bitcoin and Ethereum—marking the first time a Trump-linked business has ventured into the U.S. crypto-ETF arena.

Strategy Scoops Up Another 10,100 Bitcoin, Treasury Nears 600K BTC

Michael Saylor’s Strategy has just added 10,100 BTC—worth about $1.05 billion—to its balance sheet, lifting the company’s total stash to roughly 592,100 coins.

-

1

Bitcoin and Solana Face Pressure as Market Turns Cautious

02.06.2025 16:00 1 min. read -

2

BlackRock’s Bitcoin ETF Sees Largest Daily Withdrawal, Ending Month-Long Inflow Streak

31.05.2025 19:00 1 min. read -

3

Bitcoin’s Drop Sparks New Focus on Money Supply Trends

02.06.2025 12:00 2 min. read -

4

Will Musk Double Down on Bitcoin as U.S. Debt Soars?

04.06.2025 12:00 2 min. read -

5

Crypto Trader Faces $100 Million Loss on Bitcoin Bet

30.05.2025 22:00 2 min. read