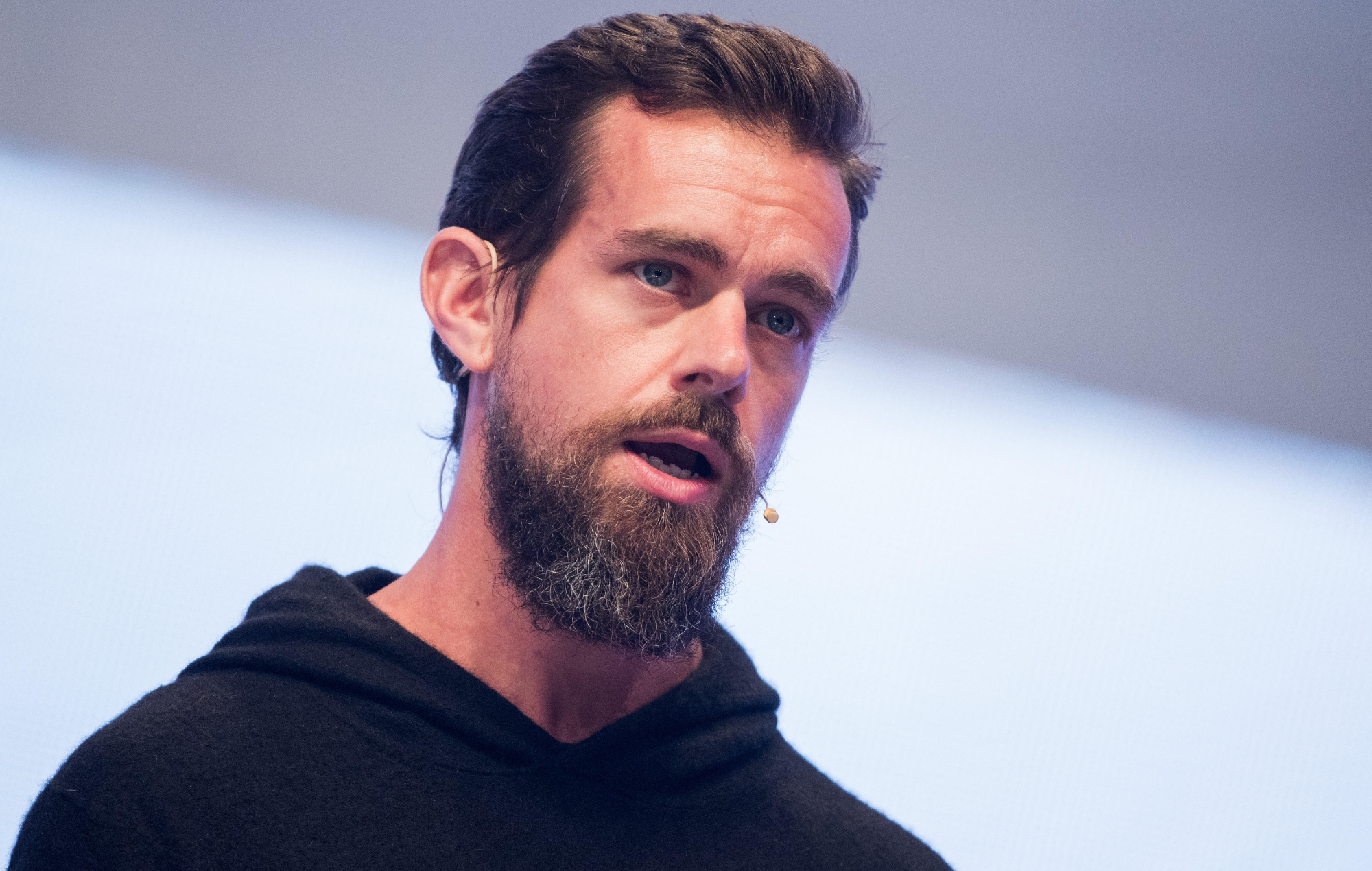

Block Inc. Shares Slide After Q3 Revenue Miss and Flat Bitcoin Earnings

08.11.2024 14:00 1 min. read Kosta Gushterov

Block Inc.’s stock took a hit in after-hours trading following a disappointing Q3 performance, with both total revenue and Bitcoin-related income missing market expectations.

The company’s shares fell by over 12% soon after the closing bell, though they recovered slightly, leaving them up around 4% for the year.

The tech firm, known for its Square point-of-sale system and Cash App, reported a modest 6.4% revenue increase from the previous year, reaching $5.98 billion—falling short of analyst projections of $6.17 billion. Bitcoin revenue, Block’s key income stream from crypto-related fees, remained stagnant compared to last year’s third quarter at roughly $2.43 billion.

Amid these results, Block announced plans to wind down its decentralized finance project, TBD, and reduce its investment in the TIDAL music platform to focus more on crypto-related ventures. According to Block, this shift will allow for further investment in initiatives like Bitcoin mining and the Bitkey self-custody wallet.

Despite the revenue shortfall, Block’s gross profit rose by 19% to $2.25 billion, with net income reaching $283.7 million, aligned with analyst forecasts. The revenue miss was partly attributed to Bitcoin’s price stability during the quarter, averaging close to $60,000.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

Weekly Roundup: What Happened in Crypto Over the Past Week

From groundbreaking Ethereum developments to record-breaking DeFi activity and major protocol updates, the crypto industry saw a flurry of important announcements this past week.

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

Galaxy Digital CEO Mike Novogratz reignited a long-running feud with economist and gold advocate Peter Schiff after the latter criticized Биткойн yet again.

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read