Ethiopia Emerges as a Promising Bitcoin Mining Hub Amid Challenges

11.10.2024 15:00 1 min. read Alexander Zdravkov

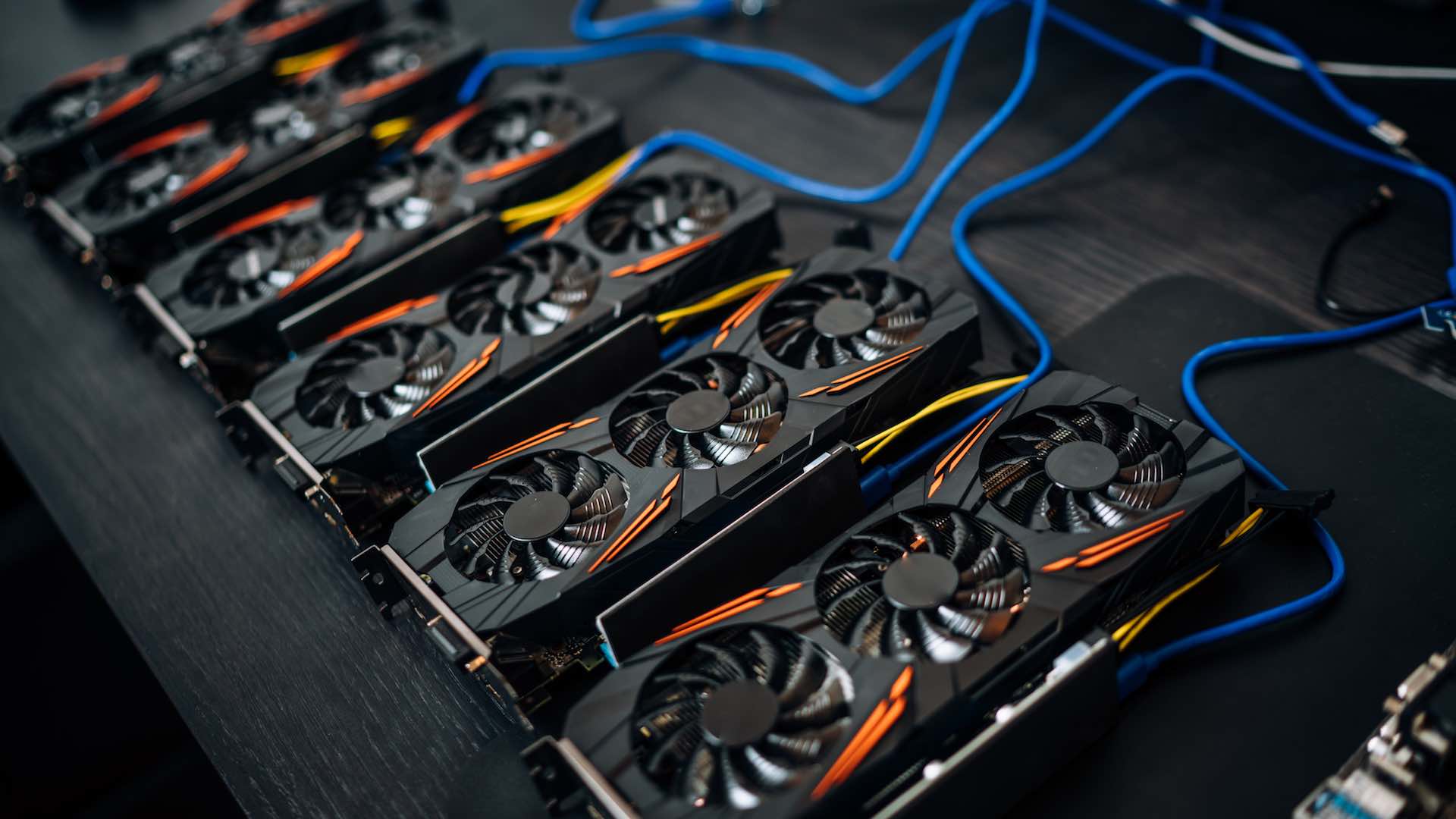

Ethiopia is establishing itself as a key player in Bitcoin mining due to its extensive hydroelectric resources and low energy costs.

Currently, the country utilizes about 600 megawatts of electricity, positioning itself as a preferred destination for cryptocurrency miners in Africa.

To promote this sector, the Ethiopian government has initiated significant partnerships, such as a $250 million agreement with West Data Group, aimed at enhancing digital infrastructure. This move is part of a broader strategy to leverage technology for economic advancement, particularly after China’s recent crypto restrictions.

With electricity prices around 3.14 cents per kilowatt-hour, Ethiopia is attractive for miners using equipment like Bitmain’s S19J Pro, which is both cost-efficient and energy-saving. Additionally, the country’s cooler climate reduces cooling expenses for mining operations.

The potential economic boost from Bitcoin mining is considerable, with projections estimating contributions of $2 billion to $4 billion. However, challenges remain, as nearly half of the population lacks reliable electricity. The government must find a way to balance the energy demands of miners with those of the general populace while navigating regulatory uncertainties.

New legislation is in the works to clarify Bitcoin mining regulations, which could address some of the existing concerns. Yet, the risk of sudden regulatory changes still looms large.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read