Bitcoin Poised for Parabolic Surge if This Level Holds, Says Crypto Expert

06.11.2024 15:05 1 min. read Alexander Stefanov

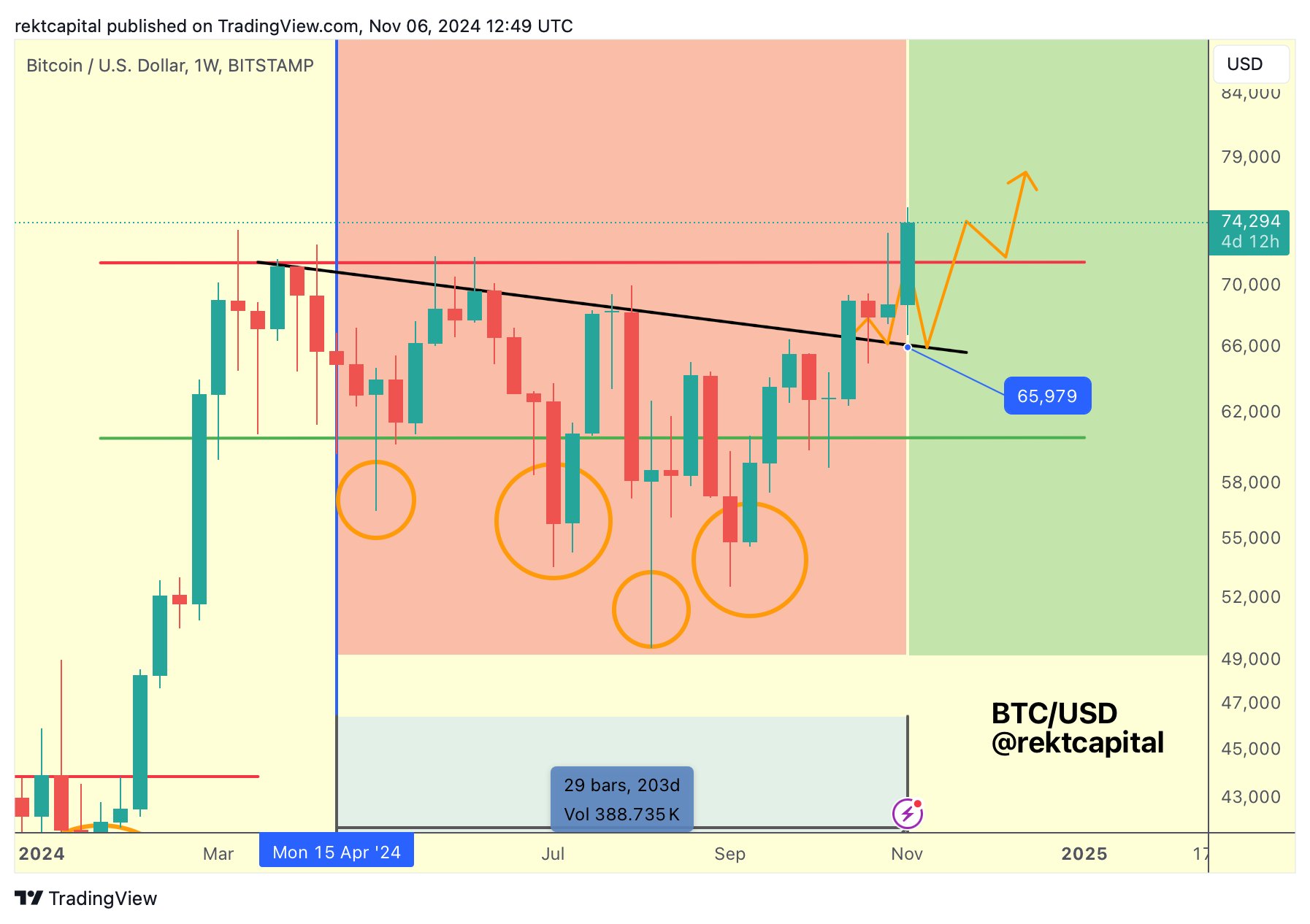

Bitcoin has recently achieved a major milestone, rallying to new all-time highs after successfully filling a significant CME Gap, as noted by prominent cryptocurrency analyst Rekt Capital.

The price action has closely followed a predicted pathway outlined in the RC Newsletter three weeks ago, highlighting a positive shift for the leading digital asset.

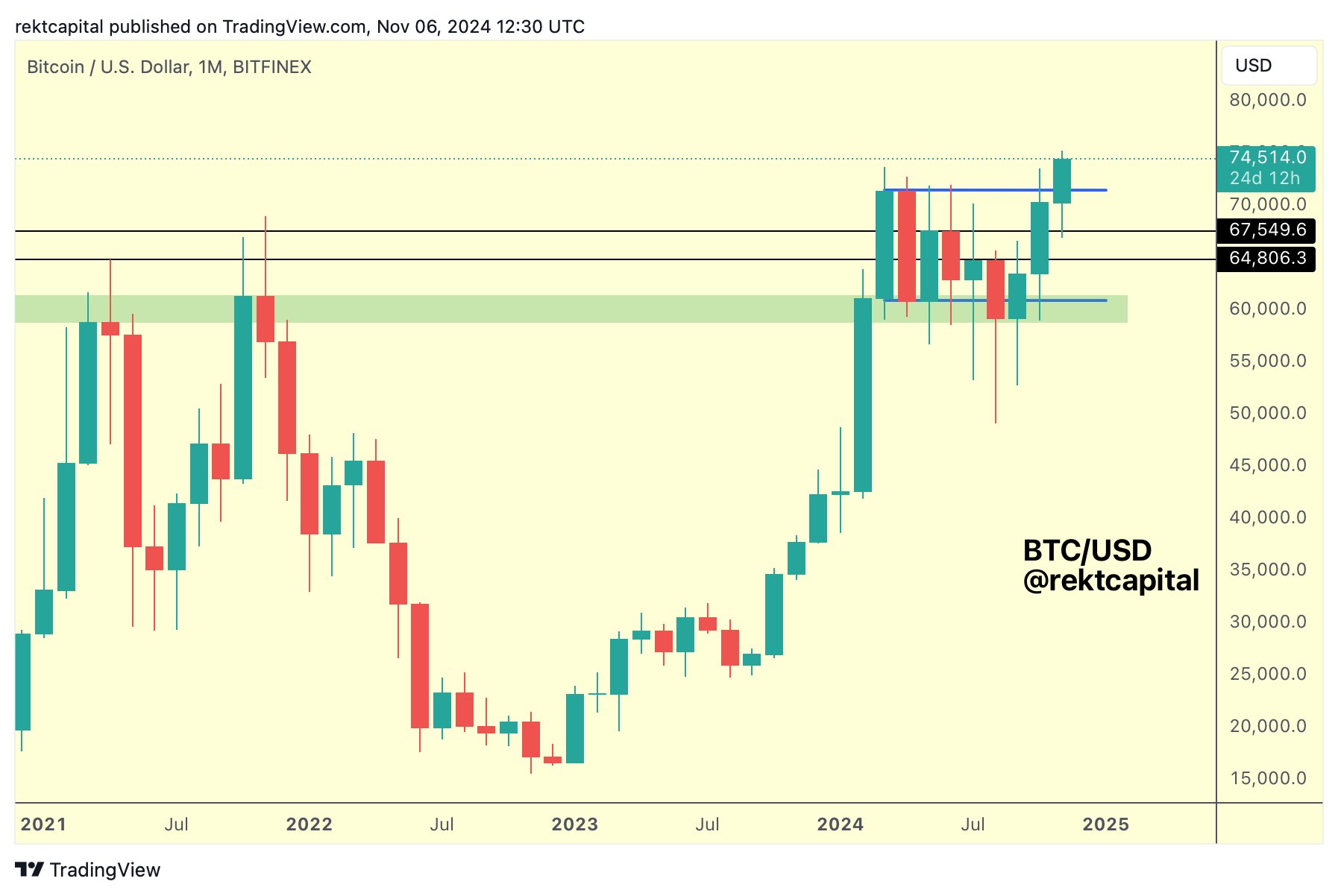

The latest price surge marks a successful retest of the May highs, which were previously set at around $67,500. This level has since transitioned from resistance to support, effectively acting as a springboard for Bitcoin’s new record-breaking highs. The fact that Bitcoin has managed to break through these key levels signals strength in its ongoing rally.

Looking ahead, Bitcoin is at a critical juncture. To confirm its transition from the reaccumulation phase into a parabolic upside phase, BTC needs to maintain a weekly close above the $71,500 mark. A sustained hold above this level would indicate that the market is prepared for further upward movement.

If Bitcoin can secure a monthly close around this level, it would set a historic precedent for the cryptocurrency. Analysts and investors alike will be watching closely to see if Bitcoin can maintain its momentum and continue to build on this newfound support around $71,500.

For now, Bitcoin’s path appears bullish, but the key test will be whether it can hold above this crucial support level in the coming weeks.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

-

1

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

2

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read